Maple Leaf Foods: Q1 Results – Sales down, earnings up

Maple Leaf Foods Inc. today reported its financial results for the first quarter ended March 31, 2010.

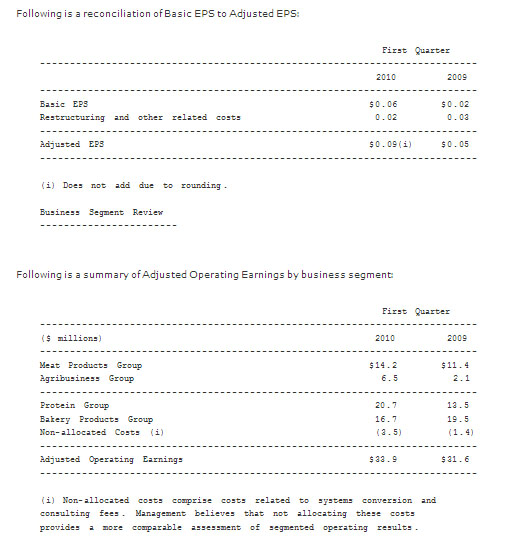

©©©-©© Adjusted Operating Earnings increased to $33.9 million from $31.6

©©©©©©© million last year.

©©© -©© Adjusted EPS increased to $0.09 compared to $0.05 last year.

©©© -©© Net earnings increased to $8.8 million from $2.9 million last year.

©

©

Note: Adjusted Operating Earnings measures are defined as earnings from operations before restructuring and other related costs and other income. Adjusted Earnings per Share (“Adjusted EPS”) measures are defined as basic earnings per share adjusted for the impact of restructuring and other related costs, net of tax and non-controlling interest.

©

“Our first quarter results reflect a modest growth in earnings,” said Michael H. McCain, President and CEO. “Our protein business continues to show substantial year over year improvement in performance, although the unexpected early rise in meat raw material costs has temporarily slowed the improvement curve. The bakery business experienced a weaker quarter due to performance in the U.K. and the North American frozen bakery business. However, we are seeing signs of improvement in both these areas as volumes recover and our cost reduction initiatives take hold.”

©

“This, along with price adjustments being implemented mostly in the second quarter, gives us confidence in expecting stronger margin growth and continued improvement through the remainder of 2010.”

©

Financial Overview

Sales for the first quarter declined 7% to $1,191.5 million from $1,279.3 million last year, mostly due to the impact of the strengthening of the Canadian dollar on fresh pork sales and the translation of bakery sales in the U.S. and the U.K. to Canadian dollars. Adjusted Operating Earnings increased 7% to $33.9 million compared to $31.6 million last year, due to better performance in the protein operations. Net earnings increased to $8.8 million or $0.06 per share in the first quarter of 2010 compared to net earnings of $2.9 million or $0.02 per share last year.

©

©

©

Meat Products Group

Includes value-added prepared meats, chilled meal entrees and lunch kits; and fresh pork, poultry and turkey products sold to retail, foodservice, industrial and convenience channels. Includes leading Canadian brands such as Maple Leaf(R), Schneiders(R) and many leading sub-brands.

©

Sales for the first quarter declined to $768.2 million from $822.2 million last year, as the stronger Canadian dollar reduced the sales values of fresh pork. Additionally, sales volumes were lower in prepared meats due to the exit of a non-core business and normalized levels of promotional activity compared to the first quarter last year.

©

Adjusted Operating Earnings in the Meat Products Group increased to $14.2 million compared to $11.4 million last year, largely due to improved markets and efficiencies in the fresh poultry operations. Performance in the prepared meats business improved over last year as a result of better pricing and mix and cost reduction initiatives, partly offset by lower volumes. However, first quarter margins were impacted by a sharp increase in raw material prices that occurred late in the fourth quarter of 2009. Management is implementing staged price adjustments over the next two quarters across its prepared meats portfolio to offset higher input costs. Earnings from primary pork processing operations declined due to a stronger Canadian dollar and weaker export markets that more than offset the benefit of improved North American industry market conditions.

©

Agribusiness Group

Consists of Canadian hog production and animal by-product recycling operations.

Agribusiness Group sales declined from $44.6 million last year to $41.8 million mostly due to lower sales of recycled by-products.

©

Adjusted Operating Earnings increased to $6.5 million compared to $2.1 million in the prior year. Losses in hog production operations were reduced due to lower feed costs and stronger hog market prices. However this improvement was impacted by the strengthening of the Canadian dollar and short-term hedging programs. Included in first quarter earnings is $3.0 million (2009: $0.1 million) in government support to compensate hog producers for losses in prior years. Earnings from by-product recycling declined slightly compared to last year due to increased raw material costs.

©