Pig production in Finland: unique climate and welfare

Even though pork is the most popular meat with consumers in Finland, the country’s pig farmers face their fair share of challenges. The country is substantially different from many other countries, leading to a higher cost price.

Finland is a unique country in Europe when it comes to pig production. Quite a few things make it stand out from the rest of Europe – but as it so often goes, being different also comes at a cost.

First of all, as the country is located in the north of Europe, winters are usually long with sub-zero temperatures, snow and ice are common, leading to higher heating costs. Additional costs also come from high welfare, health and environmental demands.

- Finland has a zero-tolerance policy towards Salmonella and must eradicate it, if it appears;

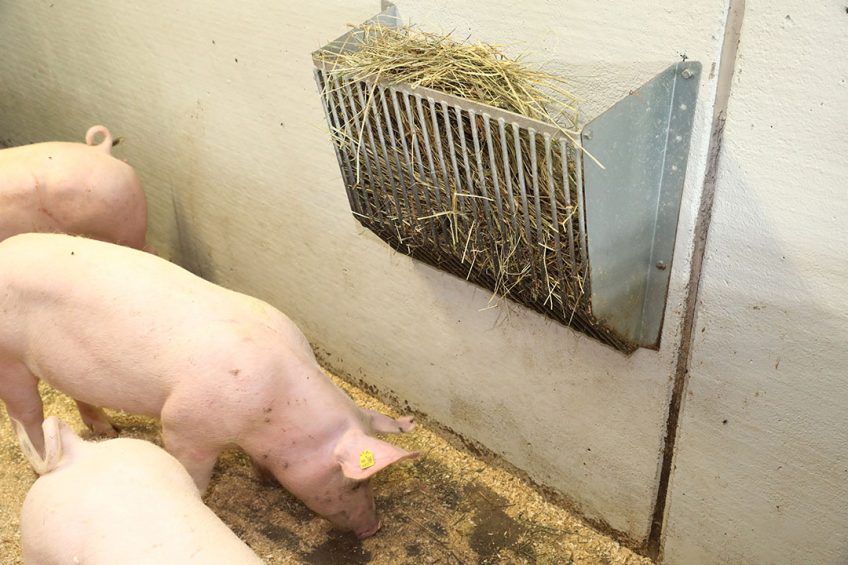

- Finland banned the practice of tail docking in 2002. Good feeding and supplying bedding regularly can increase welfare standards on pig farms and reduce tail-biting.

- Soy-free feeding is a theme, with the production chain in Finland having achieved a 32% reduction in carbon emissions. Atria, for instance, does not use soy in family farms for finishing pigs and aims to get rid of soy completely for small piglets.

- Reduction of antibiotic usage and adopting free-range farrowing practices are also hot topics in Finland.

Finland at a glance In terms of size, Finland is Europe’s 8th largest country at 338,145 km2. In terms of population, however, the country is in 26th place, with 5.5 million inhabitants. In other words, Finland is not very densely populated and that is due to its relatively northern location. Pork is the most popular meat in Finland with average consumption around 33kg/capita/year. Pigs are normally slaughtered at 5 months old when they weigh around 125kg liveweight. The most popular pig breeds in Finland are Topigs Norsvin, DanBred as well as Finnish Landrace and Yorkshire. The main feed compounders producing pig meals are Hankkija, A-Rehu (part of the Atria group), Rehux and Feedex. In terms of size, Finland is Europe’s 8th largest country at 338,145 km2. In terms of population, however, the country is in 26th place, with 5.5 million inhabitants. In other words, Finland is not very densely populated and that is due to its relatively northern location. Pork is the most popular meat in Finland with average consumption around 33kg/capita/year. Pigs are normally slaughtered at 5 months old when they weigh around 125kg liveweight. The most popular pig breeds in Finland are Topigs Norsvin, DanBred as well as Finnish Landrace and Yorkshire. The main feed compounders producing pig meals are Hankkija, A-Rehu (part of the Atria group), Rehux and Feedex. |

Labour costs are relatively high

Finnish pig farmers can secure a relatively stable profit margin for their produce, if they can first work out what their average costs are. That means knowing more about one other key factor affecting overall production costs: the availability and the cost of labour. Finland enjoys a relativity high standard of living which means workers are paid well; those in the agricultural labour sector are no different. Just recently, the Finnish government floated the idea of introducing a 4-day working week and 6-hour days, which undoubtedly will cause huge concern among the farming industry as it means higher worker salaries for less work.

Country Focus Tool

Pig Progress travels around the global taking a deeper look at the pig production sector per country.

Sows and pig farms

Time to zoom in a little further: Finland is home to an estimated 80,000 sows, and there are around 900 pig farms operating in the country. As Table 1 shows, the number of pig farms came down by just over 11% in 2019. It is a pattern well-known by Taru Antikainen, the chairwoman of the Central Union of Agricultural Producers and Forest Owners (MTK) Pig Network. She says, “The percentage has been 7-12% since Finland jointed the EU in 1995. The trend seems to be continuing for next year as well. However, the farms are getting bigger, and we are not expecting the number of sows to go below 80,000.”

Investment in the remaining farms has been quite respectable, with many units running modern housing and equipment. Some pig farms have also invested heavily into efficient methods of heating their houses using the pig manure as a recyclable commodity and an energy source.

In Finland, tail docking was banned 17 years ago. The Finnish pig industry has had to developed methods to minimise tail biting. Pig producers Rami and Susanna Yrjälä learned that excellent feeding conditions help prevent tail biting. Their approach delivers excellent technical results. Find out more…

Pig processors in Finland

There are 3 pig processors in Finland:

- Atria Seinäjoki being the largest and processing around 42% of pigs.

- HKScan Forssa with 40%

- Snellman Pietarsaari with 18%.

Atria is one of the leading meat and food companies in the region, operating in the Nordic countries, Russia and Estonia, and has been in operation for over 110 years. In 2018 it had a combined turnover of € 1.44 billion and employed 4,460 staff.

Table 2 shows production and trade figures with regard to pork production in Finland. Atria Finland’s Nurmo production plant has become the first Finnish production plant to receive a permit to export pork to the world’s largest pig meat market in China. The Nurmo production plant is Atria’s latest modern pig cutting plant.

Challenges

Taru Antikainen explains that one challenge is that it is difficult to predict where prices for pigs will go in the future: “Production is expected to stay at the current level, but consumption will probably decrease a couple of percent. Exports will grow, but by how much remains to be seen. A lot depends on the situation in China, naturally. Our prices did not climb like the ones in the rest of Europe and are currently € 1.68 per kilogramme, including transportation costs. However, the 2 biggest meat companies have promised an increase of prices at the beginning of April.”

She continues, “How much they will rise depends on the prices they can negotiate with Finnish retailers. The situation in Finland is complicated, as we have 3 highly integrated meat companies working with ‘from farm to fork’ concepts and 2 local retail outlets accompanied with Lidl.”

Antikainen acknowledges that Finland’s different approach has a financial consequence. “All the price negotiations are difficult. In addition, the Finnish law is much stricter than the current EU directives. We need to provide more space to the pigs than the EU directive requires. We are not allowed to dock tails, and our biosecurity needs to be at a really high level. All investments at the moment are for free farrowing. The government is pushing farmers to even greater animal welfare standards, and therefore the compensation for free farrowing is good currently. This is the reason why so many farmers are starting it, although the system needs a lot more work than the traditional way of farrowing in crates.”