Dynamics of the ASEAN meat industry

There are not too many scientific studies on meat production and meat trade for the ASEAN economic area. With an estimated population of 636 million (2022), the area only contributed 5.3% to the world’s meat production in that year. The 10 member countries differ regarding the volume and importance of various meat types. This article zooms in on the decade from 2012 to 2022 – years with ASF, AI and Covid-19.

The Association of Southeast Asian Nations (ASEAN) was founded in Bangkok, Thailand, in August 1967, with the aim of promoting economic development, creating a free trade zone and cooperating on security and cultural issues. The founding countries were Indonesia, Malaysia, the Philippines, Singapore and Thailand. In the following years, Brunei (1984), Vietnam (1995), Laos, Myanmar (1997) and Cambodia (1999) joined the association.

With 257 million inhabitants in 2022, Indonesia was the most populous member country, compared to only 412,000 people living in Brunei. At US$ 1.48 trillion, Indonesia had the highest level of gross domestic product (GDP), while Brunei had the lowest at US$ 15 billion. The gross value added per person varied between US$ 82,808 in Singapore and only US$ 1,228 in Myanmar (see Table 1). At US$ 4.1 trillion, the economic area’s GDP was roughly equivalent to that of Germany.

The large differences in population size, religious affiliation and purchasing power primarily determined the demand for different meat types. Religious taboos banned the consumption of beef or pork, for example. The resulting differences in the production of the various meat types are discussed at country level.

Remarkable changes in meat production

Between 2012 and 2022, meat production in the ASEAN zone increased from 16.1 million tonnes to 19.1 million tonnes, or by 19.0%. The development of the various meat types varied considerably (see Table 2). With the exception of chicken meat, which recorded an increase in production of almost 3.4 million tons, or 46.2%, production of all other meat types declined. The increasing preference for chicken meat, which is not subject to religious taboos, is obvious. That reflects the global shift from red to white meat consumption.

Impact of avian influenza

It is noteworthy that the outbreaks of the highly pathogenic avian influenza (AI) virus in some member countries apparently had less of an impact than the African Swine Fever (ASF) epidemic. Obviously, the epidemics and the change in consumer behaviour had different impacts on the share of individual meat types in total meat production.

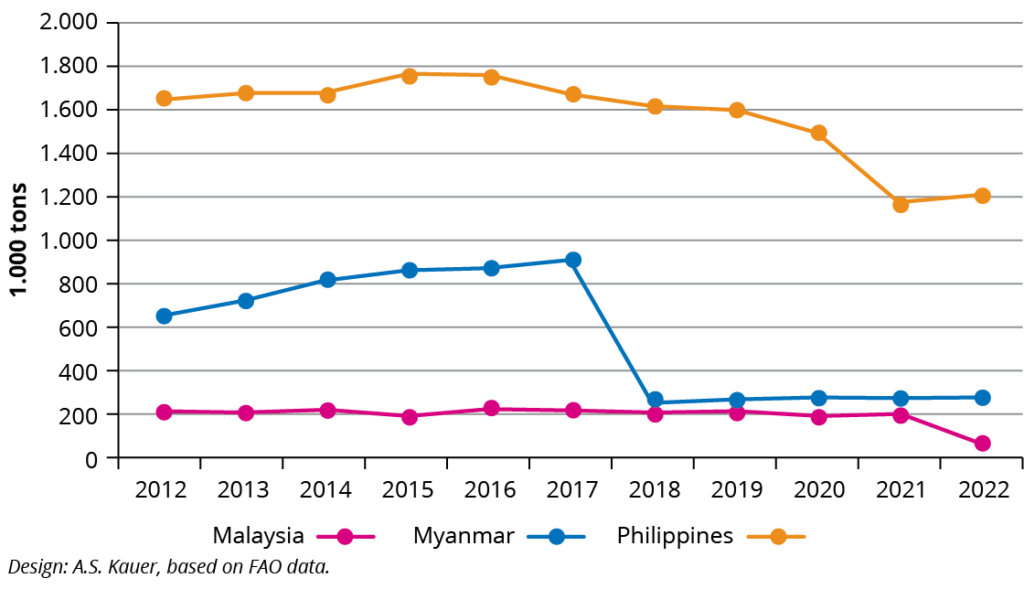

Figure 1 – The development of pig meat production in Malaysia, Myanmar and the Philippines between 2012 and 2022.

African swine fever effects

Figure 1 shows that ASF occurred at different times in the 3 countries considered. While the disease apparently spread slowly in the Philippines and a slight increase in production was already evident again from 2022, there were massive outbreaks in Myanmar in 2017 and 2018. Malaysia showed no infections for several years, but also suffered high production losses in 2022.

