Quarterly Update: Global pig prices – recovery or a false dawn?

Pig market analyst Dr John Strak wrote his previous column in April. It it, he cautioned for a false dawn in the pig industry. Caution is still needed.

In April I presented my views here, saying, “the global price cycle for the pig and pork industry has made a sharp about turn – apparently initiated by shortages of pigs in Europe – and exhibited positive rates of week-to-week change in March…… It is not impossible that this could be a false dawn…… investors and producers could start to think about making decisions about pig production in order to take advantage of pigmeat shortages in Q4 2024/Q1 2025”.

There was a cautionary note in that commentary and with 3 months more data it now seems that caution is still appropriate. In particular, the acceleration of the pig price cycle data has slowed almost to 0 and that indicates we are experiencing a weak upturn in global pig prices.

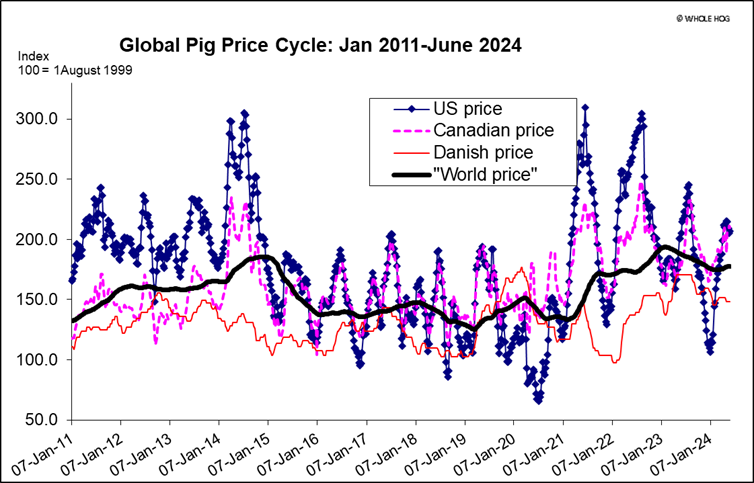

The global picture is presented in Figure 1. The turning point in the cycle appeared in March and the upturn has been maintained. But what is not shown in the chart clearly is that the rate of change in the upward trend in the cycle has slowed. I can illustrate this by referring to Table 1. I have calculated the data in that table on a weekly basis and each week-to-week change is a measure of the acceleration (or deceleration) of weekly price changes in my weighted average global pig price. It is clear in that table that the initial upturn in March, was followed by a big jump in April – but price increases have slowed markedly since then.

The data underlying these changes are taken from North American and European price reports (the major exporters of pork on the world market). I said in April that we will be able to be more conclusive about the strength of this upturn at the end of Q2. At the moment – with data available until the beginning of June – the only safe conclusion is that the upward phase of the current global pig price cycle is a weak one. In other words, it’s possible that the cycle may plateau or reverse in the months ahead.

