Quarterly Update: Global pig market is “complicated”

In his quarterly update, pig market analyst Dr John Strak describes the contrary trends in North America, China and Europe. Everyone seems to be out of step with everyone else – but are they?

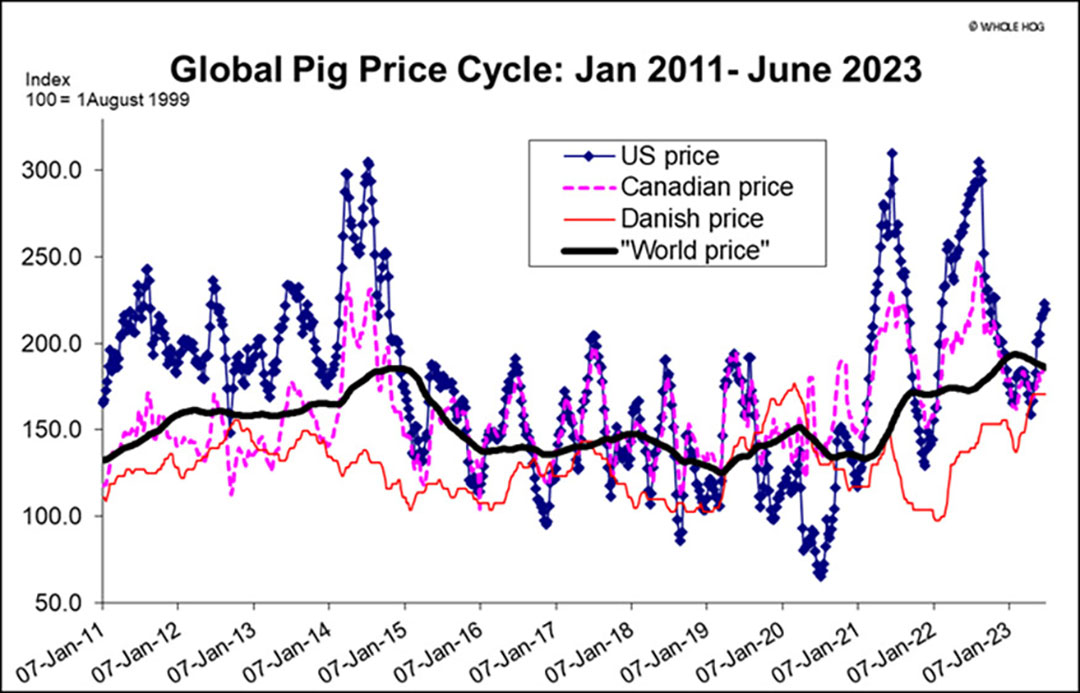

The last words in my previous column were to urge producers to be cautious. I predicted then that a turning point (a move into the positive phase of the price cycle) would not occur before midsummer this year. We live in a world of rapid change and big events, and that makes forecasting even more difficult, but I now expect that there will be no turning point in the global pig price cycle before the autumn equinox.

European producers reading this statement may wonder why any of this is relevant to them since pig prices in the Old World have been rising for 12 months now and margins have been positive in the last 3 months. Let’s disentangle the different ways in which pig prices have been behaving around the world to understand how these opposite trends coexist and how business decisions are affected.

