Quarterly Update: A hard winter ahead

In his quarterly update, pig market analyst Dr John Strak analyses the global pork market. Unfortunately, ”depressed” is the word that best describes it.

My thoughts on the global pork market were last published here in July. At the time, I summed up the situation as “complicated” – and I urged caution by producers. Well, life is even more complicated now (Israel-Hamas) and, in these final months of the year, the world market for pork can be summarised simply as, “depressed”.

However, there seems to be no sign of any anti-depressants to help counter this mood. The charts and table presented here support my pessimistic assessment and, to add further gloom, I cannot see the (deseasonalised) prices for producers improving before the end of Q1 in 2024 – and certainly not before the end of this year. In July, I had hoped that the autumn might see less gloomy times but it is looking like a long hard winter ahead.

Exacerbated downturn

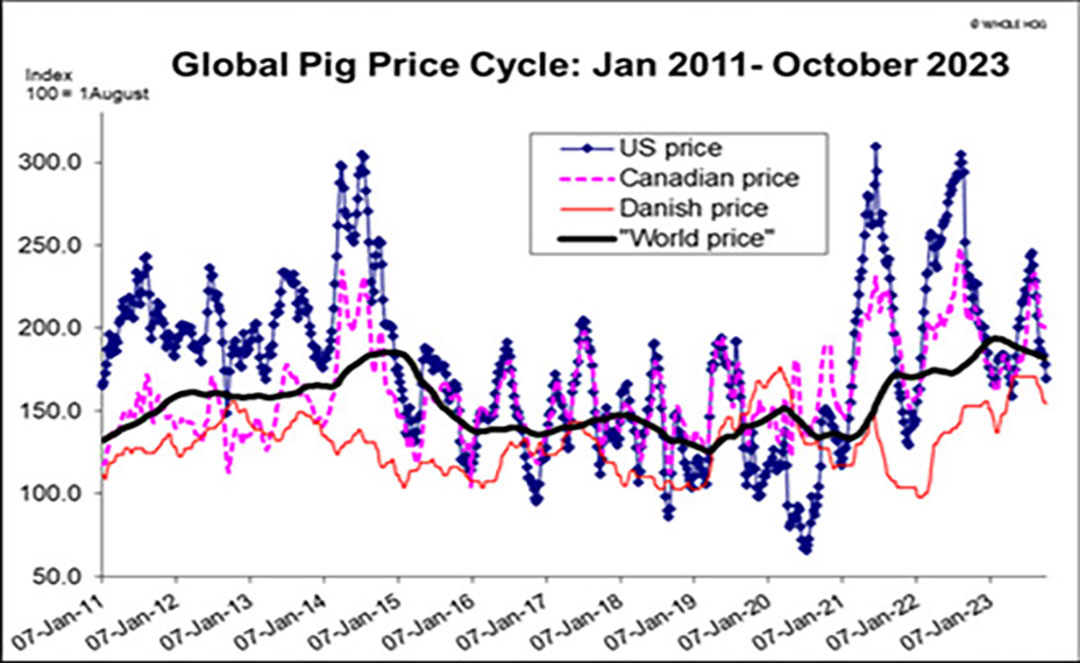

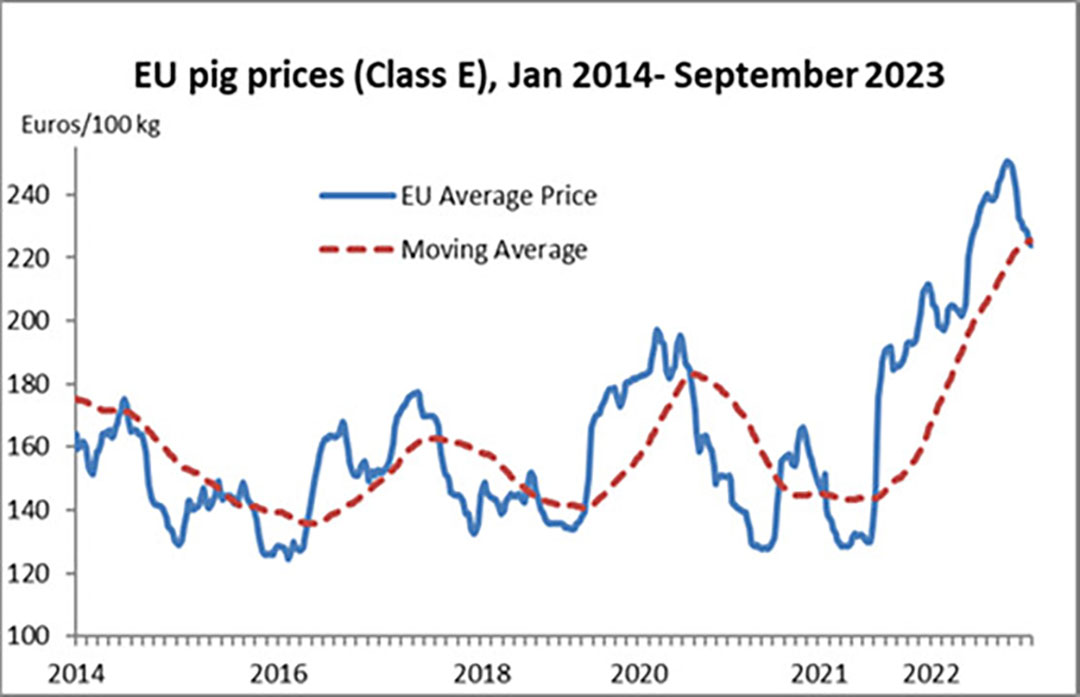

