Quarterly Update: The President, the tariffs, and the pig price cycle

Pig market analyst John Strak wrote in February 2025 that the global pig price cycle will not maintain its current upward phase in the early part of 2025. We are now in the spring of 2025 and it seems that, for some at least, the fizz has gone out of pig prices.

American and Chinese prices have behaved as I thought they would, whereas Europe’s week-to-week pig prices have been a little more resilient but are still in a downtrend. The wild card in the pack in the months ahead, of course, is President Trump. It is likely that his actions with regard to tariffs will cause the global pig price cycle to be disrupted. In fact, the “Trump card” makes any rational forecast of any aspect of the global economy virtually impossible – the only certain forecast is that there will be chaos.

USA

In Figure 1 and in Table 1 I present the latest data published in the hog census for the United States (conducted in early March 2025). These data show a reduction in numbers for the pig inventory, market pigs, and breeding sows across the board. A sign that, even though prices and margins were relatively positive in 2024, there is not any great inclination in the industry to bet on expansion.

On the plus side for prices, and this is the argument made by some US blogs, supply looks tight – there does not appear to be any big “surplus” in US hog supply coming down the track. But that view about prices assumes demand holds up. We have noted before that it is likely that US pork and offal exports were the most positive aspect of demand in the last year – in the year ahead, with a trade war about to start, US pigmeat exports and hog prices look vulnerable. Trump’s tariffs have already provoked some countervailing tariffs on US pork (and other commodities) by China.

