Quarterly pig outlook: A glass half full?

A new year begins and it starts with a familiar dilemmas – is the glass half empty or half full? Despite being a purveyor of the dismal science, in his quarterly update, pig market analyst Dr John Strak tends to see the world in the latter terms. He thinks a rebound in pig prices is likely, at least in the first half of 2022.

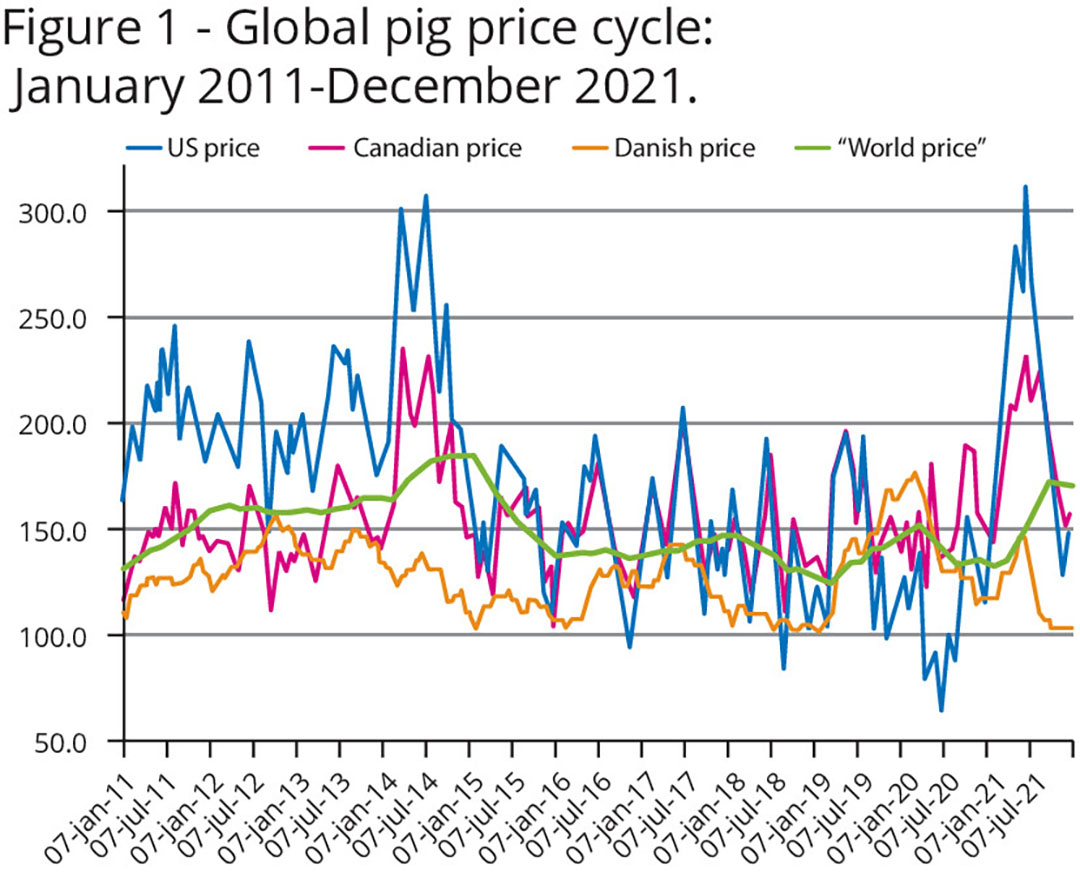

In November last year I observed that a turning point was about to arrive for global pig prices. The global pig price index had slowed its upward movement and was about to turn down, and we would enter the downward phase of the cycle. That prediction turned out to be accurate and the global pig price index has been in negative territory since last November. In normal times this phase of the cycle would last about 6 months – but these are far from normal times.

Turning point for pig prices

The data are now indicating that another turning point may be about to occur – reversing the direction of travel for prices and the cycle. And, since the smoothed global price index is a lagging indicator, actual prices may start to move up early in the first quarter of 2022. As with all turning points, future events are often unclear when the new trend is not established but, fundamentally, I think the outlook looks good for the price bulls.