Gloom in North America

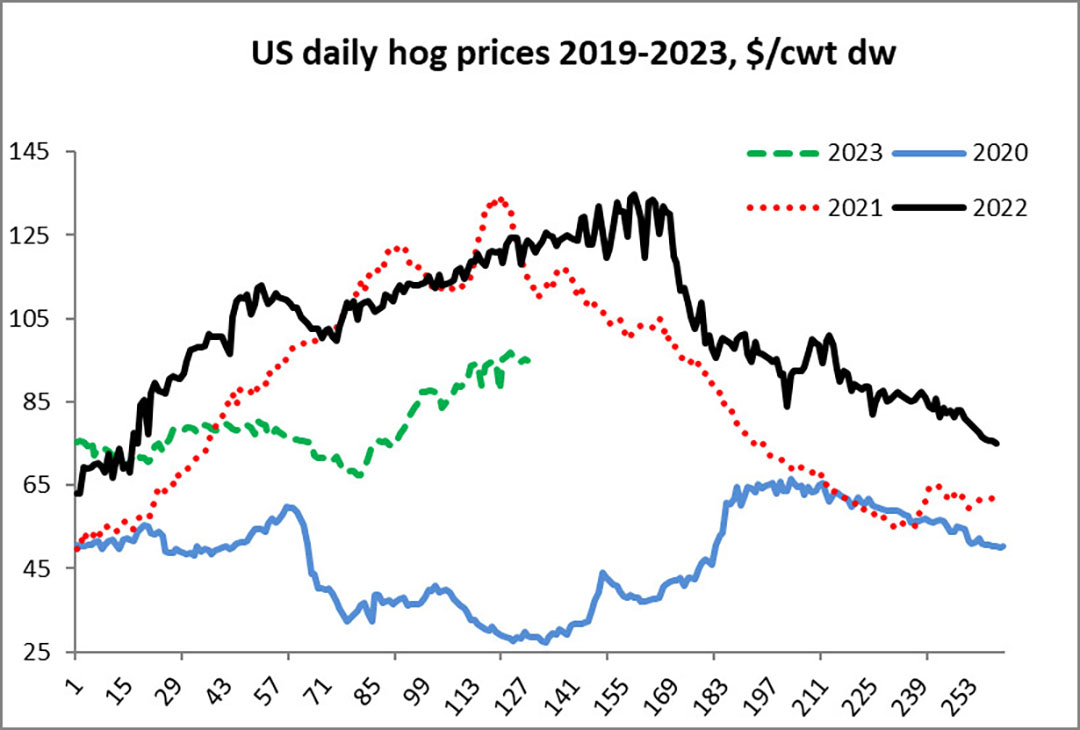

Figures 1, 2 and 3 and Table 1 present some recent data for the US hog sector. The first chart indicates that US hog prices bounced back in the last 6 weeks or so. This recovery was, however, only to a point where the price behaviour exhibited its normal seasonal pattern. To paraphrase Star Trek, it is progress Jim, but not as we know it. This recent bounce in prices is not a structural shift.