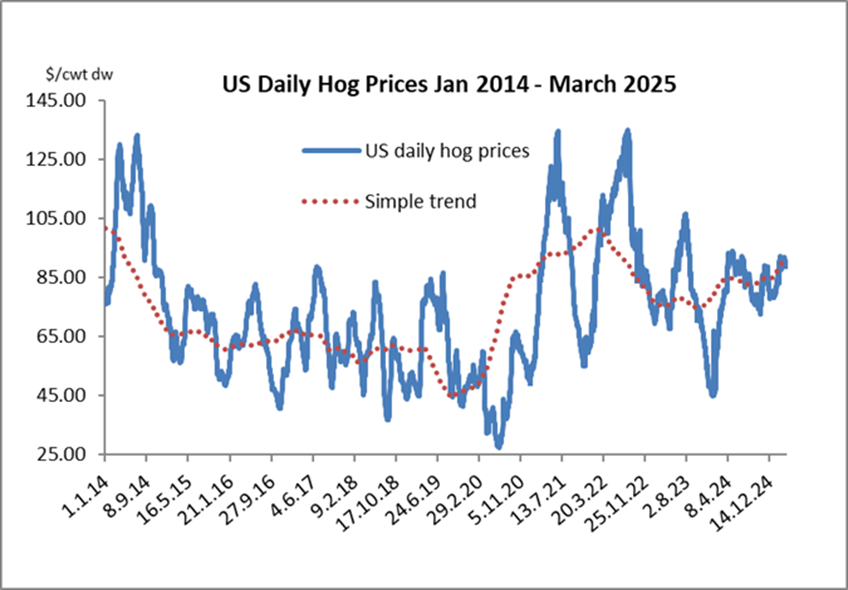

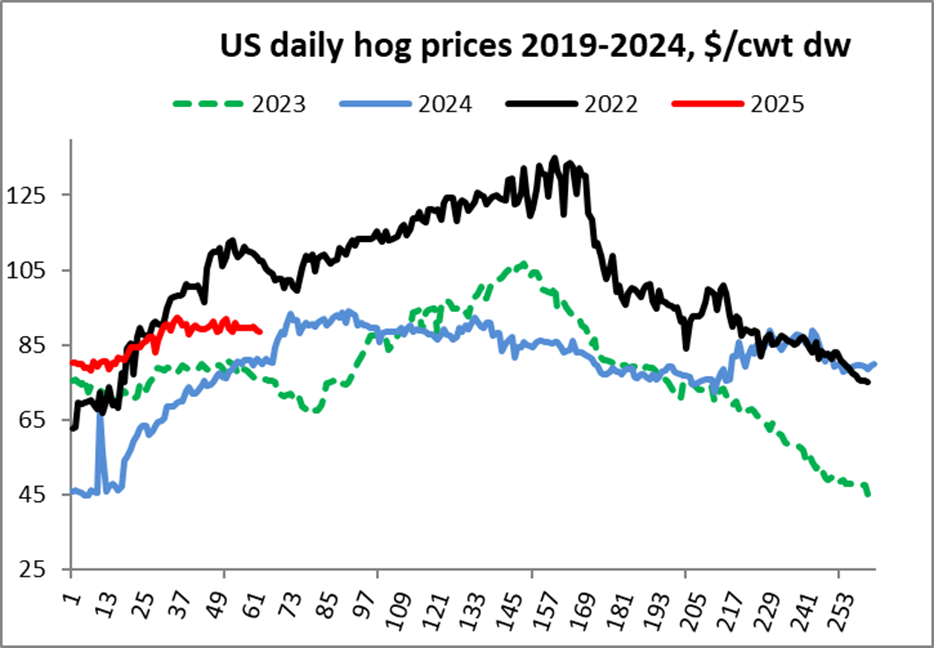

The daily hog price data for the USA shown in Figures 2 and 3 illustrate how US prices have weakened in recent months. Figure 3 in particular shows this aspect of daily hog prices in America. If we take the price series for 2022 out of the picture (since so many Covid 19-related effects occurred during that year) it seems that almost all the price gains in the latter part of 2024 are now under pressure. With forecasters almost everywhere downgrading economic growth in the USA because of Trump’s rhetoric, the chances of domestic consumers breaking records for meat demand in Q2’s BBQ season are getting smaller and smaller. In short, it’s a gloomy outlook for US demand at home and abroad (but note my health warning that some US commentators are much more upbeat about US pig prices and futures than I am here).