I noted in July that, “I expect that there will be no turning point in the global pig price cycle before the autumn equinox”. That date has passed and, if anything, the downturn in the global pig price cycle has been exacerbated. Figure 1 illustrates the position that the cycle is in using data extending to early October.

All the major exporters are exhibiting price behaviour that is driving the pig price cycle downwards. The contractions in supply that have occurred in North America and Europe that we have reported before in this column have not been enough to counter the cycle’s tendency to stick in a downward phase of the cycle. The analysis of the various prices and rates of change in this chart indicated that things will get worse (lower prices) before they get better. There is no sign of a turning point in the cycle.

China’s stop-go economy

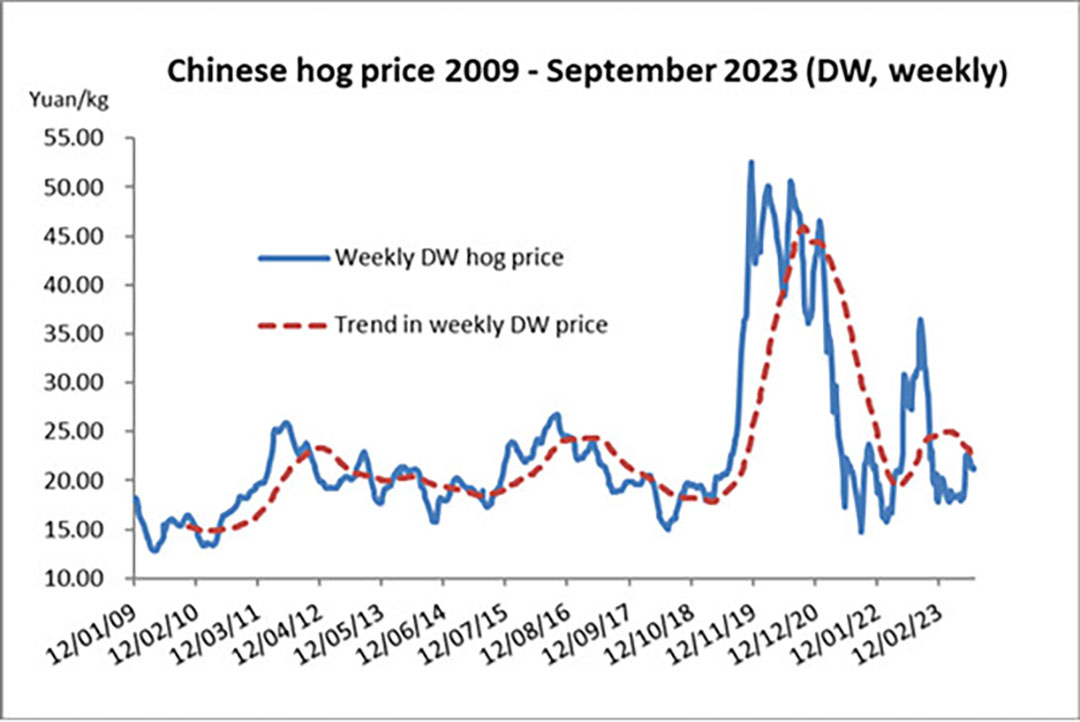

The most recent prices for China’s hog producers are shown in Figure 2. I have previously described the mood in China’s pigmeat supply chain as “hesitant”. I have also noted that the Chinese economy is faltering. As more and more news and verifiable data comes out of China, that last point seems particularly relevant.

