Germany’s pig industry: More welfare, shrinking finisher numbers

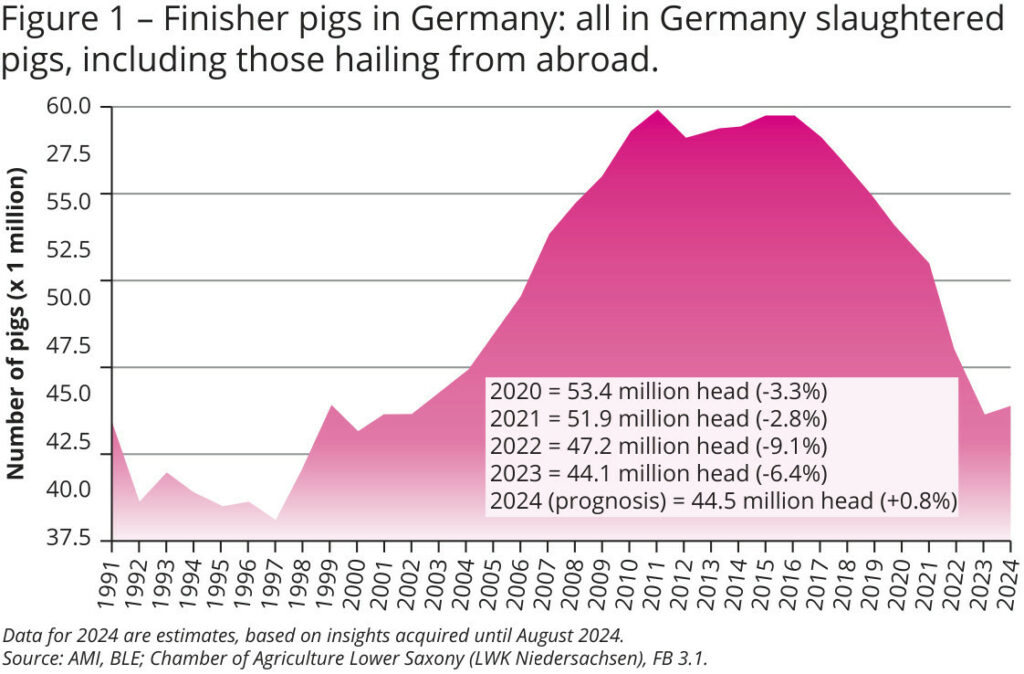

In the last 8 years, Germany’s pig slaughter figures have shown a downward trend. At its peak, around 60 million pigs were slaughtered; this year, however, only an estimated 44.5 million pigs will be slaughtered. Political challenges and stricter regulations have increased the pressure on the meat industry.

After years of decline, pork production in Germany is likely to record a slight upturn for the first time. This development is particularly noteworthy as the number of slaughtered animals had been falling continuously since 2016, see Figure 1. The increase in the number of slaughtered animals is mainly due to the significantly improved economic situation. For the first time in a long time, German sow farmers and finishers were able to make a profit again.

Notwithstanding the most recent positive vibe, it is worth to zoom out and paint a picture about the longer term trend. What has made pig farming increasingly difficult over the last years – and what will this hold for the years to come?

Animal welfare challenges

Quite a lot of developments are related to the issue of animal welfare in German pig production, which has become increasingly important in recent years. It is essential to identify 2 concurrent initiatives.

The voluntary scheme Animal Welfare Initiative (Initiative Tierwohl, ITW) was launched in 2015. This brings together agriculture, the meat industry and the food trade to promote more animal-friendly and sustainable meat production. Farms participating in the scheme are regularly inspected to ensure that animal welfare criteria are being 3met.

In addition, the federal government launched a nationwide label of origin for the pig industry in 2023, for the first time. Before that, there had been various different labels and seals symbolising more animal welfare in livestock farming. However, the federal government wished to regulate the flood of seals in an attempt to create more transparency for consumers.