Changes in meat preferences

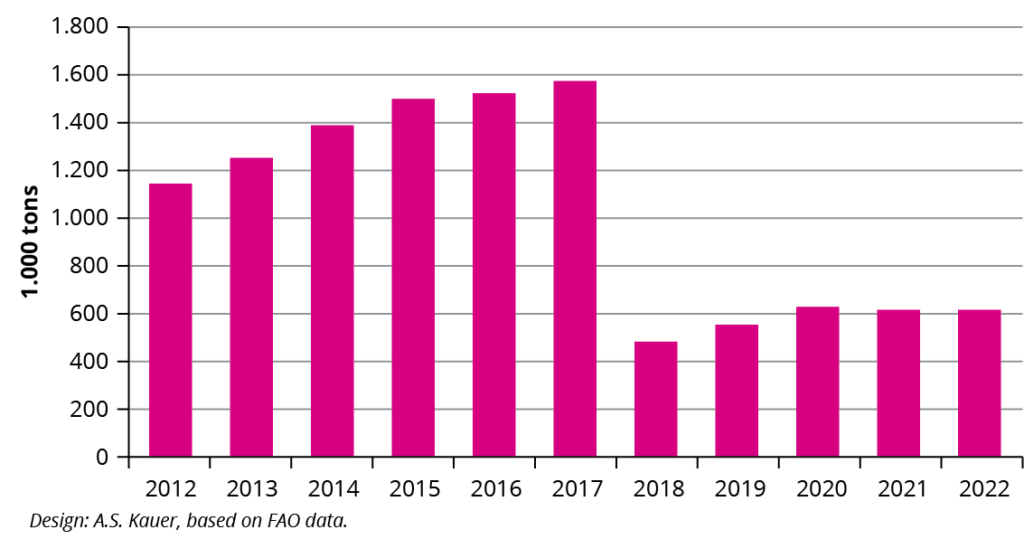

A devastating outbreak of AI occurred in Myanmar at the same time as the ASF epidemic. Chicken meat production fell by around 1.1 million tons, or by 70%, between 2017 and 2018. Although there are signs that production has stabilised from 2020 onwards, new outbreaks are reported continuously (Figure 2).

Figure 2 – The development of chicken meat production in Myanmar between 2012 and 2022.

Impact of consumer behaviour

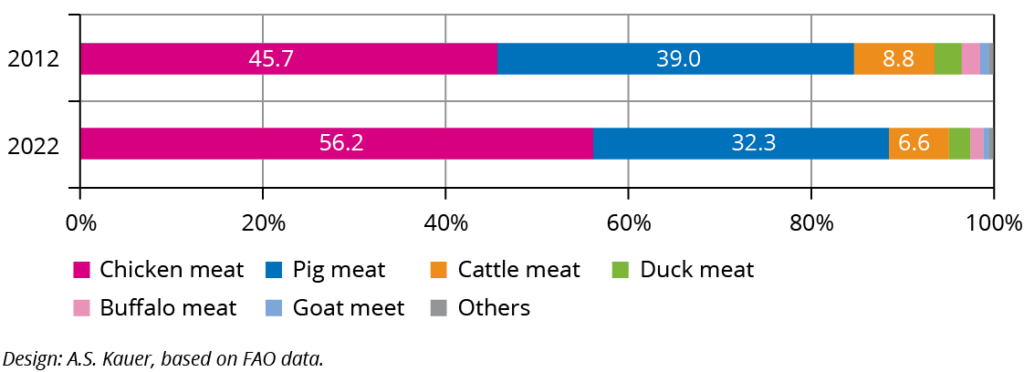

As can be seen from Figure 3, the epidemics and the change in consumer behaviour had a considerable impact on the share of individual types of meat in total meat production. Chicken meat was able to significantly expand its leading position, with its share increasing by 10.5%. In contrast, pork lost 6.7% and beef 2.2%; the other types of meat also suffered losses.

Figure 3 – The shares of the main meat types in the countries belonging to ASEAN in 2012 and 2022.

Differences in development at country level

Table 3 documents the different dynamics in the member countries. The largest absolute increases in meat production were achieved in Indonesia, Vietnam, Malaysia and Thailand. Production volumes fell most sharply in Myanmar and the Philippines. The highest relative growth rates were recorded in Indonesia, Laos and Vietnam. The significantly lower production volume in Laos must be considered, however. Myanmar recorded the strongest relative decline, at 51.5%, followed by Singapore.