Figure 1 illustrates some of the points I am making in these opening paragraphs. Pig prices in the main exporting countries were falling in the second half of 2021 and North American prices were well below the data line in the chart that represents the global index of prices by November 2021. European prices were below the global index for most of the year. The global index is calculated from weighted averages after exchange rate effects are removed. Chinese import demand and domestic hog prices were also falling away. For most producers 2021 was a year to forget (even without Covid-19).

Normal price levels for pigs in China

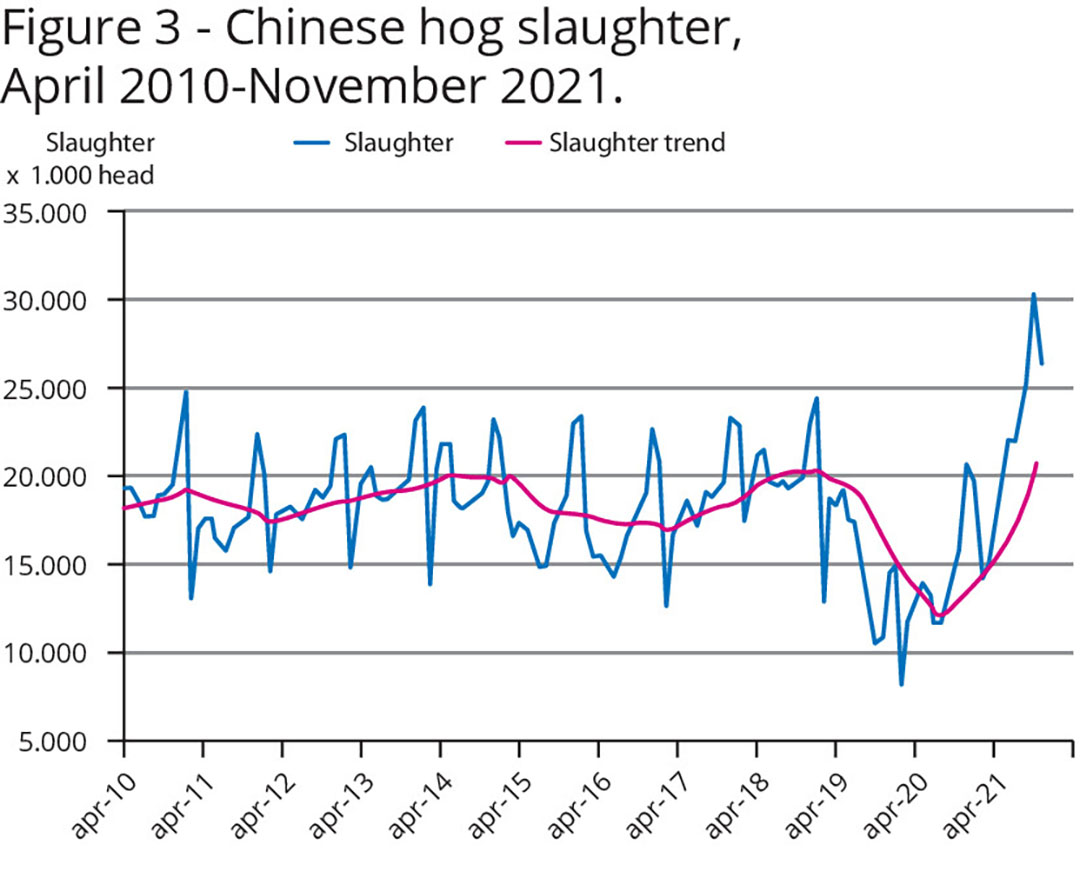

My crystal ball gazing last year suggested that the Chinese would reach previous “normal” levels of slaughter by the end of the year. That also turned out to be an accurate forecast as Figure 3 shows. This chart presents the monthly hog slaughter data for China and it illustrates how kill numbers in China jumped in the last quarter of 2021. Latest figures show slaughter rates in China up by almost 70% year on year.

The higher limit of my estimation of the “normal” kill number range was reached in December. Slaughter numbers rose sharply as Chinese producers ran for the exit when Chinese market prices crashed and feed/energy prices increased. The cull of pigs was as dramatic as the rise in pig production in response to ASF – but more predictable perhaps. In effect, China’s pig sector, in real time, provided a case study for the cobweb theorem of price cycles.