As from 2025, a label of origin will be mandatory for non-pre-packaged fresh, chilled or frozen pork. Those labels often go beyond the legal minimum requirements and offer consumers guidance when shopping.

Therefore, as from 1 July 2024, labelling for products from animal husbandry have five tiers, converting a previously existing four-tier system. The criteria for pork will match the federal government’s animal husbandry labelling. While the first four levels classify quality assurance programmes (level 1) and animal welfare programmes (levels 2 to 4), the new fifth level represents organic programmes. With that restructuring of the classification, the husbandry method follows the requirements of the national animal husbandry labelling for pork, see also Figure 2.

In the future, the 2 schemes should exist side by side without contradiction. That will enable consumers to continue to have a transparent assessment of the quality of the respective animal welfare programme according to a uniform system.

Increases of ITW premiums

The previous ITW programmes have been further developed and supplemented with various criteria. The new criteria will then be binding for all participating pig farmers from 1 January 2025.

The bonus price recommendation that has been in place since the beginning of 2024 has been adjusted. As from 2025, farms located outside Germany will also be able to take part in the ITW. The criterium of “piglet castration” has been added to the requirements for sow husbandry as a result of the opportunity for foreign companies to participate. Castration may only be carried out under effective pain relief (total anaesthesia or general anaesthesia). That means that countries such as the Netherlands and Denmark, which together exported around 9 million piglets to Germany in 2023, will have to adapt to this market demand.

Specifications of the new labelling system

The ITW is adapting its specifications to the requirements of level 2 of the national animal husbandry label “Stall + Platz,” which loosely translates as “indoors with extra space.” That initially only applies to finishing pigs. In the future, 12.5% instead of 10% more space than legally required will apply in the pig house. Criteria such as roughage, drinking water check, etc. remain. In addition, each pen will have to have an outdoor area, or contain three structural pen elements. These include:

- Contact grids;

- Partitions;

- Raised level;

- Microclimate areas;

- Different lighting conditions;

- Rubbing devices;

- Drinking trough with open water surface;

- Lying area (max. 5% perforation, soft or littered).

The new criteria can be implemented gradually: as from January 2025, the requirements must be implemented for all newly housed finishing pigs, and from April 2025 they will be mandatory for all finishing pigs.

More about the premium regulations can be found in the text box “The ITW premium in detail.”

Slaughterhouses adapting

For years, slaughterhouses have had to adapt to the significantly smaller long-term production base. That is why takeovers and site closures have been shaping market activity. Even before the outbreak of African Swine Fever (ASF) in September 2020, slaughterhouses had been reducing their capacity due to supply constraints. The loss of important Asian sales markets and significant market distortions caused by the COVID-19 pandemic accelerated the downward trend in the German pork sector.

Currently, in total, there are 317 slaughterhouses throughout Germany having more than 20 employees. Most pig slaughtering takes place in the states of North Rhine-Westphalia and Lower Saxony, in the country’s north-west, where together more than 66% of all animals are being processed. In that production centre, too, numerous slaughterhouses have had to close over the past four years. The withdrawal of the Netherlands-based processor Vion from the German market is the most serious evidence that there is massive displacement competition in the German meat sector.

The concentration in the processing sector has had a significant impact on market power and pricing in Germany, affecting the entire supply chain. Large companies, such as Tönnies and Westfleisch, are capable of improving their negotiating position with suppliers and buyers through their market position. In the future, this will lead to lower producer prices in regions further removed from the market. Slaughterhouses may also succeed in enforcing higher consumer prices in the food retail sector.

Smaller slaughterhouses will find it more difficult to compete with large ones due to the increased competitive pressure. That is likely to lead to smaller farms having to close, which in turn further increases market concentration.

