CP: To Russia and China with love

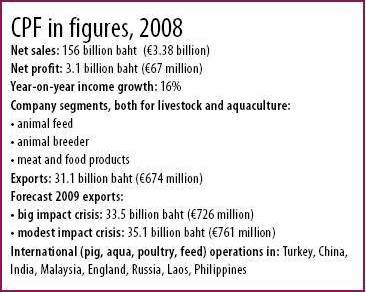

With its own breeding, processing and marketing channels, the Charoen Pokphand Group is undoubtedly one of South East Asia’s biggest players when it comes down to (pig) agribusiness. The Thai company is present in a range of countries and is now aiming its arrows at the big markets: Russia and China.

By Vincent ter Beek

His statement in the Annual Report, 2008, was clear enough. Charoen Pokphand Foods’ CEO and president, Adirek Sripratak, wrote: “The global financial crisis which started in 2008 may continue to cause a slow down in the world economy and a reduction in consumer spending. The company continues its policy implemented last year to slow-down investment and expansion projects.” Unlike projects in many other countries, however, those in China and Russia will go on during 2009, affirms Dr Satjar Ravungsook, senior vice president swine research and genetic improvement of CP Group’s food company Charoen Pokphand Foods (CPF). “Our CEO still sees good opportunities in these countries.”

©

Satjar spoke to Pig Progress together with Dr Damnoen Chaturavittawong, CPF’s senior vice president swine

veterinary service department, on the current state of Thailand’s biggest agribusiness integrator. Maybe it would be better to say: Asia’s biggest agribusiness integrator, or even call it simply a global agribusiness integrator. The company, active in the duck, chicken, egg, shrimp, fish and swine industry, has a total of 58 subsidiaries, of which a large amount is present abroad.

veterinary service department, on the current state of Thailand’s biggest agribusiness integrator. Maybe it would be better to say: Asia’s biggest agribusiness integrator, or even call it simply a global agribusiness integrator. The company, active in the duck, chicken, egg, shrimp, fish and swine industry, has a total of 58 subsidiaries, of which a large amount is present abroad.

©

Apart from the above mentioned countries, food importing companies are present in the USA, UK, Japan and Denmark. Aquaculture investments can be seen in China and Malaysia; feed mill and farming investments have been set up in Laos, India, USA, Turkey and the Philippines; and even a Thai food restaurant chain has been started in China. Affirming this international ambition, the company calls itself the ‘Kitchen of the World’, and markets a wide range of food products from cooked poultry, pork, shrimp, fish and eggs.

©

A quick history

Swine breeding originated almost from CPF’s start, back in 1978. Focusing on animal feed, Satjar says, the company expanded into livestock. “For the first swine breeding, CP imported genetics like Seghers, Hypor, PIC and Dekalb. It wasn’t quite a success at that time, as the products were not made from the right type of pigs to meet the consumer demands of the Thai market.

©

“Hence, our executives developed our own breeding programme. That was a tough time as we needed to learn how to have constant quality and how to create a housing design that is suitable for warmer climates. For that reason, we introduced e.g. evaporative cooling systems at our sites. Ever since we have developed very good experiences on the field of consumer demand,” Satjar says, adding that the company’s main target is to get maximum profits for producers.

©

Nowadays, CPF has its own breed of sows, both in sire and in dam lines. As for the sow lines, the CP21 and CP23 are used, both PRRS stable and PRRS-free hybrid lines, with ‘a good shape, strong legs and long body with high productivity’. In boars, the breeding programme yielded the Duroc CP31 and the hybrid CP73, the last one predominantly used for lean meat production.

©

Today, Thailand has about 800,000 sows, of which about half has CP bloodlines. Great Grand Parent (GGP) are held on own nucleus herds; some Grand Parent (GP) animals and parent stock are sent to contract growers. Source bases with CP bloodlines have been installed in many countries of South East Asia; apart from Thailand they can be found in Vietnam, Laos, Cambodia and Myanmar. From these nucleus sites, pigs are transported to contract breeders and growers.

©

No beta-agonists are being used during pork production, Damnoen says – and CPF’s GGP sows are free from diseases like PRRS and PCV2. The last one not being a big problem in Thailand, according to Damnoen, and the first can be kept out by good bio-security. “Our vision is to control PRRS and PCV2 without the use of vaccination. In case diseases like these would turn up in nursery farms for example, the infected pigs would be separated. This way, the disease is stopped naturally by the system.”

©

Russia

Russian investments have only just started up, Satjar explains. In total, CPF plans to establish GGP, GP and PS level to produce 1 million fattening pigs annually. The first phase will be established in the Moscow region and in the direct regions around Moscow, such as Kaluga, Tula, Ryazan and Vladimir. A first project, to be finished in April/May of this year, includes a breeding farm with 2,400 sows and also a feed mill.

©

In the Russian market, CPF uses the same breeding pattern as the company does in Thailand, Damoen explains. “Russian consumers prefer pigs a little bit fat. In our breeding programmes, we would like to keep it like that – hence we focus on meat quality and pigs will be slaughtered at a late moment, if possible on average as late as 120 kg.”

©

China

Chinese operations are run by the CP Group itself. It will have five new swine breeding projects this year; two 600 GGP operations in the provinces of Hubei and Jiangxi; one 1,200 GP farm in Shaanxi province and two 2,400 GP©farms in Xinjiang and Liaoning province. For 2010 new GGP level farms are planned in four provinces; new GP level farms will be built in eight provinces.

©

CP started its breeding projects about ten years ago, but it took a long time to get there, Satjar explains. The preparation to build up a new swine nucleus herd began 16 years ago. In order to start new breeding herds in China, new genetic programmes had to be started up from scratch. Hence, it takes a while before commercial production on a large scale can actually take off.

©

“So far, there are only five countries that can export GGP sows to China – that’s Canada, France, UK, Denmark and the USA,” explains Satjar. “Thailand is not yet part of that group, although we are trying to negotiate. That would mean that we could send our own breeding stock from Thailand. Apart from a good health status, we’d also have practical reasons to do so.”

©

He continues, “The Chinese market requires leanness, even more than in Thailand. This means that breeding stock should be lean as well.” Lean, according to Asian guidelines, that is, Satjar adds. “One of the reasons that European breeds sometimes do not sell well in Asia is because eating habits are different. Here in Asia, we seldom eat steak. So, pork meat quality may be good, but what is that worth if you cannot sell it?”

©

Having its origins in Asia, CP is convinced that it is better able to produce products for China than other global players. “Compare it to a European company that produces high quality silver cutlery. All employees know how to do that very aptly, and the company has a lot of success in Europe. However, when the company tries its luck in China, it cannot sell. Why?” He pauses a while and smiles, “Because the Chinese market requires chopsticks.”

©

Source: Pig Progress Volume 25 nr©4