Outlook until 2031: How will pig meat production develop?

Global pig meat production will continue to grow in the coming decade. This is clear from future projections. Yet, it is good to put the developments in perspective. Pig meat production growth will not match the levels seen in the poultry industry and – unlike on other continents –Europe’s industry is heading for a decrease.

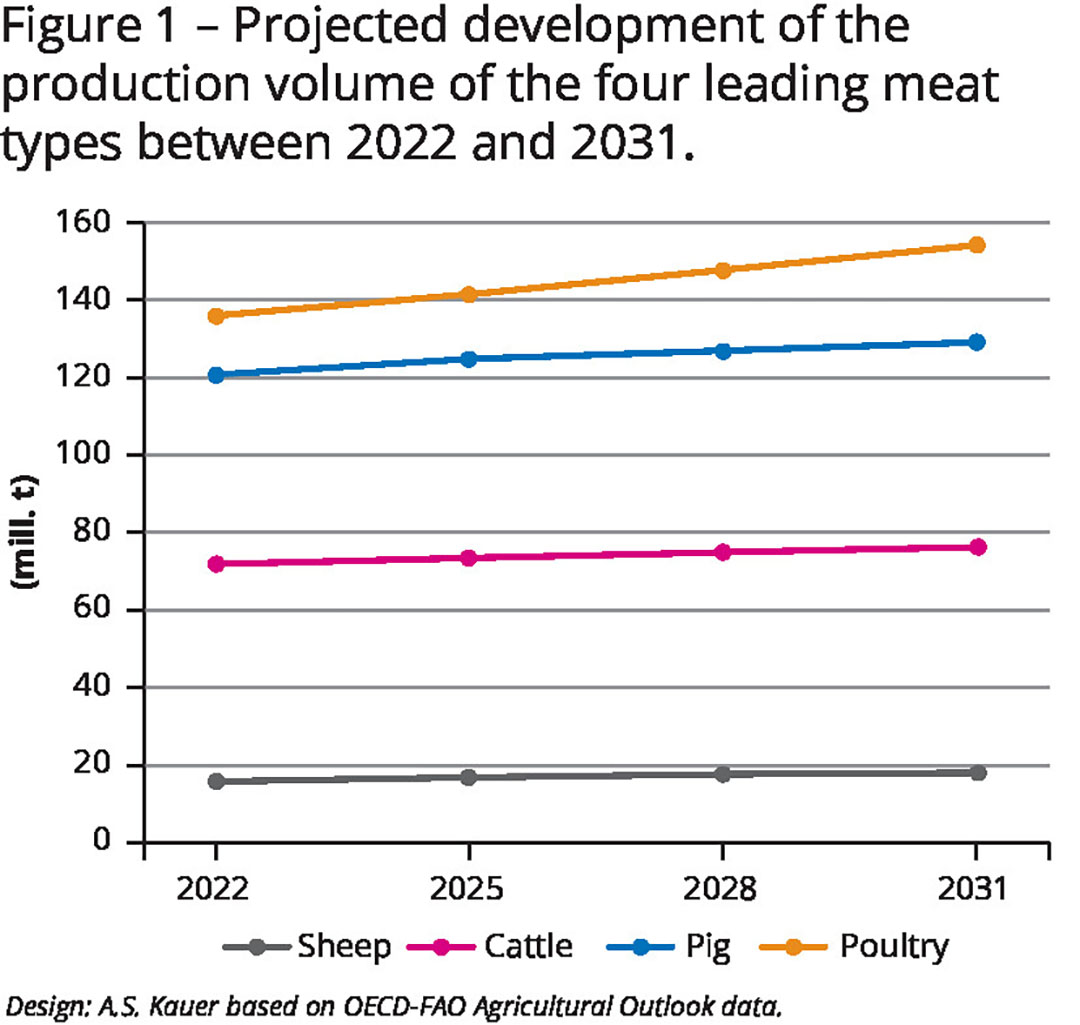

The latest Agricultural Outlook by the Organisation for Economic Co-operation and Development (OECD) and the UN’s Food and Agriculture Organization (FAO) projects an increase in world meat production between 2022 and 2031 from 345.2 million tonnes to 377.2 million tonnes.

