Underestimated: Brazil’s role on the pig meat market

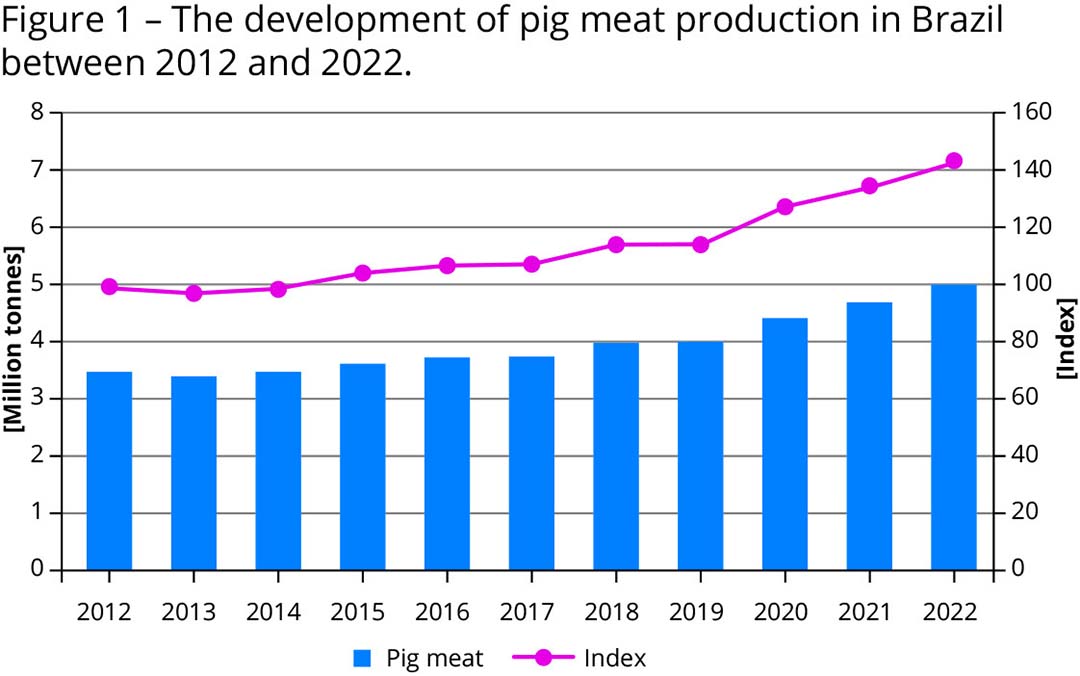

The role of Brazil in global pig meat production and trading is often underestimated. In 2022, the country ranked 4th in production with about 5 million tonnes, behind China, the USA and Spain. In pig meat exports it was ranked 7th with an export value of US$ 2.6 billion. How did Brazil’s pig meat production and trade develop between 2012 and 2022?

In 2015, after 3 years of stagnation, due to a severe economic crisis, pig meat production started to increase very fast in Brazil. Numbers went up from 3.6 million tonnes in 2015 to almost 5.0 million tonnes in 2022. Figure 1 shows remarkable absolute and relative growth from 2019 onwards. The dynamics are a result of the rapid increase in the export volume, as will be shown later.

The Brazilian pig industry has a high regional concentration (Table 1). Almost one third of overall production is concentrated in Santa Catarina, and 87.3% of that is found in the 5 leading states. The spatial congruency between the centres of production and the feed basis is obvious.