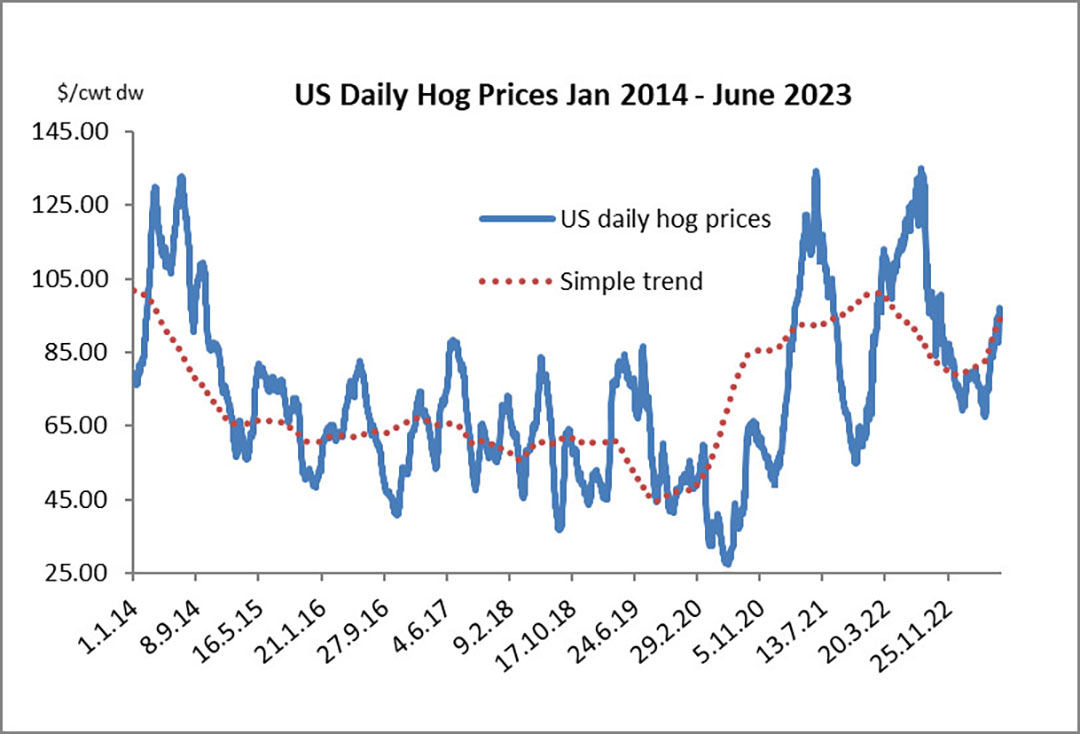

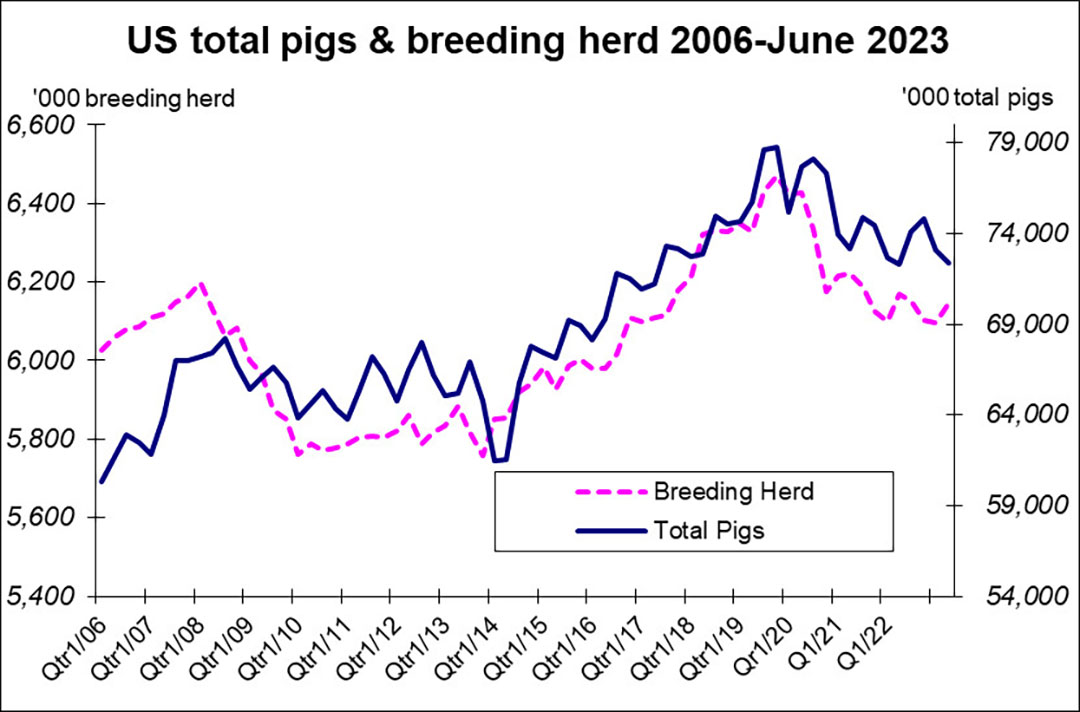

The charted data in Figure 2 also puts US hog price movements in the USA into perspective. As for supplies, the latest US hog census data are shown in Table 1. Figure 3 illustrates how total pig numbers and the breeding herd have declined in the USA. The significant contraction in the US herd is ongoing. Although the key metrics (total inventory, total breeding herd and market pigs) are virtually unchanged from a year ago the intended farrowings declared by producers in the census are set to fall by 4% in the period June-November 2023. That is many fewer pigs in the pipeline. Overall, US hog prices have fallen from 2021 and 2022 levels and, with costs rising and productivity static (PRSS), production has contracted and will continue to contract in 2023.