Changes in consumer behaviour

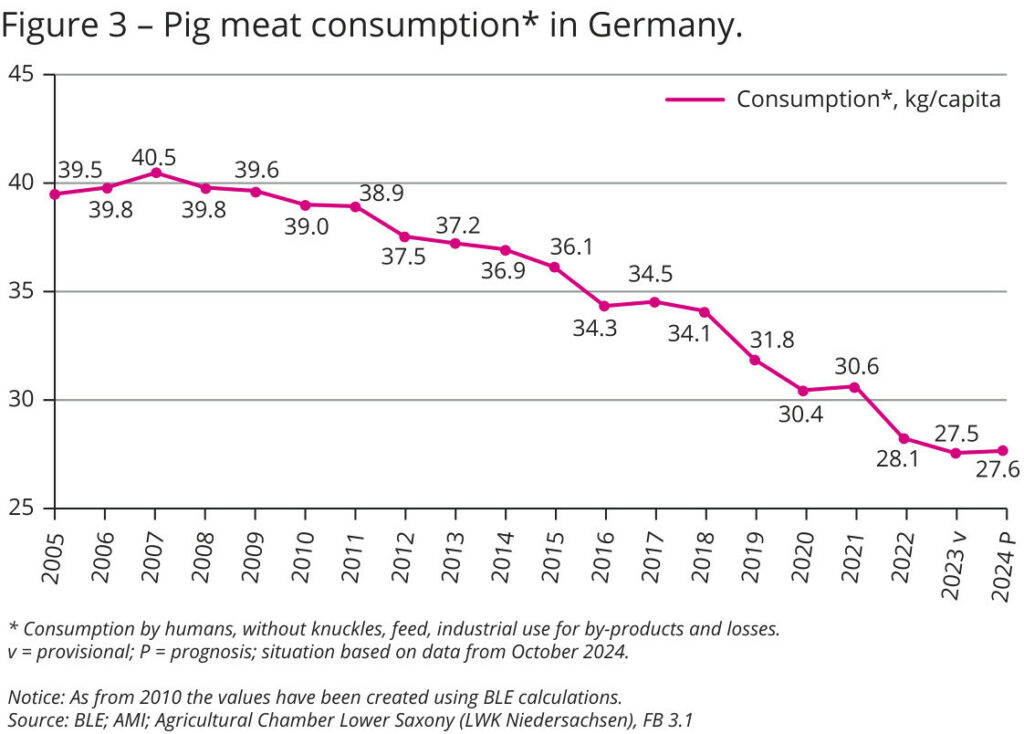

Over the past 15 years, a change in consumer behaviour could be observed in Germany. The demand for meat has changed, which has led to declining pig stocks and higher livestock prices. Consumption in particular has been negative for over ten years, as Figure 3 shows.

Some retailers, such as Aldi, Lidl, Rewe and Edeka, have announced that they will significantly expand their range of meat from higher quality livestock farming by 2030. They also want to offer 100% of their fresh pork originating from housing types 3 to 5. However, the high conversion costs and the difficult approval process mean that this goal cannot be achieved. In any case, the production costs for meat are likely to rise noticeably.

In 2023, production costs for meat already rose noticeably by around 12.6%, compared to 2022. There is currently discussion about increasing the VAT on meat from 7% to 19% in order to finance animal welfare programmes through government subsidies. That could drive up prices for consumers even further and, thus, further reduce meat consumption.

Stabilisation of Germany’s pig population

In 2024, the number of pigs in Germany has stabilised this year. Late 2024, there are 16,180 pig farms in Germany, a decrease of 760 farms or 4.5% compared to last year. The downward trend in pig numbers has slowed for the time being due to the improved economic situation of pig farming as a whole, which is a positive sign. Nevertheless, the current number of pigs in Germany is 21.2 million – the lowest number of pigs in 25 years.

However, experts expect the number of pig farmers will continue to fall. That shows that many farmers still have a bleak outlook for the future. This is particularly true for sow producers, who continue to leave the sector, which is a particularly worrying trend. It could have a significant impact on the future supply of domestically grown piglets.

* In German, the organisation is called “Landwirtschaftskammer (LWK) Niedersachsen.”