Oceania: Meat production grows, but at its own pace

There is not a lot of information available about Oceania’s role in meat production – which is partly understandable seeing the region’s relatively small population and economic value and its relative geographic remoteness. This article focuses on developments in Australia and New Zealand and discusses what the continent has done to close the existing gap.

With 43.9 million inhabitants in 2023, Oceania accounted for 0.55% of the global population. The continent’s population is highly concentrated regionally (see Table 1). Australia, with 26.4 million inhabitants, shared 57.3% of the continent’s total population, followed by Papua New Guinea with 10.5 million (22.4%) and New Zealand with 5.2 million (11.3%); the remaining independent countries of Micronesia, Melanesia and Polynesia contributed 2.8 million. Population density ranged from 2.2 inhabitants per km2 in Australia to 163 in Tonga. Both the comparatively low population and the distance between the islands are a problem, because of the limited domestic demand for food and the high transportation costs, which reduce competitiveness on the world market.

Remarkable momentum

Between 2012 and 2022, meat production in Oceania increased from 6.0 million tons to 6.5 million tons or by 8.2% (see Table 2).

A look at the development of the most important types of meat reveals major differences. The production volume of cattle meat decreased by 153,000 tons or 5.5% in the period under review. In contrast, production of the other meat types increased. Poultry meat, in particular, showed high absolute and relative growth rates. It accounted for 77.2% of the total growth in Oceania’s meat production. That reflects the red-white shift in global meat production and consumption that can be observed. The relative increase of 29.7% was almost identical to the value achieved at global level.

A comparison with the development of global production levels reveals that Oceania achieved a higher relative growth rate for pig meat, but a significantly lower rate for sheep meat. As will be shown later, this was mainly due to the decline in New Zealand’s production. Looking at the dynamics of meat production as a whole, a relative increase of 17.3% was achieved at the global level, more than twice as high as in Oceania.

That considerable difference is also reflected in the decrease of the share in global meat production (see Table 3). However, it is worth noting that the contribution to global meat production was three times as high as the continent’s share in the world population. This indicates a high export quota.

Different dynamics at country level

In a further step, the development of meat production at country level was analysed. The island regions of Micronesia, Melanesia and Polynesia are grouped together because they contributed only a small proportion to the continent’s total production.

- Between 2012 and 2022, cattle meat production in Australia fell from 2.2 million tons to 1.9 million tons or by 12.7%, while, in New Zealand, it grew from 607,000 tons to 728,000 tons or by 19.9%. In the island regions, beef production did not change in the decade analysed, stagnating at 15,000 tons, which corresponds to a share of 0.6%.

- Poultry meat, the second most important meat type, showed a remarkable dynamic. The production volume in Australia grew by 312,000 tons or 28.8%; in New Zealand, the absolute increase of 52,000 tons was significantly lower, however, a higher relative growth rate of 30.8% was achieved. In the island regions, poultry meat production rose from 37,000 tons to 56,000 tons or by 51.4%.

- The development in the production of sheep meat is interesting. Australia produced 153,000 tons more sheep meat in 2022 than in 2012, an increase of 27.6%. In New Zealand, in contrast, the production volume fell by 19,000 tons and only reached 437,000 tons, representing a decrease of 4.2%. The island regions produced almost no sheep meat.

- Pig meat production developed similarly. In Australia, it rose by 84,000 tons to 436,000 tons or 23.9%. In New Zealand, it showed a downward trend, production declined from 51,000 tons to 45,000 tons or 11.8%. In the island regions, the production volume of pig meat increased from 97,000 tons to 102,000 tons or 5.2%. However, their share in Oceania’s pig meat production fell from 19.4% to 17.5% due to the dynamical development in Australia.