High prices but no party mood in Europe

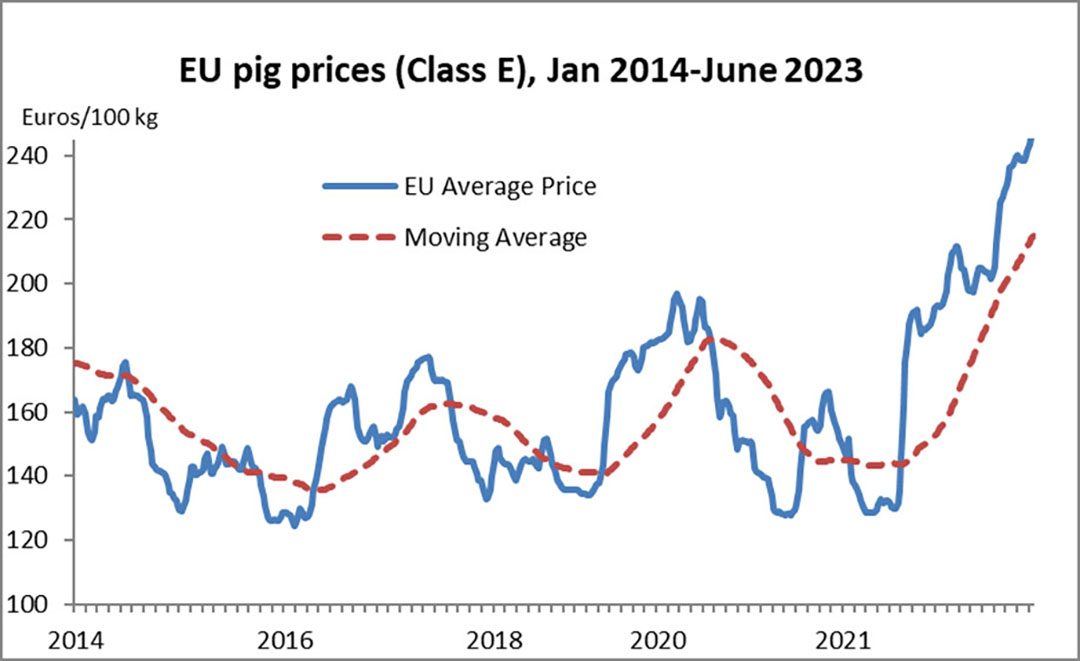

I noted in April that pig prices in Europe have been on a roll for 12 months now. Figure 4 illustrates how prices have soared in the EU (and how this contrasts sharply with the US experience shown in Figure 2). Further, according to the European Commission’s data, the EU’s producers moved into the black (on average) in the autumn of 2022. And those positive margins are still there – as much as 20% higher than variable costs as published in the May 2023 report to the Commission. The same report indicated that EU pig slaughter numbers were down by almost 8% in Q1 2023 and this explains why pig prices have been so firm. But, despite the reports that pig production is now profitable there are few signs that EU producers are encouraged to switch from contraction to expansion. The June census data for major producers will be an important data set that offers clues on where next for EU pigmeat production. My bet is that they will not show a rebound in producer confidence. If I am correct then, although EU and North American producers seem to have had different experiences on prices, producers on both sides of the Atlantic seem to have the same view of the market – a gloomy one.