Although the most recent report on the Chinese economy suggests that GDP growth might be recovering, it is undeniable that consumer incomes are being squeezed by, amongst other factors, high youth unemployment and the domestic real estate crisis. This has led to reduced confidence and willingness to spend.

For Chinese manufacturers, the lowdown in global growth and tensions over trade, technology and geopolitics between the USA/West and China have also affected growth. In the pig sector, the larger conglomerates and pig producers/processors have lost money and margins have generally been negative.

Pig prices, as my chart shows, have bounced around the bottom as producers (probably hampered by ASF, poor market information and self-indulgent forecasting) have struggled to restructure in line with new demand parameters. Chinese companies involved in the feed/pig/pork sector seem to operate on stop-go strategies despite the scale of the investment funds involved. As ever, China is the wild card in the global market for pork and that is not meant to be a compliment.

North American intentions

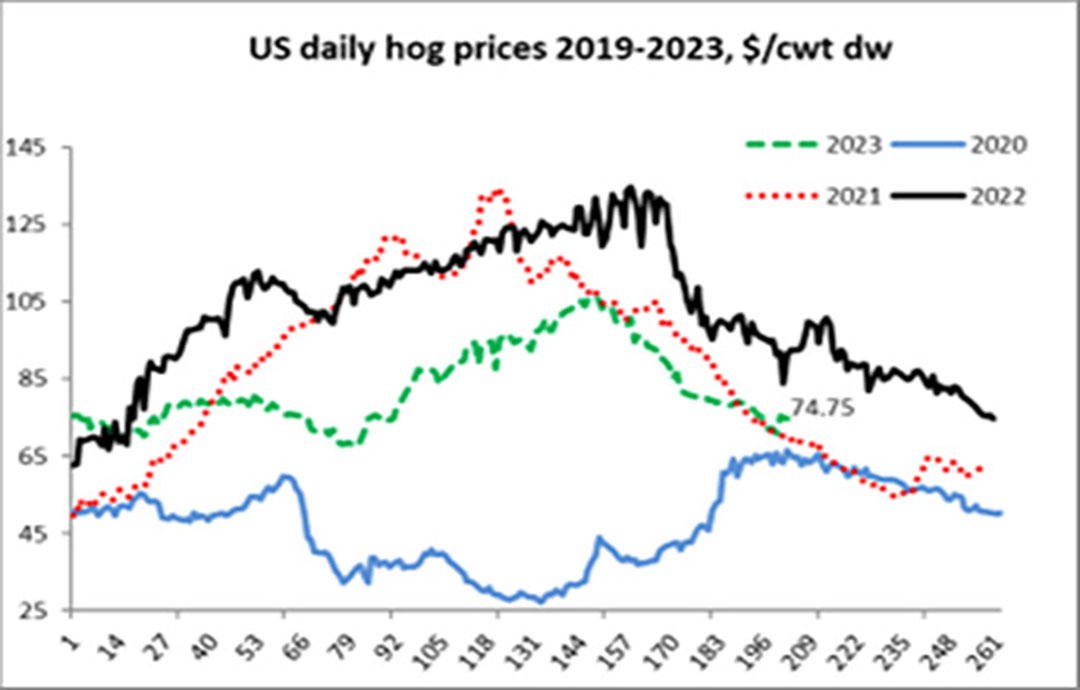

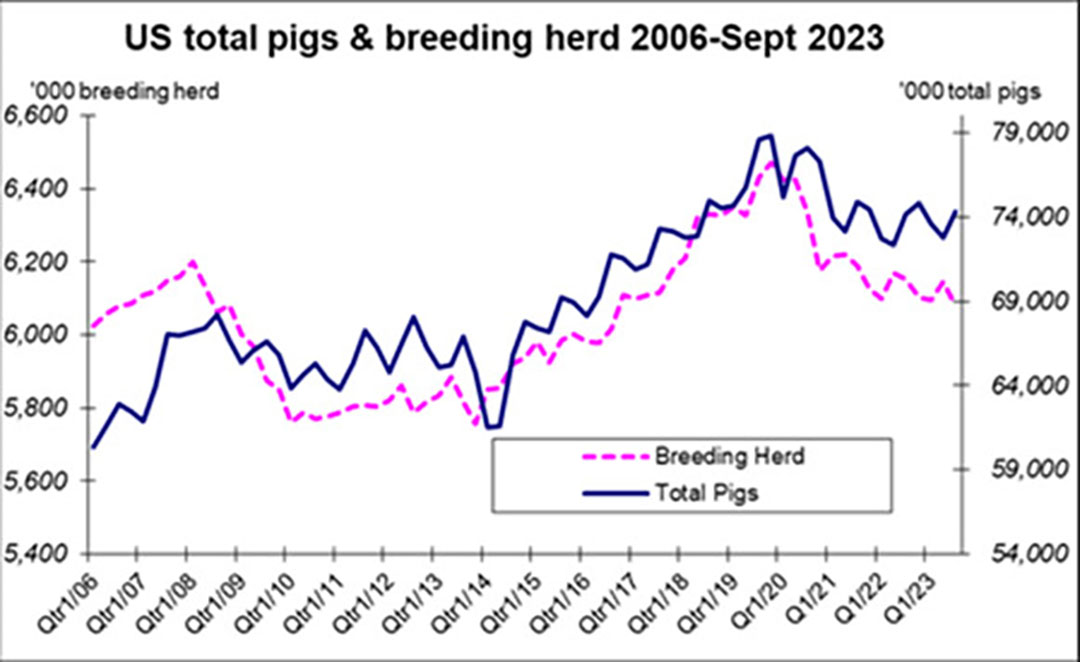

Figures 3 and 4 offer views of how prices and pig populations have the behaved in recent years. Table 1 presents recent data from the October US hogs & pigs report (why can’t more member states in the EU, and the UK produce timely and comprehensive census reports like the Americans?) Table 1 indicates that the stabilisation in US hog numbers has continued. However, the census report also indicates that, “US hog farmers intend to have 2.93 million sows farrow during the September-November 2023 quarter, down 5% from the actual farrowings during the same period 1 year earlier, and down 4% from the same period 2 years earlier. Intended farrowings for December 2023-February 2024, at 2.91 million sows, are down 1% from the same period one year ago.”

These intentions imply fewer pigs and probably less pork in the run up to Christmas this year. We may see a rebound in US hog prices against the seasonal pattern. That pattern is shown in Figure 3. Figure 4 offers evidence that the long run trend in the size of the US breeding herd is negative and, at the same time, indicates that US productivity in its pig breeding may be rising (the impact of imports of live hogs from Canada need to be considered in this appraisal).

The party’s over in Europe