Of the total increase of 32.0 million tonnes:

17.9 million tonnes or 55.9% will be poultry meat;

8.1 million tonnes or 25.2% will be pig meat; and

4.2 million tonnes or 13.0% will be beef.

Figure 1 shows that the 4 main meat types will develop differently. The gap between the production volume of poultry and pig meat will widen from 15 million tonnes to almost 25 million tonnes in the decade under review. The aim of this article is to analyse the emerging dynamics for pig meat at continent level and, as far as possible, at country level and to document the underlying steering factors.

Different dynamics at continent level

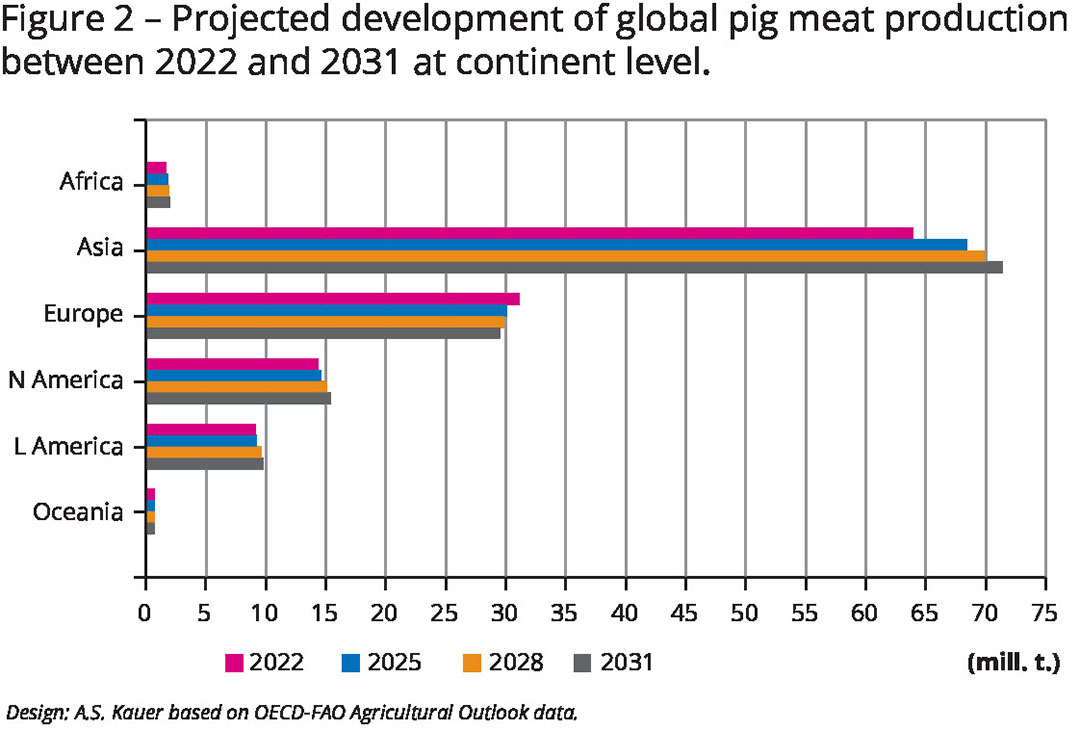

An analysis of the production development at continent level shows that the highest absolute increase is expected for Asia and North America (Table 1); Africa, Latin America and Oceania lag far behind. A decrease in production volume of 1.6 million tonnes or 5.1% is expected for Europe. The highest relative increase is predicted for Africa at 19.6%, followed by Asia at 11.9%.

Figure 2 shows the outstanding role played by Asia and the general trend towards increased production on all continents with the exception of Europe. The less favourable Feed Conversion Ratio of pork compared to poultry is becoming increasingly important due to rising feed costs and explains, among other factors, the significantly lower growth of pig meat compared to poultry meat.