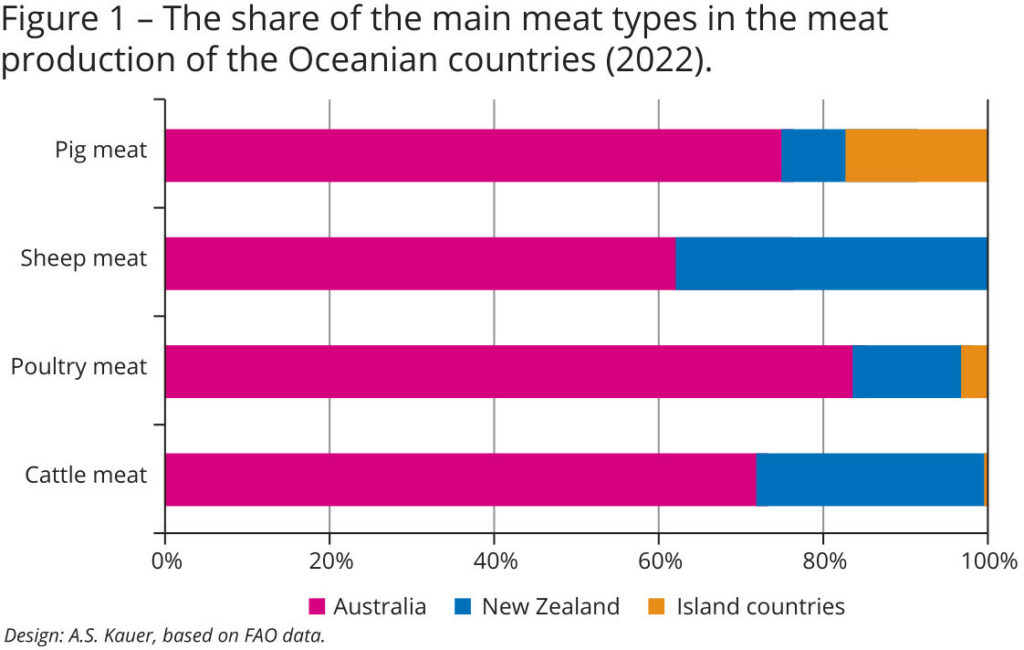

The regional concentration of meat production in Oceania was very high, as can be seen in Figure 1. Australia accounted for 68.4% of total meat production in 2022, New Zealand 22.3% and the island regions 9.3%. As expected, Australia accounted for the highest share of all meat types. It was highest for poultry meat, at 83.5%, and lowest for sheep meat, at 61.8%. New Zealand achieved the highest shares with 38.2% for sheep meat and the island regions did so with 17.5% for pig meat.

Major differences

A comparison of the shares of the types of meat in overall meat production shows major differences between the continents as a whole and global production as well as between individual countries.

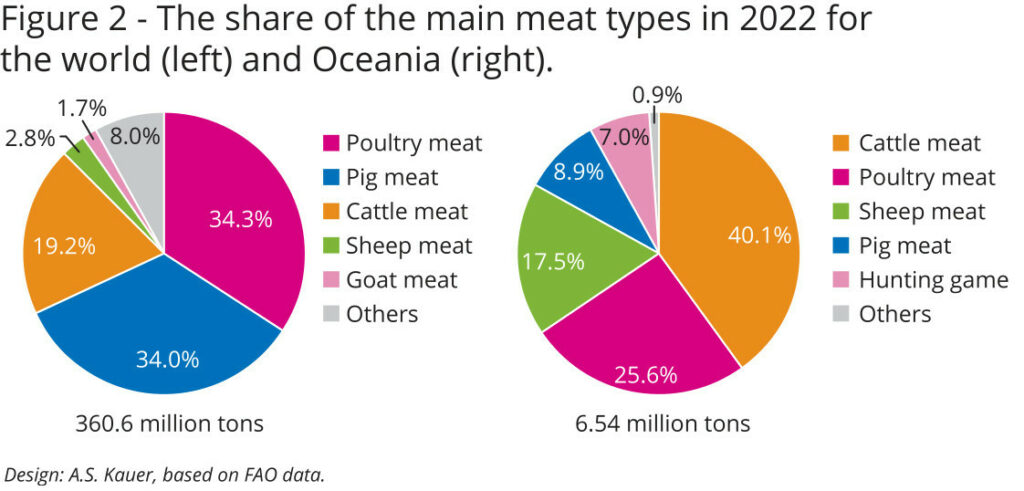

Figure 2 documents the share of the meat types in 2022 at the global level and in Oceania. Poultry meat ranked in first place in global production, followed closely by pig meat, while in Oceania, cattle meat was in first place, well ahead of poultry meat. Pig meat was only in fourth place behind sheep meat. That reflects the availability of large natural grasslands on the one hand, and the long affiliation to the British Commonwealth on the other.