China

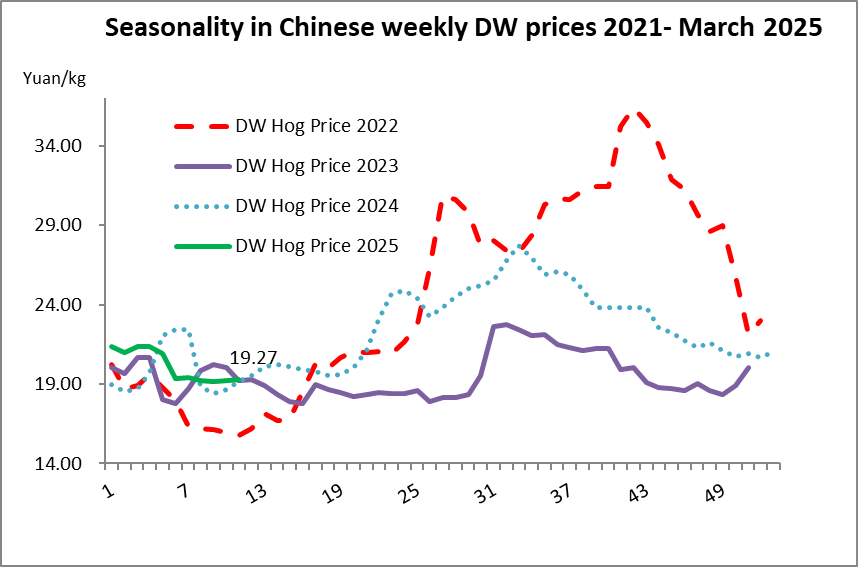

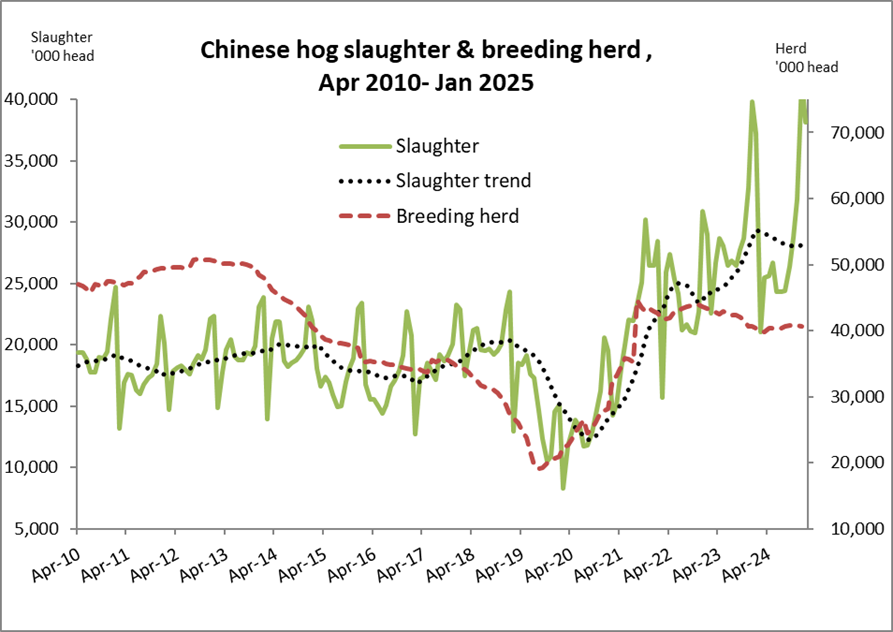

With the Chinese New Year now well behind us it appears that China’s pig prices hardly noticed the traditional celebrations. Figure 4 shows the up-to-date record of national weekly pig prices in China. On closer examination in Figure 5 the recorded prices for Q1 2025 look like they are tracking 2023 levels and any seasonal uplift is some way off. Once again, weak demand raises its ugly head – there are few signs that any Chinese consumers are feeling good about their economic prospects. Figure 6 presents the currently available data on slaughter and sow numbers in China and these data support the view that there is no bulge in pig numbers the Chinese pipeline. There may even be (whisper it quietly) some stability in the supply side in 2025. As I noted in January, there appears to be no prospect of a big recovery in Chinese pig and pork prices, or in the Chinese pig inventory in the next 6 months.

EU

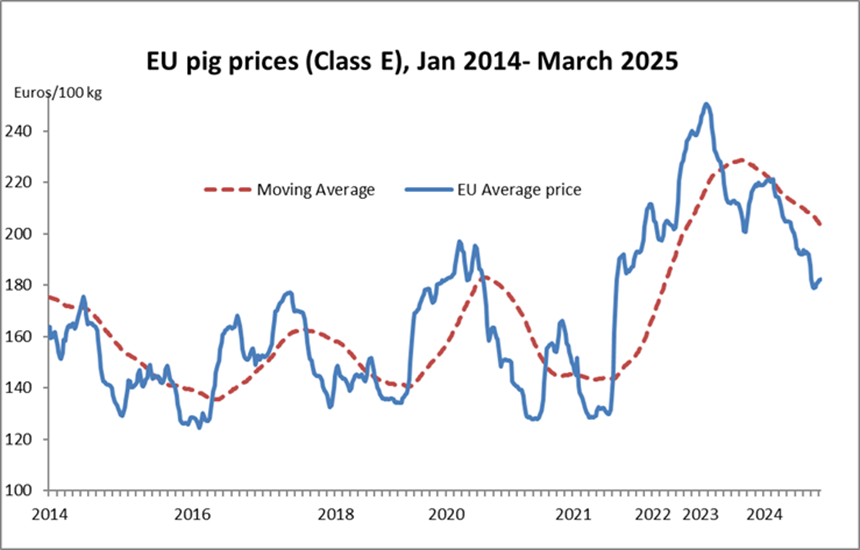

In the EU, with outbreaks of ASF and, more recently, FMD no one is sanguine about prospects for the European pig sector. Prices have not broken out of their downtrend and, relative to North America, it has been a gloomy outlook for pig producers. Figure 7 shows the situation quite clearly.

