Smithfield Foods: Record earnings for pork segment – 1st quarter

Smithfield Foods, Inc. reported fiscal 2011 first quarter results. Increased profits and earnings reported.

Highlights

— Net income was $76.3 million, or $.46 per diluted share, an improvement of $184.0 million, or $1.21 per diluted share, from the first quarter of fiscal 2010.

— Consolidated operating profit improved $252.4 million versus a year ago

- Pork segment operating profit increased $12.3 million, or 12%

— Fresh©pork operating profit improved $51.0 million

— Packaged meats results remained strong at $67.3 million, or $.11 per pound

— Pork segment produced record first quarter earnings for the fourth time in a row

- Hog Production returned to profitability, improving by $244.0 million

© - Other segment results rose $5.8 million

— Generated first quarter cash flow from operations in excess of $100 million

— Repurchased more than $52 million of debt subsequent to the end of the first quarter

— Protein supplies tightened in the U.S.; July pork freezer stocks at 72% of previous year levels

— Domestic meat prices rose to keep pace with higher grain costs

©

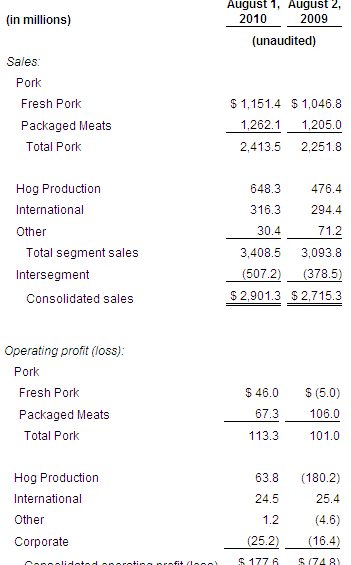

Following are the company’s sales and operating profit (loss) from continuing operations by segment:

©

©

©

©Sales for the first quarter of fiscal 2011 were $2.9 billion, up 7% compared to the first quarter of fiscal 2010. ©The year over year increase is primarily attributable to higher average unit selling prices in the Pork segment and higher live hog market prices.© The company reported net income in the current quarter of $76.3 million ($.46 per diluted share) compared to a net loss of $107.7 million ($(.75) per diluted share) last year, an improvement of $184.0 million.

©

Commencing in the first quarter of fiscal 2011, results from the company’s international hog production operations in Poland, Romania and Mexico are reported in the International segment.© Previously, results from these operations were reported in the Hog Production segment.© The Hog Production segment is now comprised solely of U.S. live hog production.© The company anticipates these segment changes will provide greater transparency into the results of its Hog Production segment and align the company’s external reporting with how management currently views these businesses.© The prior year results have been reclassified to reflect the realignment.© The segment change has no effect on total company operating profits or net income in either fiscal year.

©

Favourable business in pork segment

“Fiscal 2011 is off to a great start with record first quarter earnings. ©The business environment was very favorable in the Pork segment and sharply improved in the Hog Production segment in the first quarter,” said C. Larry Pope, president and chief executive officer.

©

Mr. Pope continued, “The hog production cycle has turned and our fresh pork and consumer packaged meats businesses are delivering solid and consistent earnings, owing to the success of the Pork Group restructuring last year and strong discipline in this segment. ©Although the first quarter is generally the most difficult quarter for fresh pork, the company generated very strong fresh pork earnings, bolstered by solid exports and low protein supplies, which created an environment of strong profitability.© Overall favorable market dynamics benefited the company in all segments.”

©

“Despite rapidly rising and historically high priced raw materials, we delivered solid results in our packaged meats business led by double digit gains in Curly’s BBQ, Off the Bone Lunchmeats, Armour LunchMakers and Kretschmar Deli.© These brands and product categories are strategically important as we continue to focus on delivering strong margins in this business,” he stated.

©

First Quarter Results:©Pork

Fresh Pork

Fresh pork margins were strong as all-time high meat cutout values more than offset significant year over year increases in live hog prices. High meat values throughout the quarter were reflective of tightened pork supplies. Operating margins were 4%, or $7 per head, despite a 38% increase in live hog market prices and a 6% decrease in volume, as the company processed 11% fewer head than in the prior year. The majority of the volume decline was the result of the closure of the Sioux City, Iowa plant in April 2010. Industry-wide, slaughter volumes were down 3.5% and frozen pork supplies were depleted to 72% of last year’s levels. Lower industry slaughter levels are expected to persist well into the company’s second quarter.

Export sales dollars increased nearly 19% and export volume was strong on a historical basis, and only 2% less than the prior year.

©

©

Packaged Meats

Packaged meats margins held strong despite considerable year over year increases in raw material costs. Pricing leadership and margin discipline across several important product categories grew overall sales dollars, even as retail sales volumes dipped below last year. Foodservice sales dollars and volumes were both up over last year.

Total packaged meats sales grew 5% percent during the quarter to $1.26 billion and operating margins remained historically strong at 5%, or $.11 per pound.

©

©

Hog Production

With the change in segment reporting for the company’s international farms, the Hog Production segment now consists solely of U.S. hog production.

Operating margins in this segment dramatically improved in the first quarter to $17 per head, an improvement of more than $53 per head compared to the same period a year ago (excluding the effect of last year’s $34.1 million impairment charge). Fewer hogs marketed increased live hog market prices 38% to $58 per hundredweight compared to $42 per hundredweight last year.© Pre-interest raising costs decreased 7% to $54 per hundredweight from $58 per hundredweight in the prior year.

©

©

International

The International segment now includes results from the company’s international hog production operations as well as its international meat production operations.

The company’s vertically integrated operations in Poland continued to deliver strong results in the first quarter. ©Lower raw material costs and sharp volume increases in the Polish meat operations combined to substantially improve profitability.© Live production raising costs also moderated in Poland compared to the same period a year ago.

©

©

Equity income from Campofrio was slightly lower than a year ago, reflecting continuing recessionary conditions throughout Western Europe. ©Equity income from Mexico was also marginally lower than last year.

©

©

For more info: Smithfield Foods

©