China’s pig price cycle

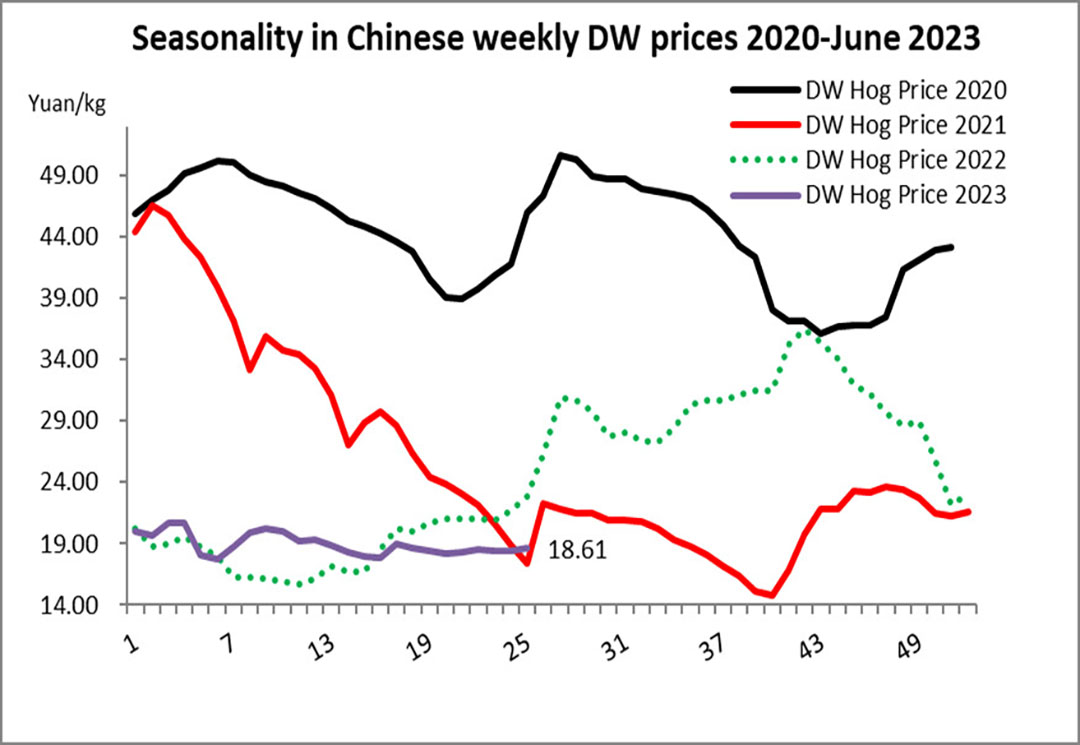

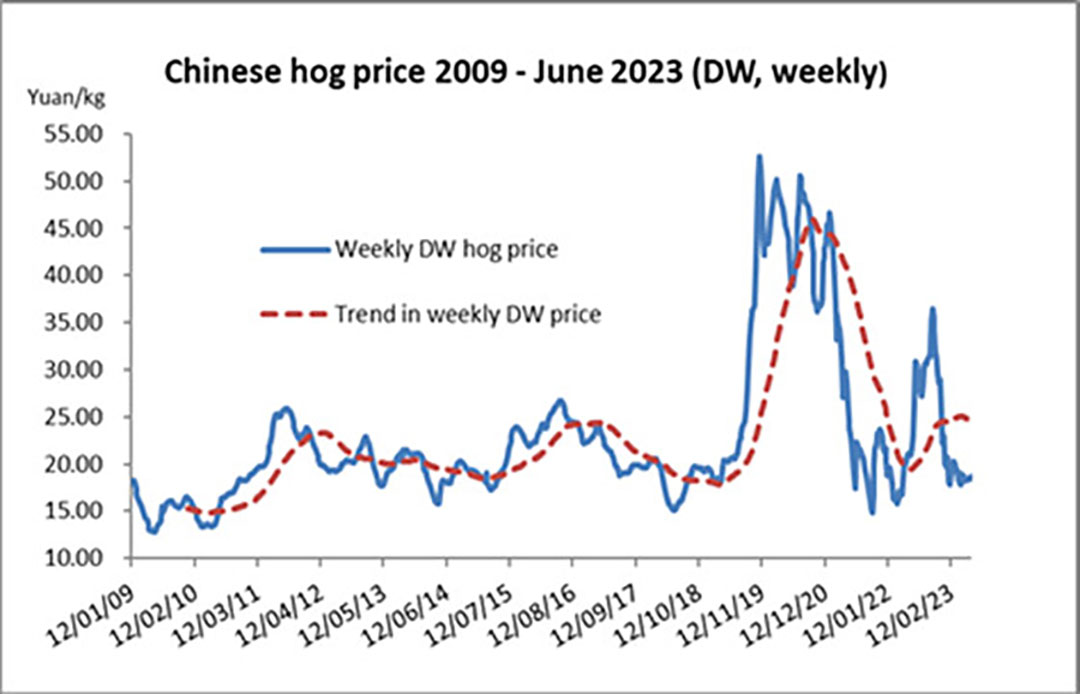

The most recent prices for China’s hog producers are shown in Figures 5 and 6. In the former, data are presented as a set of annual comparisons so that we can differentiate the seasonal pattern. You can see that the pattern is out of sync in 2023. In Figure 6, the data are shown over a long time period – their cyclical behaviour is obvious. The good news is that China’s pig prices have flat lined since I last wrote this column. This (relative) stabilisation may reflect the Chinese government’s willingness to intervene in the market and support domestic pig prices using state-financed purchases. It may also be good news that a number of large Chinese firms with major pig production investments have announced losses in their pig activities and they seem to be less inclined to expand in 2023/24. We shall see.

Recent low prices have confirmed that China’s pig production margins have been low or negative. China’s pig sector may have become more concentrated but there is still a large tail of small and medium-sized producers who could move back into the market and set off another boom-bust cycle of prices if margins improve. Worse, it is not clear of China’s top officials have the ability to deal with commodity price cycles (spoiler: national and local policies are not always in line ). If we give those officials the benefit of the doubt, it may just be that the various problems with the Chinese economy plus the post-Covid, post-ASF “hangovers” have diverted the full attention of the authorities from the livestock economy in China. Looking ahead, the best-case scenario is that the rush to expand by the semi-industrial domestic conglomerates in 2021/22 (encouraged by national and local policymakers) has now ended and that a more measured approach to expansion and development of the pig sector in China is being taken. Let’s also hope for improvements in data collection and transparency too. Overall, it is fair to describe the mood in China’s pig meat supply chain as “hesitant” ( a bit like the economy in general).

The global market

Reading through the previous commentary it should be clear why I refer to “complications” when reviewing the global market for pork. Arguably, it’s not that complicated underneath though. All the major producers have experienced losses in margins and confidence. They have all contracted in late 2022 and H1 2023 – and seem set to continue contracting. Everyone is gloomy. As the data in Figure 7 show, there are few signs that the global pig price index is likely to turn upwards in the next three months. It’s a cliché but it’s often true that it’s darkest before the dawn. I observed earlier that the recent recovery in US hog prices does not seem to portend a structural change in the market. I don’t think it’s a shift (in supply or demand) just seasonality in play. If I am wrong. we could be at the pre-turning point stage in the cycle – in which case producers who do want to take a gamble might consider checking out their breeding schedules and fertility programmes now. Whatever, I hope that my next column on this subject will be written in less gloomy times.