Fast increase of exports

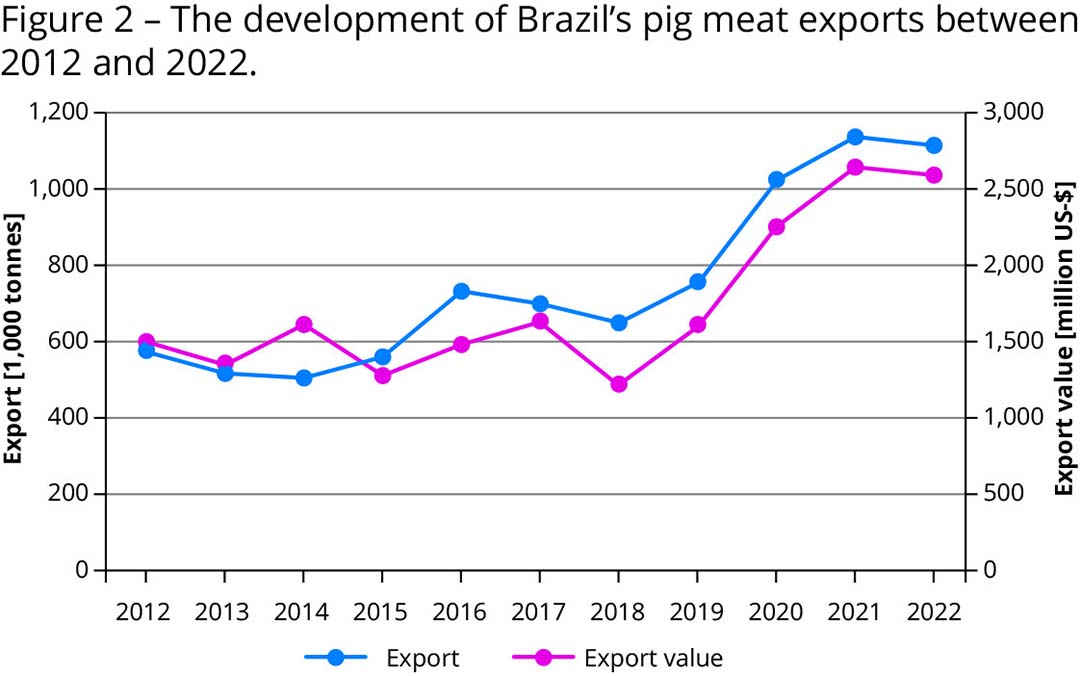

A much similar pattern can be seen in pig meat exports. After 3 years of an economic depression, a slow recovery of pig meat exports began in 2016 and lasted until 2020 when the economy was again hit by the Covid-19 pandemic. The fluctuation is reflected in Figure 2.

Between 2012 and 2014, the export volume fell by 65,000 tonnes or 13%, increased in the following 2 years by 227,000 tonnes before decreasing again until 2018. Then, a continuous upward trend occurred reaching a maximum in 2021 with an export volume of 1.1 million tonnes, a relative increase of 92% since 2012. The war in the Ukraine and general stagnation of the economies in several leading countries had impacts on the development of global trade flows.

That is also reflected in the lower volume of Brazil’s pig meat exports. The fluctuating export volumes had a parallel in their value. A maximum per exported tonne was reached with US$ 3,175 in 2014, obviously a result of a shortage in global supply. In 2018, only US$ 1,875 could be achieved as a consequence of other economic downward trends: massive losses on stock markets and a decline in average incomes in many countries.

In the following years, the average value per tonne stabilised at US$ 2,300. Even in 2022, when China and Hong Kong reduced their imports from Brazil considerably, the average value remained stable as the lower exports could be compensated by higher export volumes to several countries in Africa, the Middle East and non-EU Europe (see Table 2).

Dynamics at the country level

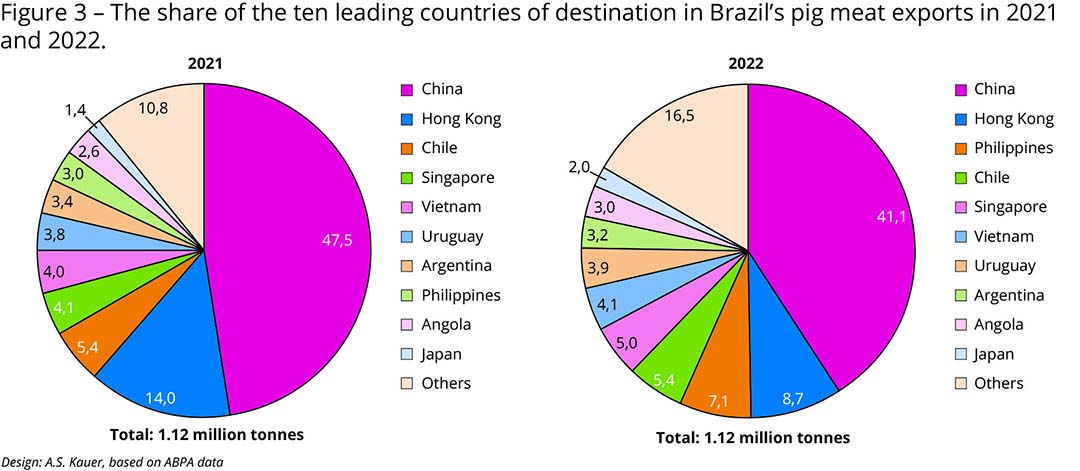

The documented changes in the shares of the target regions of the exports is reflected in the dynamics at country level (see Figure 3, Table 3): In 2021, 61.5% of overall exports had China and Hong Kong as their destination, with China in an absolutely dominating position. Adding Singapore, Vietnam, the Philippines and Japan, the six Asian countries shared 74.0%. This documents the dependence of Brazil on imports by East Asian countries.

