AgFeed Industries: 2010 results

AgFeed Industries, Inc., an international agribusiness company with operations in the U.S. and China and one of the large independent hog producers and manufacturers of animal nutrients in China announced record levels of revenue in both its animal nutrition and U.S. hog production units for the fourth quarter of 2010 and for the full year 2010.

The company’s 2010 fourth quarter and year-end revenues were the highest in company history representing an increase over revenues for the same periods in 2009 of 77.2% and 40.7%, respectively.

Loss reported

AgFeed reported a fourth quarter 2010 loss of $20.2 million, or $(0.42) per fully diluted share, on revenues of $99.5 million. For the full year 2010 the Company reported a loss of $ 42.7 million, or $(0.90) per fully diluted share on revenues of $ 243.6 million. This loss was principally attributable to the performance of the Company’s legacy Chinese hog production system, the hog farms acquired by former management during 2007 and 2008.

AgFeed reported a fourth quarter 2010 loss of $20.2 million, or $(0.42) per fully diluted share, on revenues of $99.5 million. For the full year 2010 the Company reported a loss of $ 42.7 million, or $(0.90) per fully diluted share on revenues of $ 243.6 million. This loss was principally attributable to the performance of the Company’s legacy Chinese hog production system, the hog farms acquired by former management during 2007 and 2008.

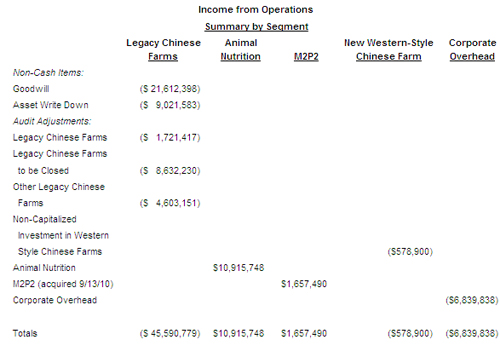

AgFeed’s loss for 2010 is attributable to operating losses in its legacy Chinese hog production system of $14.9 million of which $8.9 million was attributable to eight legacy farms being closed and non-cash, non-recurring, write downs and reserves related to the restructuring of this business unit of $30.6 million. This $30.6 million in asset write downs is comprised of $16.8 million of goodwill written off during the third quarter of 2010, $4.8 million of goodwill written off during the fourth quarter of 2010 and fixed asset written down during the fourth quarter of 2010 of $9.0 million.

John A. Stadler, AgFeed’s Chairman and Interim President and Chief Executive Officer stated, “While we are pleased with the continued operating excellence demonstrated by the performance of both our animal nutrition business and our U.S. hog production business, the performance of our legacy Chinese hog production system is unacceptable. The team at M2P2 has demonstrated great success in executing our U.S. business plan and has positioned us to pursue growth opportunities that present themselves domestically. This team is now fully engaged in leading the restructuring and execution of operational changes to return our legacy Chinese hog production system to profitability. Our plan is to add to our team international professionals to firmly establish AgFeed as a global agribusiness.”

Recognizing the unacceptable performance of the company’s legacy Chinese hog production system, AgFeed’s Board of Directors completed its detailed analysis and operational review of this business unit that commenced during the fall of 2010. This review has resulted in additional actions and asset-write downs to those announced by the Company in November 2010.

Management changes

AgFeed’s new Board of Directors has made the following management changes and implemented operational changes to support the execution of the Company’s international strategic plan while aggressively addressing the operating issues confronted by the legacy Chinese hog production system.

- Appointed John Stadler as the Company’s Chairman and Interim President and Chief Executive Officer;

- Appointed Edward Pazdro as the Company’s Chief Financial Officer;

- Appointed McGladrey & Pullen, LLP as the Company’s auditor;

- Deployed managers and executives from its M2P2 subsidiary to lead the restructuring and return to profitability of the legacy Chinese hog production system;

- Commenced the closing of eight legacy Chinese hog farms considered to be of a configuration and quality that they were deemed incapable of meeting AgFeed’s long-term operating benchmarks;

- Reduced overall headcount from 1,843 to 1,673.

The Company’s Chief Financial Officer, Edward Pazdro, said, “We have worked closely with outside consultants, auditors and our new management team to thoroughly assess the long-term viability and profitability of our legacy Chinese hog farms, and based on current market conditions, believe that our asset values are appropriate and present a long-term picture of the value of our legacy farms.” Mr. Pazdro stated further, “The combination of M2P2’s operating discipline with our management information systems will allow us to monitor and execute our strategic plan.”

For more info: www.agfeedinc.com