Quarterly Update: Pig prices end the year on the up

Pig market analyst John Strak wrote in October 2024 that “Week-to-week price changes for the global index have been negative since early July and there are few signs in the data that this situation will change. The trend is clear – the cycle is definitely in a downward phase.” Within a few weeks of writing that – by mid-October – that trend had been reversed and it has maintained a positive direction since. So much for his crystal ball. He now wonders: how did I get the signals from the data so wrong? And what does 2025 hold for pig and pork prices?

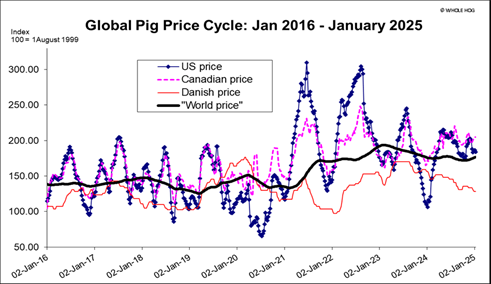

To be fair, the early Autumn data did show that weekly negative rates-of-change in prices were slowing i.e. a possible turning point was on the way. But I thought that the demand drivers (relatively weak domestic and export demand) would win the day (the supply side didn’t seem particularly tight) and thus the cycle would stay negative until the end of the year. However, as Figure 1 illustrates, the global pig price index has clearly turned up, and has been in an upward phase since October 2024. The other charts presented in this article help explain the context surrounding that global picture and I will begin this end-of-year review with a look at the data from the USA.

USA

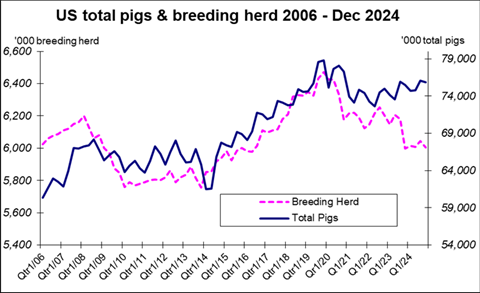

In Figure 2 and Table 1, I present some of the data published in the latest hog census for the United States just before Christmas. What’s evident from these data and the chart is that, outwardly, nothing much seems to be changing in the US pig population in this Q4 report.

Growth in productivity

Nevertheless, Figure 3 offers a hint at a trend that is worth highlighting. The growth in productivity in the US pig sector is significant and very clear from the chart line presented in Figure 3. Lower incidence of disease, better biosecurity, improved management in the barn, and a younger, heathier age distribution in the breeding herd probably explain these productivity gains.

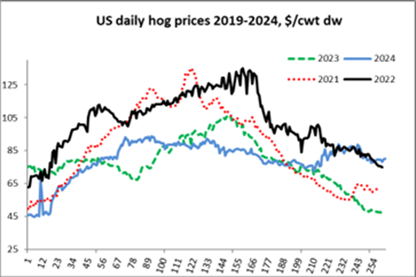

Margins improved in US pig production in 2024 (after a torrid year in 2023) and part of that profit improvement may have been from higher productivity. But significantly (and where my September forecast got it wrong) the daily hog price data in Figure 4 illustrate how US prices improved relative to previous months and years in the final quarter of 2024.

What drove this? Well, we do not know for certain yet, but it seems that export demand for US pork wasn’t weak at all in Q4 2024. We only have trade data for October and November but those months show an average 6% growth in year-on-year pork exports – and these shipments made up over 30% of total US pork production.

It may just be that overseas demand for US pork was enough to bolster US hog prices in the last quarter of 2024. Another piece of the puzzle is that slaughter levels were up slightly in Q4. Looking ahead, the December census data imply hog slaughter in Q1 2025 will be down by around 0.5% and slaughter numbers will be up by more than 1%.

EU

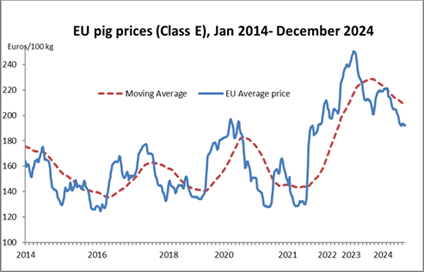

Figure 5 illustrates the behaviour of the EU’s average pig price. It would seem that the cycle in that region is still in a negative phase. The EU’s analysts estimate that EU pig production will fall by around 0.5% in 2024 and by a further 0.2% in 2025. The USDA’s analysts, on the other hand, project a slight increase in production in the EU next year.

It is not just my crystal ball that’s a bit foggy! Of course, this lack of clarity is a function of the way data for the recent past has not been published yet and it’s the latest data that most directly affect forecasts for the next 6 months. Margins have improved for EU pig producers but, as with US producers, there is some pain (losses) in previous years that producers need to deal with before expansion is given a second thought – and the ongoing uncertainties associated with low growth economies and mediocre consumer demand in Europe underline this caution.

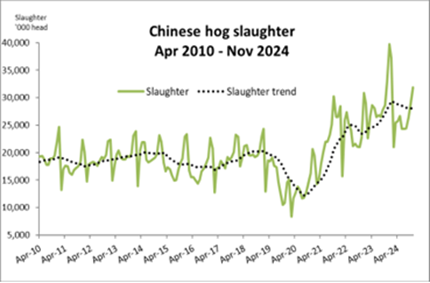

China

As I write this piece we are approaching the Chinese New Year (29 January, year of the snake) and normally that would encourage analysts to predict rising prices driven by buoyant demand for pork in China. Figure 7 shows slaughter numbers for the Chinese pig herd and these are trending downwards – in line with government strictures on the size of the national herd. This observation is further support for an expectation of rising pig prices. Figure 6, however, hardly shows any positive impact on Chinese pig prices.

Any upturn in prices in recent weeks is slight and the second half of 2024 shows a definite negative trend. There may well be a firmer mood in Chinese hog prices in January in the run up to the holiday but it would be hard to argue that China’s market for pigs and pork is on a rising trend. Continuing pessimism amongst analysts about; jobs, the property market, consumer incomes and macroeconomic policies in China suggest to me that there is no prospect of a big recovery in Chinese pig and pork prices in the next six months.

Summary

I concluded my last forecast on the global pork market by saying, “The outlook for global pig prices in the next quarter is negative.” It now seems that I was wrong about that – at least for the USA and that region’s prices boosted the global price index sufficiently to support an upturn in the global x cycle. I do not see that continuing. Looking forward over the next 3 months, I feel compelled to say that, despite my crystal ball’s recent (untypical) failure, the global pig price cycle will not maintain its current upward phase in the early part of 2025.