In 2022, China and Hong Kong imported over 130,000 tonnes less than in the preceding year, reducing their share in total export volumes by 11.7%. Despite that sharp decrease, the total export volume fell by only 70,000 tonnes. The leading exporting companies were able to increase exports to several countries in Asia and in South America, Africa, the Middle East and even Europe. As can be seen in Table 3, imports by the Philippines grew by 45,900 tonnes, those of Singapore by 9,800 tonnes and Japan by 7,300 tonnes. Imports by Angola, Georgia and Russia also increased considerably. First data regarding Chinese imports in 2023 indicate a volume similar to that of 2022 despite higher production. Growing domestic demand following the removal of Covid-19 restrictions will result in stable imports.

Special pig cuts give Brazil export success

Similar to other leading pig meat exporting countries, the product composition has changed over the past decade. Special cuts have become the products that lead to export success. Denmark was the first country which reduced the export of carcasses and switched to “tailor-made” cuts already in the 1990s. Even though in Brazil cuts were already the leading export product at the beginning of the past decade, the share of carcasses further declined from 2.0% in 2013 to 0.4% in 2022. The share of offal also fell from 12.1% to 6.8% in the same decade, while that of cuts increased from 82.7% to 90.1% (Figure 4).

In 2022, China and Hong Kong together imported 104,200 tonnes fewer cuts than in 2021. The sharp decrease by 16.5% was compensated mainly by higher exports to countries in East Asia and, with smaller volumes, to European countries. The highest absolute increase was in the Philippines, Thailand and Japan; Thailand, the Philippines and South Korea had the highest relative growth (Table 4).

African Swine Fever

The considerable increase in the imports by the Philippines, Thailand and South Korea resulted from the massive outbreaks of African Swine Fever (ASF) in these countries from 2019 on. Private industry estimates assume that the ASF outbreaks in the Philippines caused the death or culling of more than 4 million pigs. Official data, on the other hand, indicate that during the infestation period only 431,000 pigs were culled. The loss of over 4 million pigs would have accounted for over one third of the whole swine inventory and explain the massive growth in import volumes.

In South Korea, 21 outbreaks between 2019 and 2021 also caused considerable losses and forced the country to increase its imports. A similar situation occurred in Thailand, where official reporting about the dissemination of the virus began in January 2022, with the first findings being antedated to November 2021. Through 2022 the virus’ presence was confirmed all over Thailand, from north to south.

It is obvious that the leading Brazilian export companies benefited from the pandemic situation in South East Asia because they were able to compensate the considerable decrease of the imports by China and Hong Kong and maintain their export volumes thanks to the additional demand generated there for the cuts offered.

Summary and perspectives

The analysis above documents Brazil’s important role in global pig meat production and trade. Between 2012 and 2022, production grew by 42.9% from 3.6 to 5.1 million tonnes, respectively. In parallel, pig meat exports increased by 92% from 582,000 tonnes to 1.12 million tonnes, respectively. Until 2021, China and Hong Kong shared over 61% in the overall exports. In the following year, their imports fell over 130,000 tonnes to only 49.8%. This sharp decrease could, however, be compensated by growing exports to several other East Asian countries. In particular the Philippines, Thailand and South Korea were forced to increase their imports because of severe outbreaks of ASF which reduced their pig inventories considerably. Special cuts tailored to the demand of these countries explain Brazil’s success in these markets.

The future development of Brazil’s pig meat production and exports will to a large extent depend on China’s imports. In its Agricultural Projection to 2030, the USDA predicts an increase in Brazil’s pig meat exports by 44.5% to 1.8 million tonnes. That assumption is mainly based on the projection of the development of the imports by China, the Philippines, South Korea and Mexico. The predicted growth in China’s import volume (5.5 million tonnes) seems to be far too high. It is obviously based on the high imports during the Covid-19 pandemic in 2020. The assumption that the country will not be able to control outbreaks of ASF also plays a role.

Import volume between 2.7 and 3.3 million tonnes

The estimate in the OECD-FAO Agricultural Outlook to 2030 of only 1.5 million tonnes seems to be too low. It obviously assumes the reduction of the outbreaks and increasing production. An import volume between 2.7 and 3.3 million tonnes is more realistic. For Mexico a sharp increase by 280,000 tonnes to 1.28 million tonnes is expected. The country will become one of the major markets for Brazil’s pig meat exports. It can be assumed that Brazil will also have a considerable share in the growth of the imports by other East Asian countries. This is due to the firm market position it has already achieved.

References available on request.