Quarterly update: Pig markets have reasons to be cautious

In the world of pigs and pork caution is still required, even though Covid-19 may be a thing of the past fairly soon. Pig market expert Dr John Strak analyses the last quarter in the pig markets around the globe and looks ahead to the months to come.

The daily theme of the last 18 months has been to be careful. In almost all of our normal routines caution and vigilance have been the new norms of human behaviour. That cautious approach, with the help of vaccines, scientists and medical personnel, may have paid off and Covid-19 may be on its way to being beaten in the developed world.

But, in the world of pigs and pork caution is still required. The way ahead, from the autumn onwards, is still not clear. Supplies of pigs look tight and that will support prices. There has been a welcome rebound in pig prices in the North America and in Europe in the 2nd quarter – although there have been some wobbles. But rising feed prices and ongoing battles with animal disease are challenging for the 2nd half of 2021.

Raising costs on farms and in cutting rooms

In the developed economies, the post-Covid recovery may be putting pressure on labour availability and raising costs on the farm and in the cutting rooms. In China, again, the data do not allow us to be certain about the future but one projection I have made estimates that the Chinese pig sector will reach the lower end of its normal slaughter levels by the end of 2021. We may be seeing the beginning of the end of China’s boost to pork exports from the west and China is, again, the main driver of uncertainty in any forecast.

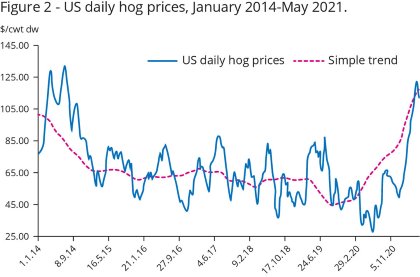

In the USA the battle against Covid-19 in the general population seems to have been won but the hog sector still has challenges. These include: anecdotal stories about the re-emergence of PRRS in the national herd; heat and drought affecting feed conversion and feed prices; and shortages of labour on farm and in packers’ units. These are 3 big issues that are constraining and will constrain pig and pork supplies.

Pig and pork supplies in the USA

The June census of US pig numbers (see Table 1) is reporting significant cuts in the numbers of breeding animals and market pigs in the USA (as did the March census). The numbers of weaners and smaller hogs are also down (both falling by about 3%) and the intended farrowings by hog farmers in the next six months are down by 2%.

Whichever way you look at it the numbers of pigs (and probably pork production if the hot weather continues) in the USA will be smaller (year on year) in the latter half of 2021. The economic recovery in the USA will undoubtedly be a strong driver of domestic demand in 2021 and will help absorb any decline in export demand in the short term.

All of these observations point to firm hog prices in North America (albeit the seasonal decline in US hog prices is about to begin).This part of the global value chain for pork is probably the most certain in the months ahead.

Pig prices recovered in Europe

Pig prices have recovered in Europe in the 2nd quarter. But they are not back to the highs of 2020 and the rebound seems to have met its limits by the end of June. Pig census data in Europe are far from adequate but clues as to the direction of travel, and confidence in the sector, are available.

The German pig inventory was reported to be down by 5.5% in May whereas the Danish inventory as up by about 3% in April (these contrasting numbers are partly explained by the drop in live pig exports from Denmark Danish exports). German pig numbers are on the wane (new welfare rules, ASF, Covid-19) whilst breeding herds in the major exporters like Denmark and Spain have hardly changed.

Read also this farm visit: Bringing circular pig production a step closer

Total EU breeding herd declined

The total EU breeding herd was reported to have declined by 0.5% in December 2020. Piglet prices are currently just above the 5 year average and the EU Commission reports that, despite rising prices, margins for pig production have been below the average since early 2020. In all, it seems that the EU’s pig farmers are not inclined to expand – ASF, the volatility of prices and low margins are not encouraging confidence. The EU pig price chart (Figure 3) is revealing – this is not an illustration of a sector in good health.

What next? More volatility I fear since the uncertainty around China’s demand for EU pigmeat and the stuttering return to normal economic life as coronavirus vaccination programmes are extended ensures that almost all production decisions are risky. And dealing with risk implies caution.

China’s pig prices signalling a turning point

The last time I presented the data on China (early April) I noted that China’s pig prices were signalling a turning point and were heading downwards. Figure 4 clearly illustrates what has been happening to deadweight prices this year. And prices at wholesale markets and retail stores have shown the same behaviour.

In April I observed that there could be several reasons for the collapse in prices but I admit now that those prices have fallen faster and further than I expected. The analysts are still split on the explanation for the price collapse and some think that it is explained by high levels of ASF infection and diversion/early slaughter of hogs. But the problem with that theory is that it would require a high of degree of connivance with Chinese officials since any ASF-infected pig diverted to human consumption is likely to prolong the ASF problem in China.

Such disposals into the food chain are banned by the authorities since ASF-infected pigs are supposed to be destroyed. It’s possible that some of the increased slaughter levels in China are due to ASF-linked “diversion”. But is it plausible to claim that most of these increased slaughter numbers are explained by illegal actions?

Read also: Pigs flock to the Spanish sun

Other explanations include:

- Seasonality (hot weather) curtailing domestic demand; and

- An increase in “grey” imports; and

- A mismatch between import levels (official and unofficial) and domestic supply estimates. Chinese import agents may be as much in the dark about the shape of China’s pig supply response as western observers and, since import shipments are booked in advance, there will be forecasting errors.

The slaughter level data are relatively reliable in total and the trend in kill numbers is positive. But we don’t have a breakdown of hog weights that might help address the ASF theory. The price data are also generally robust and these clearly indicate that supply is outrunning demand. Whatever the explanation the Chinese authorities have now stated that they will intervene in the market to prevent hog prices falling too low.

Imports of pigmeat have dropped off

The exporting countries’ data suggest that imports of pigmeat have dropped off sharply in the last few months and that is a clue as to what China’s domestic supply function looks like just now – and is expected to look like over the summer. For what it’s worth my simple extrapolation of the recent slaughter activity in China projects that China will reach the lower end of the range of its “normal” level of kill in December this year (around 17 million pigs per month).

The same projection would have China reaching the upper level of its normal range in July next year (around 22 million pigs per month). This is a projection, not a forecast, but you heard it here first.

Less optimistic about global pig prices

My positive view of global pig prices for the remainder of 2021 is now somewhat tempered. I wrote in April that, “Global prices in the 2nd quarter seem set to rise and rise in the exporting countries.” But I am now slightly less optimistic about global prices – especially at the end of 2021 – even though the global pig price cycle is in a strong upward phase. Figure 6 illustrates the latest position for the global pig price cycle and the chart suggests that a turning point is unlikely before October.

As Covid-19 vaccination programmes gain momentum there is no doubt that domestic demand for pork (and all meats) will increase in the remaining months of 2021. It’s also likely that the number of pigs in the pipeline in the developed economies will be fewer than in the same period for 2020. These facts will support pig prices. The caveat is China – if exports to that market drop sharply that might be enough to pull global pig prices down as fast as they went up. As ever, it seems, it’s all about China.