Religious barriers

In addition, there are religious barriers to the consumption of pig meat, which exclude about 3.5 billion people as potential consumers. The different dynamics on each continent will affect its share in world production in the current decade. The countries of Asia will account for 78.4% of the global increase in production, followed by North America with 11.0% and Latin America with 6.8%.

Asia extends dominating position

Figure 3 shows that Asia will be able to extend its dominating position, gaining 2.6%, followed by Africa with 0.2% and North America with 0.1%. European countries, in contrast, will lose 2.9% of their 2022 share. Despite the downward trend, Europe will remain the second core region in global pig meat production beside Asia, ranking well ahead of North America. A closer look at development at country level will show which countries will gain in importance and which will lose market share.

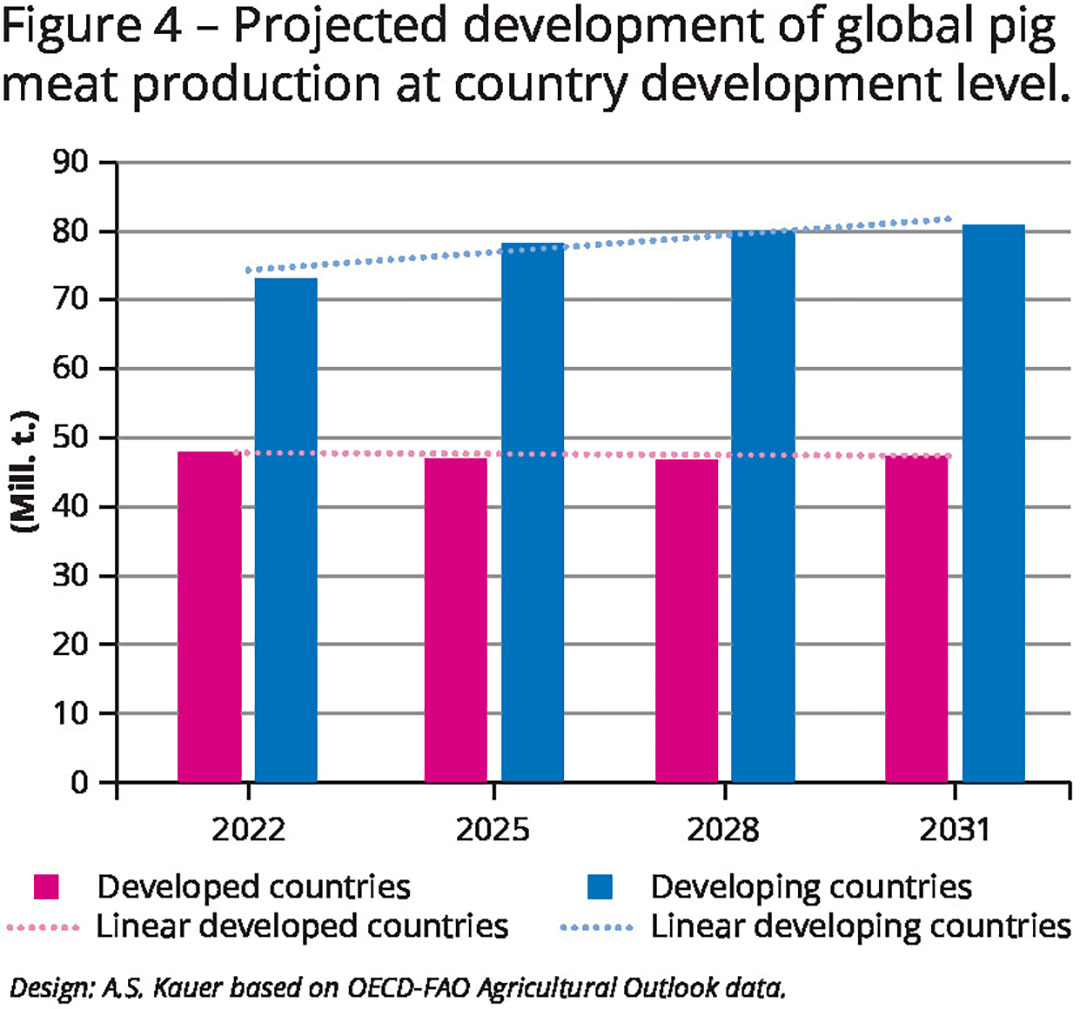

Developing countries making future dynamics

An analysis of the expected development of pig meat production according to the development level of the countries shows that developing countries will be the driving force behind the dynamic development in the current decade (see Figure 4). The developed countries’ share in global pig meat production will decrease from 39.6% to 36.7%, while developing countries’ share will increase from 60.4% to 63.3%. In 2022, the gap between the production volumes of the 2 country groups was 25.2 million tonnes; it will increase to 33.6 million tonnes or 33.3% by 2031.