Production decline in Myanmar

While the halving of production in Myanmar can be attributed to the 2 epidemics, Singapore has largely discontinued animal production due to the ecological problems in coastal areas caused by the excrements from livestock farming. The decrease in pork production in the Philippines of almost 440,000 tons due to ASF outbreaks resulted in over 300,000 tons in pork imports in 2022, to supply the population. It is surprising that Myanmar only imported a small amount despite the massive slump in production. Obviously, there were no financial resources available for that. It is worth noting that Vietnam was able to halve its imports of chicken and pig meat in the decade under review due to the dynamic development of production. Only Thailand exported considerable amounts of chicken meat. Between 2012 and 2022, exports almost tripled, reaching a volume of 357,000 tons. The main countries of destination were Japan, China and Malaysia.

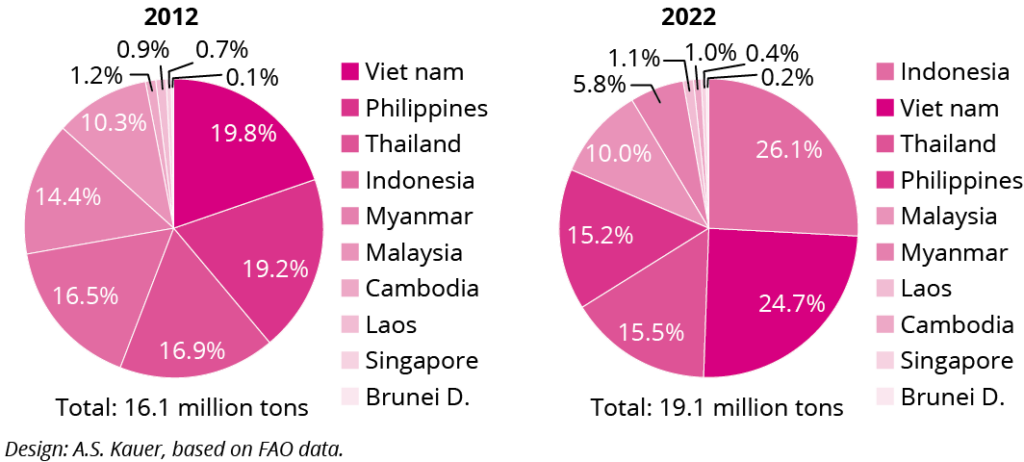

Regional concentration of production

The regional concentration of meat production in the ASEAN economic area was extremely high (Figure 4). The different dynamics in the individual countries led to considerable changes in the ranking of countries and their shares in total production between 2012 and 2022.

Figure 4 – The shares of the ASEAN member countries in the meat production of the association in 2012 and 2022.

Indonesia’s increased production share

The remarkable increase in production in Indonesia caused it to rise from fourth to first place, displacing Vietnam from this position. The Philippines fell from second to fourth place due to declining production. Myanmar and Malaysia changed positions. While Malaysia’s contribution to total production remained largely stable, Myanmar’s fell from 14.4% to 5.8%. The country was the big loser in the decade under review. The sharp increase in regional concentration is noteworthy. Indonesia and Vietnam accounted for over half of the ASEAN zone’s meat production in 2022.

Growth in chicken meat production

A closer look at the development of the production volume per meat type in the member countries reveals some interesting results. The leading roles of Indonesia and Vietnam in 2022 were primarily due to the increase in their chicken meat production. In Indonesia, this increased from 1.7 million tons to 4.0 million tons, or by 133%, in the decade under review. In Vietnam, it doubled from 0.53 million tons to 1.1 million tons. Myanmar’s sharp decrease was partly due to the decline in pig meat production of 377,000 tons, or 57.0%, and partly to the decrease in chicken production of 523,000 tons, or 45.8%. The Philippines’ descent from second to fourth place was the result of the decline in pig meat production from 1.65 million tons in 2012 to just 1.26 million tons, a drop of 26.4%.

Religious differences on meat production

In addition to the increasing purchasing power of the population, the share of individual meat types in total production depended to a large extent on the composition of religious affiliations. This is documented below, for selected countries.