China’s misunderstanding of pig producers’ supply response

The rest of the pork production world, of course, can only sit and watch as the Chinese learn about stuff that is taught in Economics 101 classes in high school and college. Actually, as observers we can take some actions to mitigate the impact that China’s mistakes in commodity market management cause – hence my references to flak jackets and helmets when I write about this market behaviour. Producers and investors in pig and pork production are in a more risky business environment at the moment and they need to act more cautiously.

Collapsing pig prices through 2021

If Figure 3 illustrates what has been happening to kill numbers then Figure 2 offers a picture of how Chinese pig prices have helped drive this wild swing in pig and pork supply – initially sparked by ASF in China. Chinese weekly deadweight pig prices in 2019/2020 rose sharply.

But then they began to collapse from early 2021. The Chinese government eventually became directly involved when it introduced a market price support scheme that involved state purchases but, mostly, the market has been trying to adjust to this of this over supply through the cull of sows. A related adjustment is the level of imports and the growth of foreign pigmeat into China has slowed. That’s where the rest of the world starts to feel the impact.

It is Chinese New Year at the end of January and that would be expected to increase domestic pig prices in the period before the big holiday but more important for the medium term the signs are that China’s pork production levels will be lower in 2022 and the market more in balance. The big question is, has China achieved all it needs from its sow cull? I think it probably has, but, as ever in China, the data is in a black box.

US breeding herd at late 2020 levels

Table 1 presents the data from the latest (December 2021) US hog census. The breeding herd in the United States now appears to be at about the same level as December 2020. If the census is accurate that means the US has ceased reducing its sow numbers. The US is also reporting a high incidence of PRRS in sows and that is reducing US productivity. The census estimates for the total inventory and for market pigs are both down by about 4%.

These are relatively large reductions and they, along with the PRRS data, strongly suggest that US pork production will be lower in the 1st half of 2022 than it was in 2021. Prices, therefore, will likely be higher. The US economy seems to be recovering well from Covid-19 – albeit that Omicron’s spread in the population has reached record highs.