Population growth

That reflects the expected population development. Between 2022 and 2031, the world population will increase from 8 billion to 8.4–8.5 billion. Asia and Africa will be the continents with the highest population growth. In 2031, in the predicted annual increase of 68 million, Africa will be responsible for 37 million, Asia for 26 million and the Americas for 6 million; in Europe, in contrast, the population will decrease by 1.1 million.

A closer look at the expected production development at country level reveals that of the 15 non-EU-27 countries considered, 5 are developing countries, 6 are emerging economies and 4 are developed countries. As Table 2 shows, the production volume in these 15 countries will be higher than at the global level. That reflects the expected decline in production in Europe, particularly the EU-27.

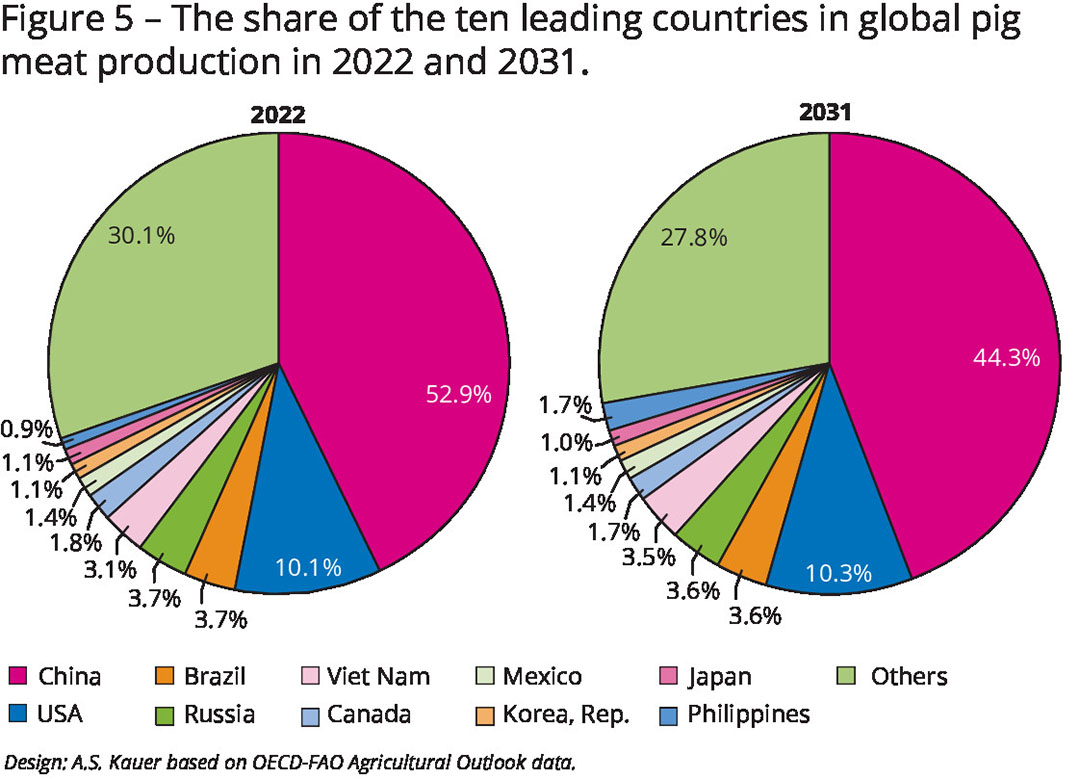

China, USA and the Philippines

While an increase in production is projected for 11 of the 15 countries considered in the decade under review, a decrease is expected for Japan, Canada, South Korea and the United Kingdom. Just 3 countries – China, USA and the Philippines – will account for 83.7% of the expected production growth of the country group, with China alone accounting for 58.9%. However, that assumes that China will succeed in containing the outbreaks of African Swine Fever.