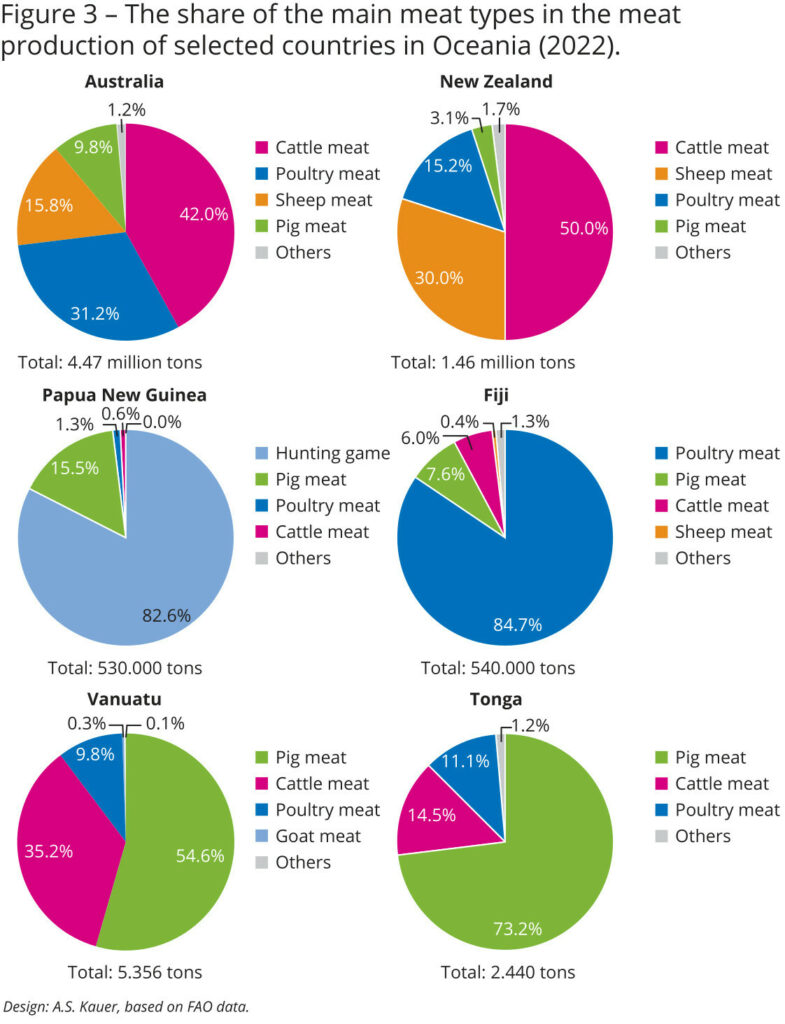

Figure 3 documents the differences in the importance of the individual meat types in selected countries. In Australia and New Zealand, beef took the leading position. However, while poultry meat ranked ahead of sheep meat in Australia, sheep meat was in second place in New Zealand. Both countries dominated the list of sheep meat exporting countries in 2022. With a combined export volume of 833,000 tons, they accounted for over two thirds of the global export volume. The greater importance of poultry meat in Australia is due to the consumption behaviour of the population in the urban centres and the importance of tourism.

The distribution in Papua New Guinea, which had about twice the population of New Zealand, is interesting. With the exception of pig meat, commercial meat production was only of minor importance. In 2022, over 80% of the population’s meat demand was still determined by game meat. Vanuatu and Tonga are characteristic countries regarding the importance of pig meat, which accounted for well over half (Vanuatu) and almost three quarters (Tonga) of meat production, followed by beef. Both animal species were predominantly kept extensively, which also applied to backyard poultry farming.

In contrast, poultry meat was the unchallenged meat type in Fiji, with a share of almost 85% in total meat production. This is mainly the result of growing tourism. Due to the origins of visitors from countries with different religious affiliations, poultry meat is offered mainly in the tourist hotels because there is no ban on the consumption of this meat type.

Summary and outlook

In the past decade, Oceania occupied only a subordinate position in world meat production, with the exception of sheep meat. The small population, the peripheral location to the major world markets and the scattered location of the islands were the most important steering factors for falling behind the global dynamics. Although cattle meat still held the leading position in the continent’s meat production, poultry meat showed by far the highest relative growth rate in the period under review. That reflected the global trend towards an increase in the production and consumption of white meat. On the global meat market, Australia and New Zealand achieved an undisputed leading role in the export of sheep meat. Trade in other meat types was only of minor importance.

It can be assumed that Oceania will lose further shares in global meat production over the current decade, due to the low demand from the domestic market and the region’s peripheral location to the most important meat importing countries. Poultry meat will be characterised by very dynamic development in Oceania and will increase its share in the continent’s total meat production. In contrast, cattle meat production will further decline, simply due to the higher production costs and high retail prices. Sheep meat is likely to consolidate its position, mainly due to stable exports. Pig meat, which has been of comparatively minor importance, is unlikely to show high growth rates in the future.

References available upon request.