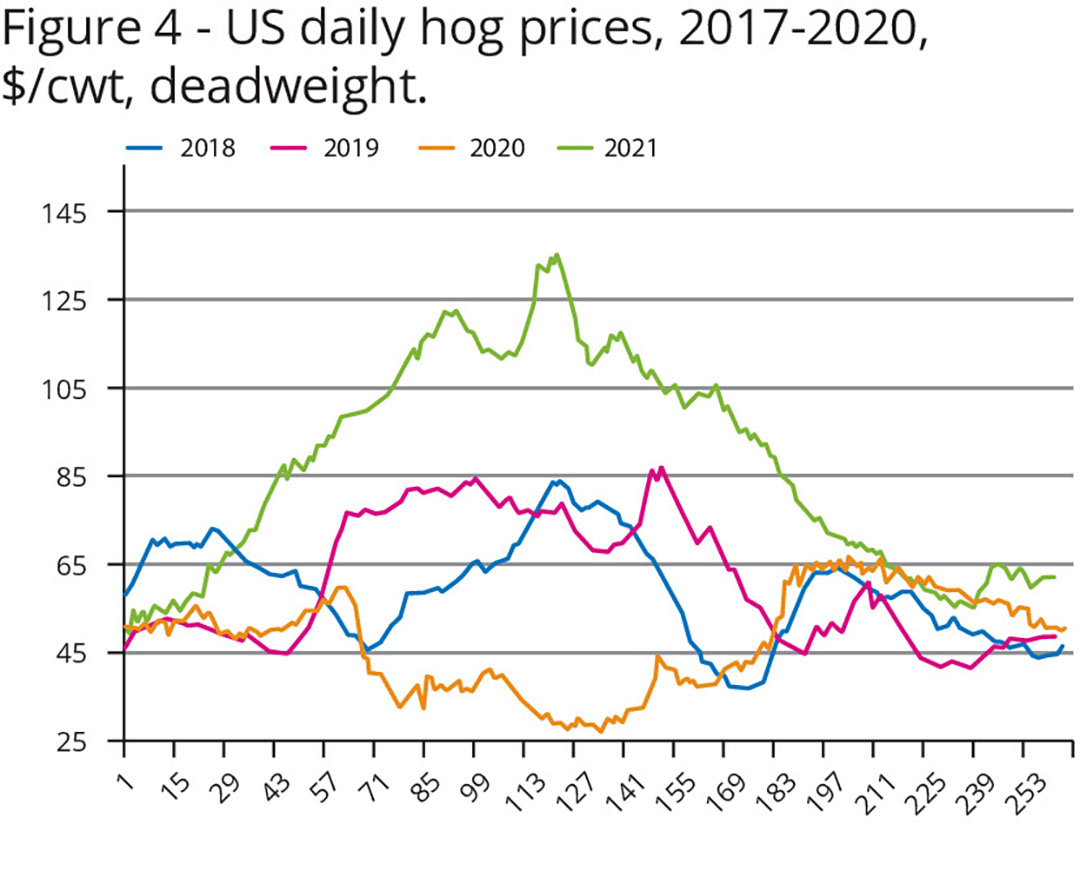

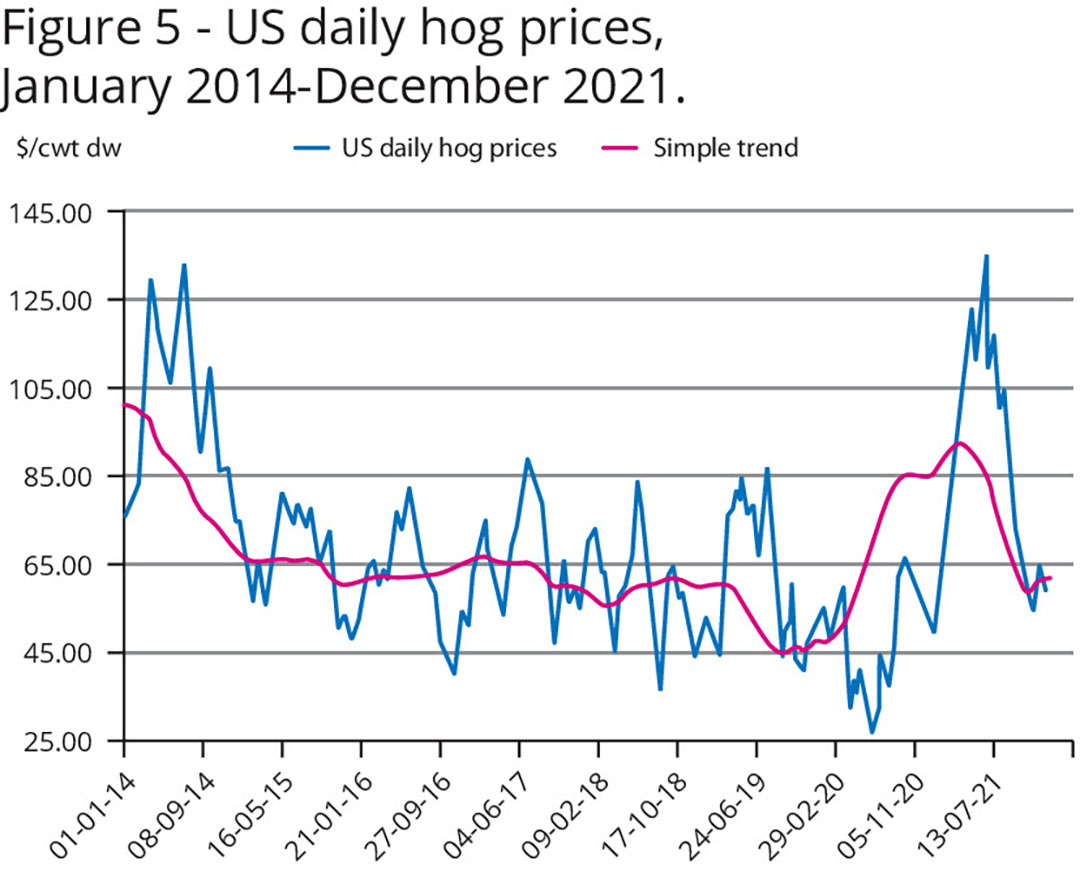

Weak recovery in US hog prices

Figures 4 and 5 present the daily hog price data through to the end of the fourth quarter in 2021 and a weak recovery in US hog prices is observed at the end of 2021. These charts also show how US hog prices dropped from their previous record levels. A big question for the US market in 2022 is, will ASF appear on the North American continent this year (knowing that it arrived in the Dominican Republic and Haiti in 2021)?