I have observed before that pig prices in Europe have been on a roll – but the summer of 2023 has put an end to the good times. The EU average pig price peaked in mid-July. Figure 5 illustrates how prices have soared in the EU and have now collapsed back towards the underlying trend. Actual prices are about to break through that trend and it seems that that there will be continuing weakness, at least until the Christmas season arrives. Subdued domestic demand and an export market that has become less competitive for EU producers is part of the restructuring story for Europe’s pig sector.

The events in the Middle East and the stickiness of energy prices in Europe do not inspire a return to confidence for the EU’s producers, or consumers. The EU’s Short Term Outlook for EU agricultural markets in 2023 and 2024 has recently been published. The Outlook reports, “A smaller breeding herd as well as African Swine Fever (is expected to) push EU pigmeat production further down by 6.6% in 2023, despite lower feed prices. Sustained domestic demand and lower demand from China (will) slow down EU exports by 16% in 2023. In the first half of 2023, EU pigmeat production went down by -8.6%. This level of contraction in a key animal protein sector is likely to lead to price rises in the future – if domestic and/or export demand for pigmeat recovers.

The global market: is it all doom and gloom?

If you have not reached for a Danish pastry or chocolate cake (or whatever lightens your mood) after reading this far I am impressed by your resilience. Indeed, that is the one quality that will be needed above all in the months ahead. If you earn your living from the pig and pork production industry the charts and my text above do not offer much joy.

As ever, though, it is better to know and be able to plan ahead than to be in the dark and react at the last minute. If you are planning, then I would respectfully suggest that this is not the time to invest in new capacity – not this side of Christmas.

But…. and this may be the light at the end of the tunnel, 2024 may bring signs of a turning point. It would be extraordinary if a downturn in the global cycle went on right through next year. If there is an upturn in the next 12 months it is wise to keep a close and ongoing check on animal health, breeding schedules and fertility programmes.

Be resilient and be ready is the most optimistic tone that I can offer.