Maple Leaf Foods 3rd quarter 2010 results – net loss/ consistent sales reported

Maple Leaf Foods Inc. (reported its financial results for the third quarter ended September 30, 2010.

©©© -©© Sales were consistent with last year at $1.3 billion

©©© – ©©Adjusted Operating Earnings increased 2% to $64.5 million from

©©©©©©© $63.0 million last year

©©© -©© Adjusted EPS increased 10% to $0.23 compared to $0.21 last year

©©© -©© Net loss in the quarter, which included $48.1 million of non-cash

©©©©©©© pre-tax adjustments, was $16.1 million compared to net earnings of

©©©©©©© $22.5 million last year

©

Note: Adjusted Operating Earnings measures are defined as earnings from operations before restructuring and other related costs, other income and the impact of the change in fair value of interest rate swaps. Adjusted Earnings per Share (“Adjusted EPS”) measures are defined as basic earnings per share adjusted for the impact of restructuring and other related costs and the impact of the change in fair value of interest rate swaps, net of tax and non-controlling interest. Refer to the section entitled Non-GAAP Financial Measures at the end of this news release.

©

“The rapid rise in raw material costs in both grains and meat proteins, is the story for 2010,” said Michael H. McCain, President and CEO. “Notwithstanding this significant inflation, we realized our sixth consecutive quarter of earnings growth, continued margin expansion in the protein segment, and double digit earnings per share improvement over last year. This steady progress reflects our focus on near-term value creation and implementing initiatives across our businesses to increase margins and growth that are expected to deliver significant return to shareholders now and through 2015.”

©

Financial Overview

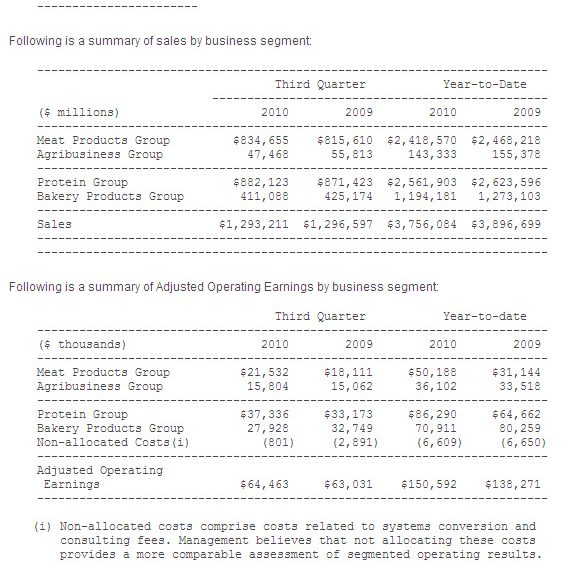

Third quarter sales of $1,293.2 million were consistent with last year. Excluding currency impacts related to the U.K. and U.S. bakery operations and fresh pork sales, sales increased by 2%. Adjusted Operating Earnings increased 2% to $64.5 million compared to $63.0 million last year. Improved results in the Meat Group, supported by better performance in fresh pork and poultry, were partly offset by lower earnings in the Bakery Products Group, mostly due to lower volume and increased investment to support product launches, advertising and promotions.

©

Net loss, including a non-cash pre-tax charge of $14.6 million due to the change in fair value of long-term interest rate swaps not designated in a formal hedging relationship and $50.0 million in restructuring costs (including $33.5 million of non-cash charges), was $16.1 million in the third quarter of 2010 compared to net earnings of $22.5 million last year. Year-to-date net loss was $4.4 million compared to net earnings of $30.2 million last year.

©

Business Segment Review

Following is a summary of sales by business segment:

Following is a summary of sales by business segment:

©

©

©

©

©

Meat Products Group

Includes value-added prepared meats, chilled meal entrees and lunch kits; and fresh pork, poultry and turkey products sold to retail, foodservice, industrial and convenience channels. Includes leading Canadian brands such as Maple Leaf(R), Schneiders(R) and many leading sub-brands.

©

Sales for the third quarter increased 2% to $834.7 million from $815.6 million in the third quarter last year. Excluding the impact of a stronger Canadian dollar that reduced the value of fresh pork sales, sales increased by 4%. Improved pork markets, higher net pricing in prepared meats and improved sales mix contributed to increased sales. These benefits were partly offset by reduced volumes in fresh pork and prepared meats as consumers continue to adjust to new price points.

©

Adjusted Operating Earnings in the Meat Products Group increased to $21.5 million compared to $18.1 million last year, reflecting higher market prices for fresh chicken and pork and improved operational efficiencies in the Company’s poultry operations. While margins in the prepared meats business benefited from improved net pricing and early operational benefits of product simplification, profitability in the business was impacted by lower volumes as consumers adjust to new price points. Margins continue to be pressured by further increases in raw material meat costs that resulted in continued focus on price adjustments during the quarter.

©

Management is focused on implementing near-term initiatives to increase margins in the prepared meats business as part of its recently announced value creation plan. In order to streamline product mix, significant changes are being implemented to standardize ingredient formulations, product sizes and specifications across all categories. These initiatives will be completed during 2011, reducing complexity for customers and improving operating efficiencies.

©

Agribusiness Group

Consists of Canadian hog production and animal by-product recycling operations.

Agribusiness Group sales declined 15% to $47.5 million from $55.8 million in the third quarter last year due to lower sales values and volumes in the rendering operations.

©

Adjusted Operating Earnings for the Agribusiness Group increased to $15.8 million from $15.1 million in the third quarter last year. Earnings from hog production operations improved due to higher hog market prices and lower feed costs. Stronger performance in hog production was partially offset by lower earnings in the by-product recycling business compared to last year due to lower by-product sales values and volumes.

©

©

©