If you think the glass is half full then you will assume, like me, that ASF is not found in in the US herd this coming year.

Pig production in Europe: not much expansion

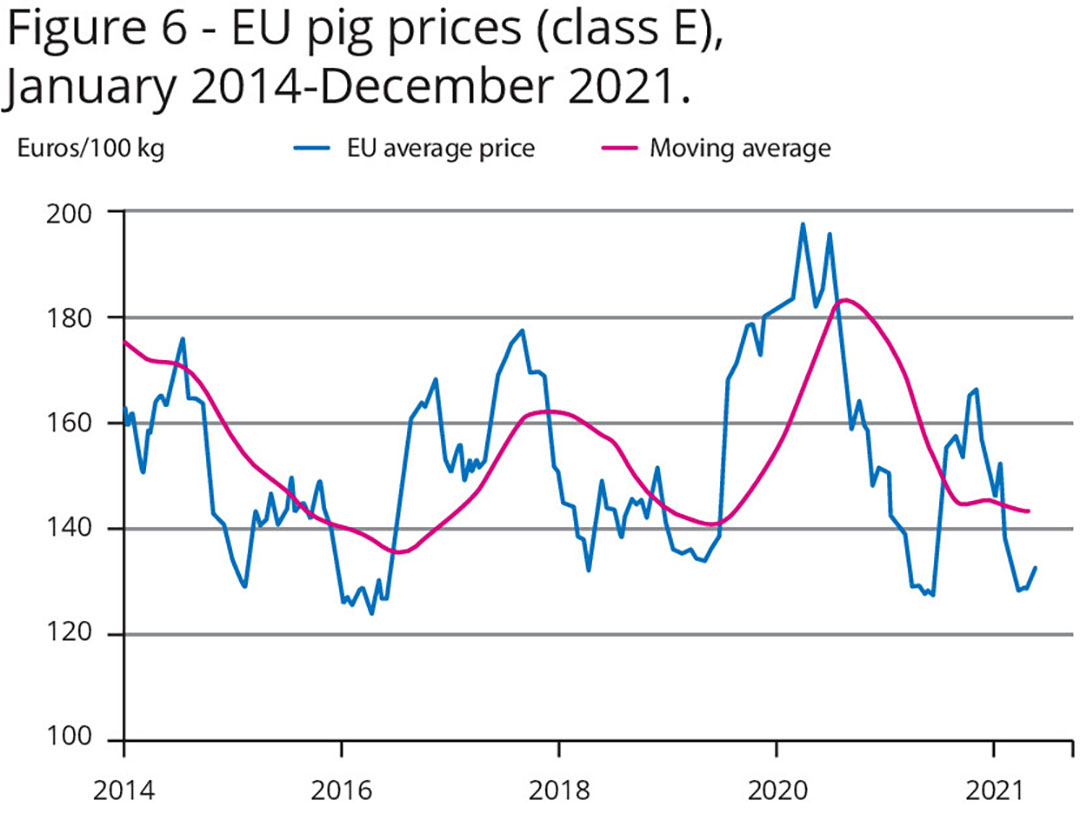

In Europe, pig farmers have not generally been encouraged to expand and the major player, Germany, has contracted significantly. The herd there is down by almost 10% in 2021. In the most recent census data, only Spanish and Danish farmers have held their breeding herd numbers stable or increased them. The outlook for Europe’s pigmeat exports in 2022 is not good and the EU predicts that will be down – driven by a big fall in exports to China.

That is a bear factor for prices but I see the reduced supply of pigs plus recovering domestic demand in Europe as countering this. That judgement is the big question for 2022 in Europe. Will any fall in pork export demand be smothered by improving domestic demand and lower domestic supply? To a large extent the trajectory of the Omicron variant in Europe will determine the answer to this question.

Hopeful pig message for 2022

So, there you have my New Year message – it is a glass half full and there is hope. I have summed up the underlying assumptions for the pigmeat market in the text above and I concede that each of these assumptions could have a glass half empty interpretation. The data, in my view, are positive for pig prices but there are external variables that we cannot measure or predict that can swing the market one way or the other. I just pray that we do not have a replay of 2021 in the New Year.