EU

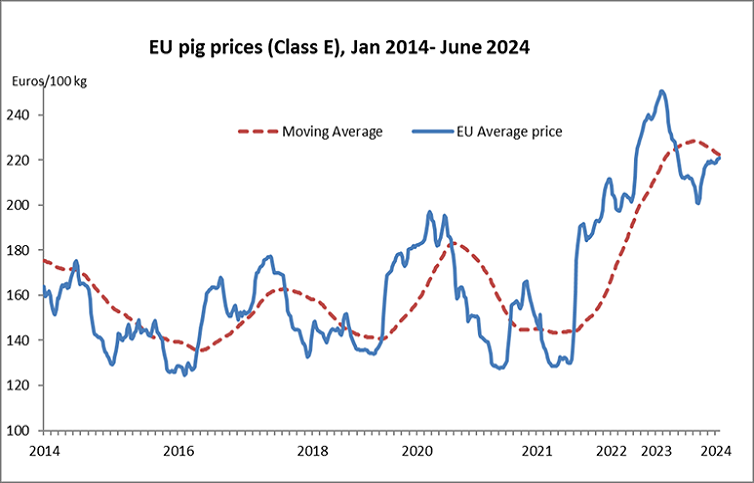

Europe’s pig prices have lost their sparkle. Figure 2 illustrates this. Nevertheless, the EU Commission reports that average pig producers’ margins are positive (and have been for several months). Clearly, the relative shortage of pigs in some parts of Europe and the world has induced positive margins/end to contraction for most country’s producers (and/or their processors) in Europe. The Danes, as shown by the last 2 sets of census data from Denmark, are an example of how improved prices and margins have induced a recovery. The most recent census in Denmark (April) reports that sow numbers are up 2.5% year on year and pregnant gilts have increased by nearly 5%. Similarly, young female pigs retained for breeding are also up by almost 5%.

For the EU as a whole, the December census data are the only full set of data at this time. In these census reports for each member state of the EU we see that the total number of in-pig sows seems to be about the same in 2023 versus 2022 (+0.6%) although the total number of female breeding pigs is reported as being up 1.6%. But for the major producers the growth may be higher than this. An average calculation of the breeding sows’ provisional data for the key states appears to show a growth of c. 2% in the EU’s breeding sow herd in the December 2023 census.

USA

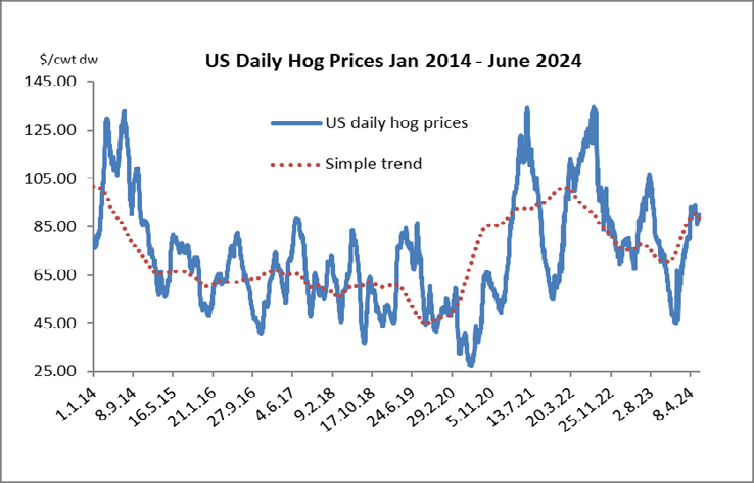

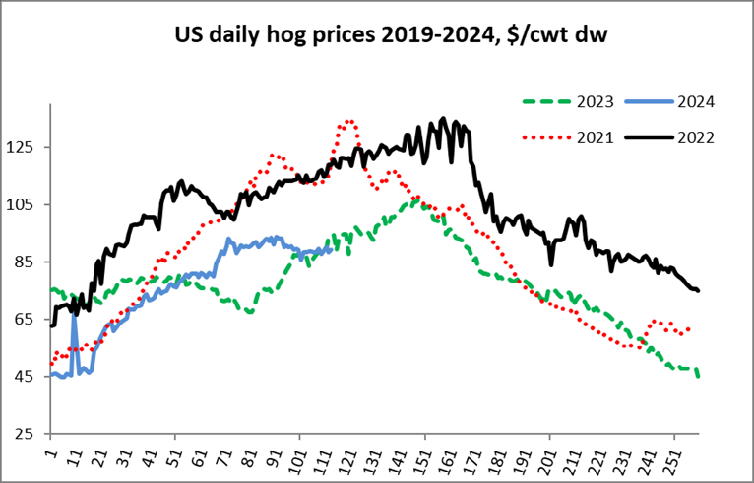

The recent experience of pig prices in the USA is another example of volatility and the relative weakness of the market for pork. Figures 3 and 4 illustrate this. In particular, Figure 4 shows the US pig price struggling to follow the normal seasonal pattern in Q2. This year, the “BBQ effect” has been absent. And yet US pork exports have been relatively strong (they account for around a quarter of the US hog price according to the USMEF). Exports of pigmeat from North America (and Europe) have recently been supported by supply shocks in Vietnam and the Philippines (and in China in past years). How long can that continue? It notable that the USA’s domestic market for pigs and pork in the second quarter has been quiet.