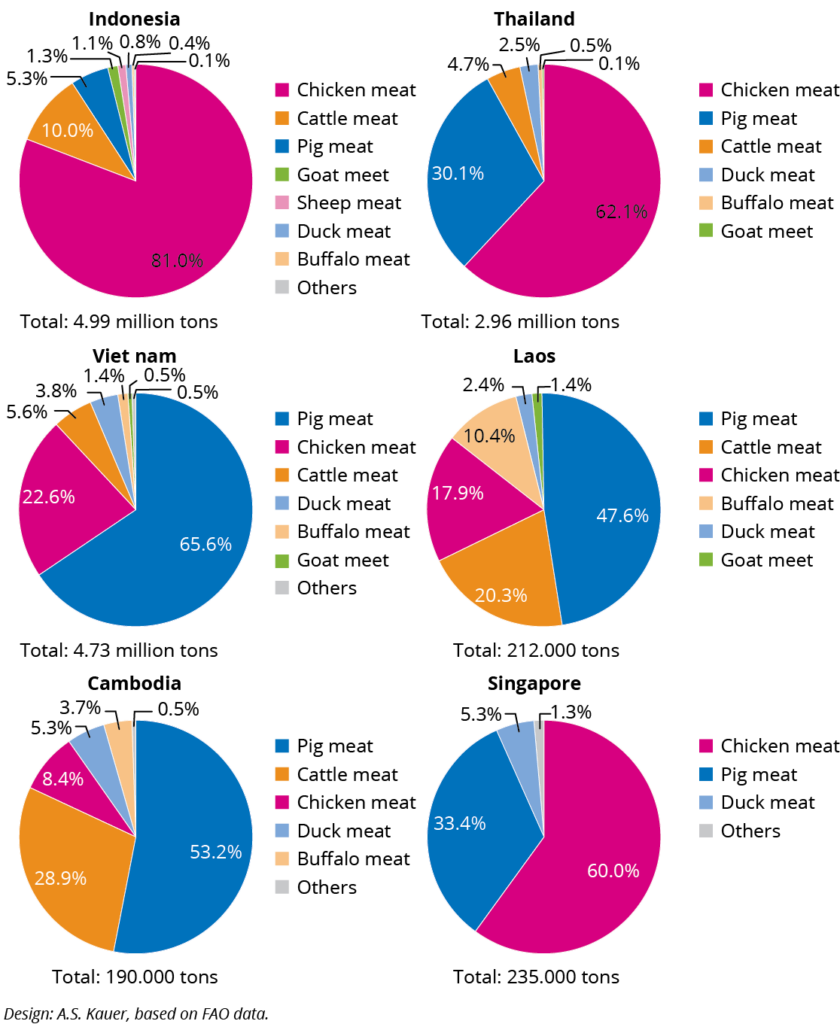

Figure 5 – The shares of the most important meat types in meat production of selected ASEAN member countries (2022).

Countries predominantly producing chicken meat

As can be seen from Figure 5, a rough classification can be made between countries in which chicken meat was predominant and those which mainly produced pig meat. In Indonesia, chicken meat accounted for 81% of meat production. That high proportion can be explained by the dominance of Islam, to which 88% of the population belong. Pig meat was therefore only of minor importance.

Thailand’s meat production breakdown

Although chicken meat was also the predominant type of meat produced in Thailand, with a contribution of 62.1%, pig meat also accounted for 30.1%. The domination religious affiliation was Buddhism, which 95% of the population profess and they are permitted to consume pork.

Religious diversity in Singapore’s meat production

The breakdown was similar in Singapore. However, the very low production volume must be taken into account here. Religious affiliation is broadly diversified, with about a third of the population being Buddhists.

Pig meat dominance in Vietnam, Loas, & Cambodia

In Vietnam, Laos and Cambodia, pig meat had by far the highest share in meat production. In Cambodia and Laos, the majority of the population profess Buddhism; in Vietnam, 88% of the population stated in 2022 that they did not belong to any religious denomination; Buddhists and Christians only accounted for small shares.

Shift in Vietnam’s meat production

In Cambodia and Laos, beef and buffalo meat each shared over 30% in meat production. Chicken meat ranked third in both countries, but the low production volume compared to Vietnam must be considered. As already mentioned, the growing importance of this meat type has led to a doubling of production in Vietnam.

Role of religious affiliation in meat production

To summarise, it can be said that the religious affiliation of the population largely determined the composition of meat production.

Summary and outlook

Between 2012 and 2022, meat production increased from 16.1 million to 19.1 million tons, or by 19%. Growth was particularly dynamic in Indonesia and Vietnam. Massive outbreaks of ASF and AI in Myanmar and the Philippines, on the other hand, resulted in a sharp decline in production, which had to be offset by imports.

Changes in consumer preferences for certain meat types and the impacts of the disease outbreaks significantly altered the ranking of member countries in meat production, in the decade under review. The regional concentration of production increased considerably. In 2022, Indonesia and Vietnam shared over 50% in total meat production. Which meat type took a leading position in a member country depended to a large extent on the religious affiliation of the population as well as on the purchasing power of the inhabitants. In countries with a predominantly Islamic population, chicken meat dominated because that is not subject to a consumption ban. In countries with a high proportion of Buddhists, on the other hand, pig meat ranked first or second.

It can be assumed that there will be a rapid increase in meat production in a number of countries due to rapid population growth and increasing purchasing power. In line with a global trend, chicken meat is likely to gain shares and pork meat to lose shares in meat production and consumption. The favourable feed conversion rate of broilers will also play an increasingly important role. Limiting factors, also in the future, will be outbreaks of ASF and AI. If these highly infectious animal diseases cannot be contained, meat production will grow only moderately.