Quarterly Update: A false dawn – price cycle stays negative

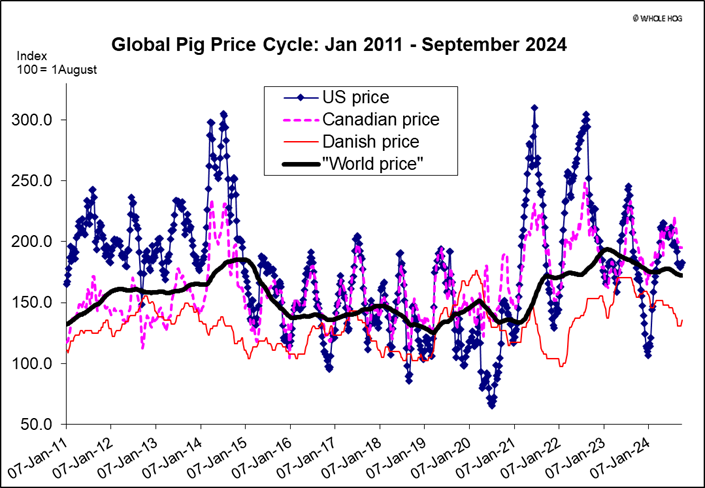

Pig market analyst Dr John Strak wrote in his last column that “the acceleration of the pig price cycle data has slowed almost to 0 and this indicates we are experiencing a weak upturn in global pig prices”. He qualified this by noting that, “the upward phase of the current global pig price cycle is a weak one…. it is possible that the cycle may plateau or reverse in the months ahead”. His conclusion was that it was not clear if the global pig price cycle was starting a recovery or if this was a false dawn. It is now clear it was the latter.

Week to week price changes for the global index have been negative since early-July and there are few signs in the data that this situation will change. Indeed, the recent news from the USA regarding the labour dispute at some of its ports suggests that the downward pressures on prices will increase in the short term.

The global picture is presented in Figure 1. The price cycle is shown to have been on a downward trend in the last 3 months. There has been a seasonal decline, of course, but the behaviour of the cycle in this chart is illustrating price changes that are over and above the seasonal effects. Table 1 I provides the estimated rates of weekly price change for the cycle’s index of major exporters’ prices (the index is constructed from weighted averages). The negative rate of change price falls is slowing but the trend is clear – the cycle is definitely in a downward phase. Figure 1 is another way of illustrating these data.

USA

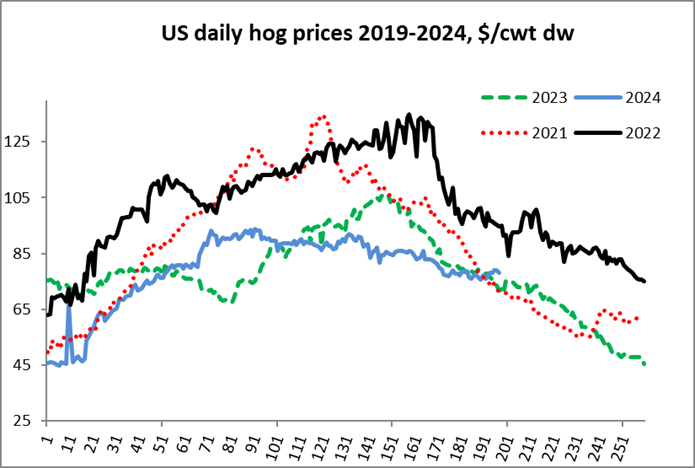

Figure 2 provides a picture of how US hog prices have been behaving this year and compares that with previous years. It seems that prices in 2024 have shown some significant deviations (up and down) from the normal seasonal pattern but, on average, this is not enough to convince me that recovery is on the way. At best, it would appear that the US market has been treading water with prices and margins, in general, still under pressure – especially when inflation in some of the typical producer’s production costs are considered.