China

The news from China in the second quarter of 2024 has been relatively clear, and uniform. The clarity comes from the announcement by China’s Ministry of Agriculture that there will be a new lower target for the nation’s pig production capacity. The official target for the number of breeding sows has been lowered to 39 million from 41 million. The uniformity arises from the many company reports and Chinese official statements that have emerged in May and June. These reports and statements are agreed that lots of money has been lost by many of the major Chinese producers/processors in 2023/24. There also seems to be wide agreement that the bottom of the Chinese pig price cycle has been reached in Q2 2024. Another common feature of the private sector announcements is the aim to put reducing production costs as the key factor for restoring profits in the future.

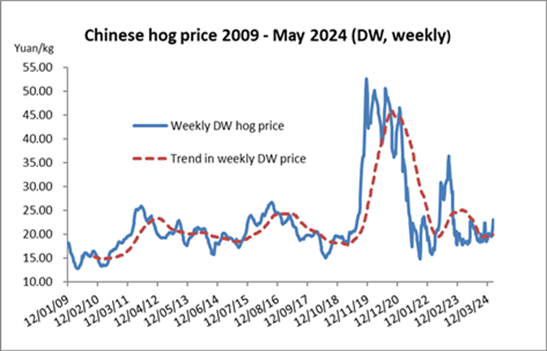

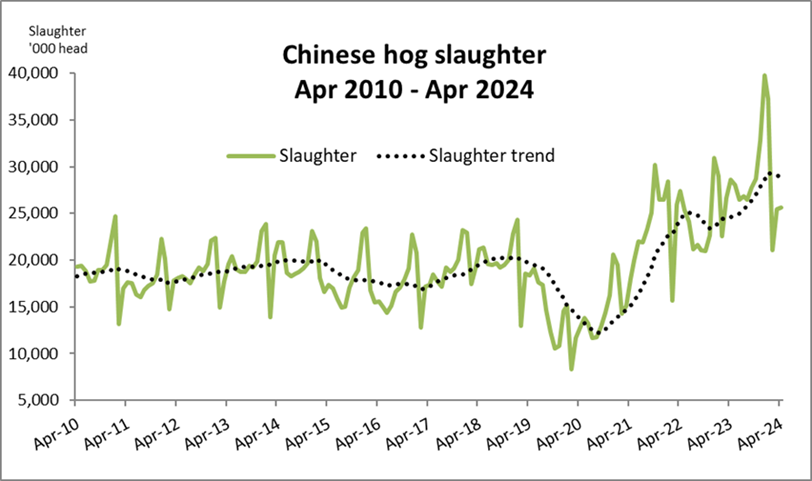

Figures 5 and 6 show the behaviour of Chinese pig prices over a long period. Figure 5 shows how volatile Chinese pig prices have been over a long period – with ASF and Covid-19 being major disruptors. Latterly, prices have been weak as a result of over expansion of the Chinese herd driven by those disease impacts. But at the end of May pig prices jumped, as slaughter numbers fell (Figure 7), leading to claims that the end of low prices has arrived and huge sighs of relief in many Chinese pig company boardrooms.

Summary

What is next? Well, the interpretation of the data and charts in this article is, I am sorry to say, not very clear. Global pig prices are in an upturn but it’s a weak trend. I can see reasons why the upward phase would weaken further – especially if Chinese producers achieve cost reductions and see recent price improvements as a reason to expand (whatever the Chinese government’s target capacity is). EU producers are certainly in recovery mode – maybe not expanding but looking to get more productivity from existing breeding stock via different strategies. In the USA the jury is out – no one seems enthusiastic about expanding their herds but productivity improvement is also high on the agenda there.

I can only advise: watch this space!