The Philippines will show the highest relative increase with 95.8%; Japan will have the highest decrease, of 1.4%. Despite the downward trend in some countries, the contribution of the top 15 countries to world production will increase from 73.3% in 2022 to 75.4% in 2031.

Figure 5 shows the change in the shares of the top ten countries outside the EU-27 in global pig meat production between 2022 and 2031. China, the Philippines, Vietnam and the USA will be able to increase their contribution, while Russia, Brazil, Canada and Japan will lose shares. Here, the extraordinary role of Asian countries in the future dynamics becomes obvious again.

Development in the EU member states

If pig meat production in the EU-27 were included in the analysis at country level, the following situation would emerge for 2021 (more recent data are not yet available for the EU) (Table 3): Of the 15 countries, 7 would be EU member states. They would account for 16.3% of global production.

EU-27

For the EU-27 as a whole, the OECD-FAO Agricultural Outlook predicts a decrease in production by 1.8 million tonnes from 23.9 million tonnes in 2022 to only 22.1 million tonnes in 2031, or by 7.5%. The share of the EU-27 in global production will accordingly decrease from 19.8% to 17.1%. Forecasts at country level are not yet available. However, Spain, Denmark and the Netherlands will likely be able to maintain their production volumes, while Germany, Poland, Austria and some Eastern European member states will face a decrease.

Germany likely to show sharpest decline

In view of the developments in recent years, Germany is likely to show the sharpest decline. In Lower Saxony, the centre of German pig meat production, the number of farms keeping pigs decreased by 24.4% between 2017 and 2022 and, in parallel, the pig population fell by 1.3 million (or by 16.0%) to only 7.4 million. For Germany as a whole, a decrease in pig meat production from almost 5 million tonnes to just 3.8–4.0 million tonnes is expected.

Development in Poland and other Eastern European countries will heavily depend on their ability to control African Swine Fever outbreaks. In addition to rising production costs, a result of higher raw material prices and energy costs, the per capita consumption is declining in most countries. Pig meat will continue to lose market share to the fast-growing poultry meat, which consumers increasingly prefer. Not in the least because of the lower retail price.

Will alternative pig meat be a competitor?

In view of the dynamic development in the production of plant-based meat substitutes and the emerging possibility of producing meat from cell cultures, one can assume that their share of total meat consumption will increase significantly in the current decade. In 2021, sales of plant-based meat substitutes reached a value of US$ 5.7 billion worldwide.

Western Europe and North America accounted for US$ 4.7 billion. Meat from cell cultures (chicken meat) has been permitted so far in Singapore, but is yet to reach a noteworthy sales volume. Overall, despite the dynamic development, meat substitute products only accounted for a market share of 0.5% of the total global sales volume of US$ 1,071 billion.

In particular, substitutes for beef and poultry meat were available on the market. Only in Asia, pig meat achieved higher market shares. North America, the EU or Asia have not yet received applications from start-ups or companies to obtain market approval for pig meat from cell cultures. so this technology is unlikely to produce any quantities that are significant for the market in the medium term.

However, there are indications that some start-ups and companies are working on the production of hybrid products that could achieve cost parity with conventionally produced pig meat earlier. Nevertheless, here too, market approval of cell-cultured meat is still necessary.

A preliminary conclusion

In the current decade, pig meat production will grow at a much slower pace than poultry meat. Rising production costs and stagnating or even falling per capita consumption in a number of countries are important steering factors. In contrast to all other continents, production volume in Europe will decrease.

Nevertheless, Europe will remain the second most important core region for pig meat production, alongside Asia, which can further expand its dominant position. In the predictable future, plant-based meat substitutes and pig meat from cell cultures will not achieve larger market shares.