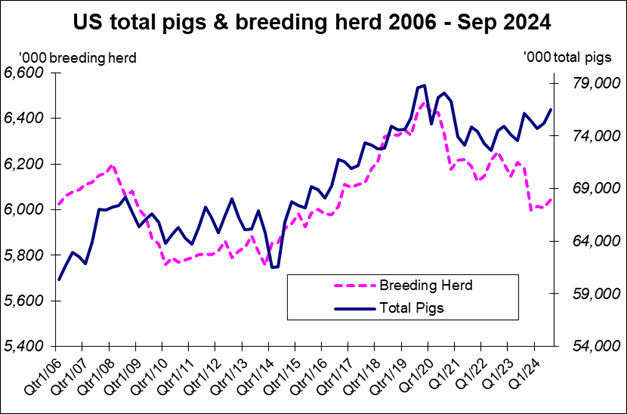

The latest US hog census from the USDA (September 1) would appear to support this observation. Figure 3 and Table 2 present data from this recent census. They show a decline in the size of the breeding herd. And producers’ declared farrowing intentions are hardly changed in the next 6 months: there seems to be no great rush to fill the barns with more sows in the USA. Union dock workers have threatened to strike in ports along the US East and Gulf Coasts.

My information is that roughly 45% of waterborne US pork exports leave from these ports – mostly on their way to the Caribbean, Central and South America. Some of this volume might, presumably, be redirected via Mexico if a strike does happen but I am not a logistics expert so this is a situation that needs to be watched. If the worst does happen (a strike) in the short term we would expect US hog prices to fall as transport and supply chain decision-makers attempt to mitigate the impact of the strike.

EU

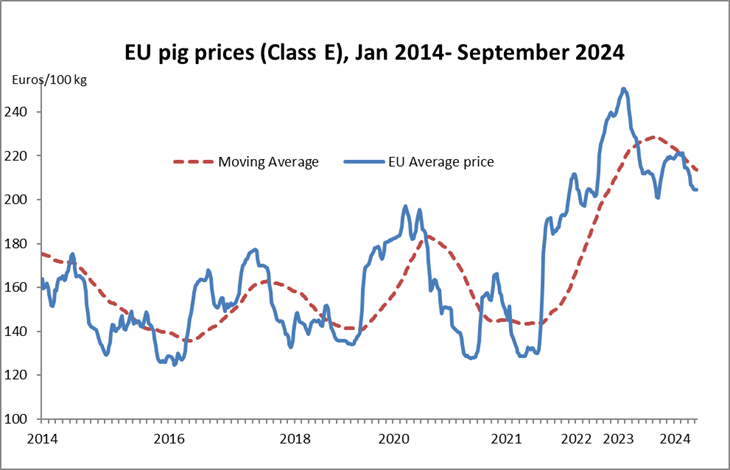

I have observed previously that Europe’s pig prices have lost their sparkle. Figure 4 illustrates this and the cyclical nature of the EU’s pig prices. Again, we see a downward phase in the cycle. Eurostat has recently published the May/June pig census for 13 EU member states and, in summary, the total pig population in the EU appears (some data are still preliminary) to have fallen by about 1.5%. The breeding herd has risen by about 1.3%. We can interpret these data as describing a stabilisation of the pig sector in the EU, given previous years’ experiences when sow number reductions were much larger for many member states. These latest census data for the EU suggest a small rise in the supply of pigs in 2025 in Europe – but they do not suggest major changes in the direction of the sector.

China

The last 3 months have brought some significant changes in data and mood in China – with regard to the state of the pig and pork industry, and the economy in general. Pig prices are clearly on the recovery trail and Figures 5 and 6 illustrate this point. Chinese officials believe that domestic production will grow in 2025 (and the USDA’s latest forecast agrees). However, those same officials are publicly warning producers not to, “blindly overstock”. Is the scene set for China’s hog sector to repeat its previous tendency for boom and bust? We will know for sure when data from Q1 2025 is available. It is notable that consumers generally are not spending money and China’s macro-finances/ consumers look set for more belt tightening in the months and year ahead. That might even dampen demand for China’s favourite protein: more supply and less demand spells trouble.

Summary

The outlook for global pig prices in the next quarter is negative. Conflict in the middle east and a possible hike in oil prices will not help consumer sentiment either. On the supply side fundamentals, there is nothing that suggests a collapse in prices – but neither are there signs of any major support (no significant supply deficits). ASF in the EU and the Philippines will be with us for some time yet but, without any other major disease events (we can’t predict these), our charts and available data indicate that the global pig and pork business, and its underlying economics, will not bring much joy to the bottom line.