However, Trump’s trade war could benefit Europe’s pig producers as foreign buyers switch to alternative sources of pigmeat in reaction to US pork that is subject to countervailing tariffs. That is certainly the case for China – although the real prize there is to make inroads into the market for offal (dominated by the USA). Relatively weak consumer demand (on average) is also a factor across Europe. There are tentative signs of a pig price recovery in the EU – it’s far too early to predict that this will occur – but supply is generally tight and any improvement in export demand could help a recovery along.

Global position

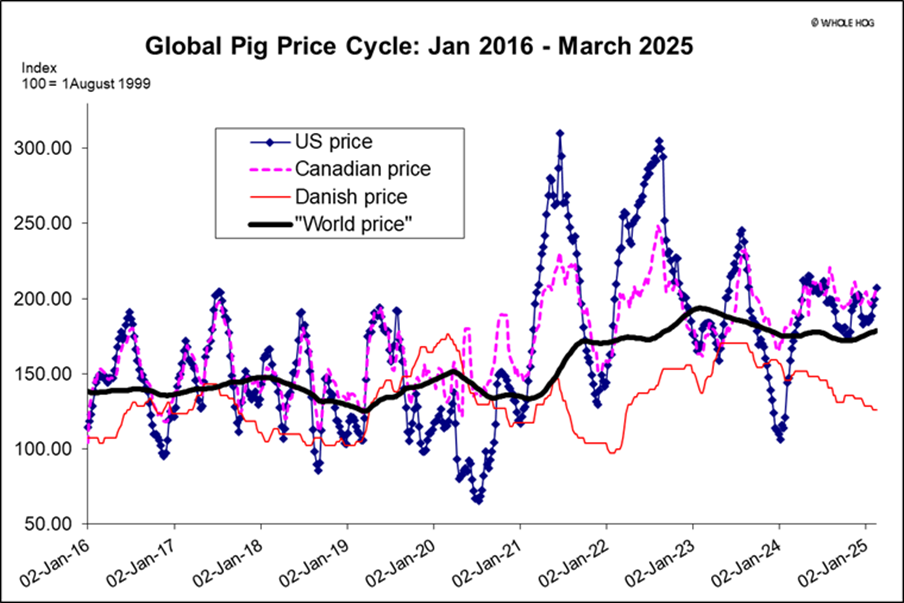

Figure 8 presents the data on global pig price index and its constituent parts. And at first sight it is a relatively positive view of where prices are heading. Global prices are still on an uptrend. There are lags in this model though and even though these data imply a continuing upward phase in the global pig price cycle that is a forecast that has to be heavily qualified. Trump’s tariffs and trade war bluster have not yet been fully captured by the reported data.

We know, nevertheless, that prices and trade will be affected by Trump’s behaviour in the weeks and months ahead – we also know that the data will eventually show this and that the pig price cycle will then, most probably, exhibit a turning point. Long before then, our customers and suppliers will have indicated what the markets think – and it is unlikely to be a positive opinion.

We must also allow for the fact that Trump could reverse all his announcements on tariffs within hours or days. Unpredictability is his trademark. All this chaotic activity just shows that economic models of markets cannot cope with the actions of someone like Trump.

Summary

My conclusions for this quarterly forecast have 1 certainty: nothing is certain. If Trump continues with his attack on the world’s trading system we will see disruption on a large scale. Even if he backs down the uncertainty will remain as long as Trump is president. In situations like these perhaps the only sensible reaction is to retreat to the bunker. Caution, and a moratorium on all investment spending is the business strategy that offers the most resilience and chance of survival. Good luck!